Powering a strong recovery

an economic growth plan for Canada

The challenge

For Canadians, the COVID-19 pandemic is a once-in-a-lifetime health and economic emergency that has exacerbated long-standing structural weaknesses in our economy. Policymakers therefore face a dual challenge of considerable magnitude: they must lay the foundations for a safe and sustainable recovery while at the same time putting in place a long-term plan for economic growth and prosperity.

The immediate priority for governments is to contain the spread of the virus. Additional lockdowns on the scale of those seen in Spring 2020 would be catastrophic for workers, families, businesses and society as a whole. Eventually governments would run out of fiscal room to provide income support and economic stimulus.

Over the past several months, the Business Council of Canada has put forward a series of recommendations to address the health and economic crisis. Among other priorities, we have stressed the need for greater coordination and consistency among the three levels of government in dealing with the virus, guided by the best available scientific evidence. We have called for widespread, systematic and rapid testing and contact tracing, greater clarity around public health guidelines, and compliance with those rules to keep the virus in check. We have urged public health agencies to be more transparent about where outbreaks are occurring and what is driving them. We have repeatedly emphasized the need for targeted relief for employers and workers in the hardest-hit sectors, including travel, tourism and hospitality.

In each of those areas, much more work remains to be done. The purpose of this paper, however, is to look beyond the pandemic to some of the underlying structural challenges that confront Canada’s economy, and help frame a wider conversation about the policies that are needed to overcome those challenges. The permanent economic damage of COVID-19 will be significant, both globally and nationally. Our combined federal and provincial public, household and business indebtedness will be significantly higher, and so will our unemployment rates relative to 2019 levels.

Over the coming months we will be reaching out to a wide range of stakeholders and inviting them to contribute their own ideas, strategies and solutions. The starting point for these discussions is the recognition that Canada faces significant economic headwinds. Perhaps the most obvious is our country’s aging population. With each passing year, demographic trends are squeezing labour markets and talent pools while depressing tax revenues and driving up demand for health and social services. We can add to this Canada’s prolonged record of weak labour productivity, structural impediments to the growth of Canadian-based global companies, and regulatory obstacles that go well beyond pipelines.

As a medium-sized economy heavily dependent on exports, Canada needs to contend with the rise of protectionism, the erosion of the multilateral rules-based international order, and geopolitical changes that have left us increasingly isolated on the global stage. Along with the rest of the world, we must also address the multi-faceted challenge of global climate change, including the need for more climate-resilient infrastructure and significant financial investments to support the transition to a low-carbon society.

Last but by no means least, we must recognize that an increasing share of economic activity is being driven not by physical assets but by intangible assets and investments such as intellectual property, software, data, and brands – areas in which Canada generally lags peer countries. More than 90 per cent of the value of the S&P 500 stock market index now resides in these intangible assets. Canada’s traditional economic policy toolkit requires updating if we hope to cultivate innovative domestic firms that can compete globally in this new era.

Early in the COVID-19 pandemic, we saw how close cooperation between Canada’s public and private sectors could overcome complex and urgent problems. Announced on March 20, 2020, the federal government’s “Plan to Mobilize Industry” harnessed the strength of the country’s industrial base and the resourcefulness of Canadian companies in responding to the sudden need for large quantities of critical health and safety supplies such as personal protective equipment, sanitization products, and diagnostic equipment.

In our view, a similar “all hands on deck” approach is required to deal with Canada’s longer term economic challenges. Central to these is the need to address Canada’s underperformance on productivity. Over the long run, the level of productivity is the single most important determinant of a country’s standard of living. Canada’s productivity rates have lagged those of our peers for decades, resulting in lower incomes and lower household purchasing power.

As former Bank of Canada Governor David Dodge said recently, “In the long run, the real income of Canadians and the public programs they cherish depend on the value of the goods and services (GDP) Canadian workers and businesses produce. You can’t eat what you don’t produce, and the value of what we are producing as a country is not covering what we are consuming.1”

A plan to create jobs and grow our economy

The choices we make today will have serious and lasting consequences for generations to come. For the sake of future generations, we must be laser-focused on growing our economic capacity while also addressing the immediate and longer-term challenges of climate change. We need to create an economic environment in which businesses can thrive and create good jobs, and in which all Canadians can achieve their full potential.

To increase Canada’s productive capacity, we need to leverage the country’s human, physical and intellectual capital. Greater productivity drives economic growth and rising incomes, which in turn generates higher living standards, more sustainable social programs, and greater social mobility.

If Canada, with a relatively small population, is to remain globally competitive we must sell more goods to the world than we consume. This is neither a theoretical point nor a subject of concern only to business leaders or shareholders. Rising incomes are a key economic measure for the well-being of Canadian households, whether they live in Lethbridge, Gander or Baie-Comeau. Productivity is the major determinant between economic growth and economic stagnation. It is the foundation for successful communities and nations.

A credible plan for economic growth rests on three main pillars: people, capital and ideas.

People: The foundation of our economic success resides in our human capital. We need to cultivate it and enhance it.

Capital: We need an enabling environment that attracts investment, nurtures new ventures and industries, and allows existing businesses to expand and create good jobs.

Ideas: Developing new ideas and putting them to use are key to competitiveness and growth. As we transition to an economy where wealth creation comes increasingly from intangible assets such as IP and data, a modern innovation toolbox must be a core element of our economic framework.

Six key obstacles

- Canadians are getting older. The share of the population that is 65 or older was 14 per cent in 2010 but is forecast to reach 20 per cent by 20242. An aging population weakens GDP growth and makes it harder for employers to find the people they need to expand and grow. It also puts upward pressure on government spending, notably for health care and pension costs.

- We import more goods and services than we produce. Over the past decade our country’s current account deficits with the rest of the world have hovered between two and three per cent of GDP. Non-energy exports have essentially remained flat and the share of Canadian exports that go to emerging economies is among the lowest of G7 countries (Fall Economic Statement 2018).

- Canada struggles to grow firms with the scale to compete globally. In 2020, only 13 Canadian companies were listed among the Fortune Global 500, an annual ranking of the top 500 corporations worldwide as measured by revenue.

- Business investment in Canada has lagged that of other major advanced economies in recent years. According to the federal government’s 2019 Economic and Fiscal Update, real business investment increased between 2015 and 2019 in the United States, the United Kingdom and Germany. In Canada, it fell sharply and has yet to recover.3

- A 2018 Brookings report4 found that Canada’s advanced industries – including sectors as diverse as auto and aerospace production, information technology and oil and gas extraction – are far less productive than their U.S. counterparts: “In 1996, the productivity differential between the average Canadian worker in a metro area and the average U.S. worker in a metro area was about 17 per cent. By 2015, that gap had grown to 100 per cent.”

- Canada’s federal debt-to-GDP ratio was 30 per cent before COVID-19 but now exceeds 50 per cent. This will impose serious constraints on the government’s fiscal capacity going forward. As former Bank of Canada Deputy Governor Paul Jenkins has stated, “The most durable source of funding is sustained economic growth, not a reliance on low interest rates.”5

2 https://www150.statcan.gc.ca/n1/daily-quotidien/190930/cg-a003-eng.htm

3 https://www.budget.gc.ca/efu-meb/2019/docs/statement-enonce/chap01-en.html#s5

4 https://www.brookings.edu/wp-content/uploads/2018/06/Canadas-Advanced-Industries_18-06-05_FINAL2.pdf

5 https://www.cdhowe.org/intelligence-memos/paul-jenkins-%E2%80%93-long-%E2%80%A6-and-short-finding-equilibrium

People

Canada’s most important asset is its human capital. We have one of the best post-secondary attainment rates in the G7 and an immigration system that has proven to be one of the world’s most successful. We need to double down on these strengths.

As Nobel Prize-winning economist Paul Romer has observed, “My number-one recommendation is to invest in people6.” A long-term strategy for human capital development is essential to building resilience in our labour markets and expanding Canada’s productive capacity. Investing in human capital and attracting talented newcomers to our shores are among the smartest possible policy responses to the unceasing forces of disruption, dislocation, and skills-based change.

Policymakers must therefore work with provinces to help Canadians acquire the skills they need, attract highly skilled immigrants, and increase participation in the labour force, particularly within disadvantaged communities. Global competition for talent is intense and likely to become even more so as companies and economies vie for advantage in the post-pandemic world. Canada must pursue an unrelenting, people-centric strategy.

Developing a more agile, adaptable workforce

The COVID-19 emergency has accelerated a transition that was already underway in Canada’s labour market. Rapid technological change, an uncertain and volatile environment for exports, the rise of the gig economy, and ongoing demographic shifts have combined to create a new reality for Canadian employers.

Building an agile and resilient workforce – one with the right mix of skills to respond to the evolving technical and creative demands of the global marketplace – requires continued investment and adaptation by Canadian businesses. It also requires strong partnerships with government and post-secondary institutions.

An obvious example of the changing landscape is the explosion in the number of technology and IT jobs. In the past decade, employment in software publishing in Canada has increased 61 per cent, to 50,000, while the number of jobs in computer systems design has risen 66 per cent, to 258,000. Little wonder that some business and post-secondary leaders have called for a rethink of education, skills and training, highlighting the need for more computational thinking, digital competencies, and new ways to connect teachers to practitioners, among other priorities7.

Education is an exclusive provincial responsibility under Canada’s federal system, but there is still plenty that Ottawa can do to help Canadians get the education and training they need. The federal government’s current efforts in this area primarily leverage Part II of the Employment Insurance (EI) Act and are intended to help unemployed individuals prepare for, find and maintain employment. The result, unfortunately, is an insufficient patchwork of initiatives announced in successive federal budgets rather than a comprehensive strategy that takes into account the evolving nature of the labour market. The need for reform is even more acute now that the pandemic has displaced millions of Canadian workers. While some of those jobs will return once COVID-19 is no longer a threat, many others are likely gone forever.

In our view, the federal government should work with provincial and territorial governments to develop a comprehensive skills agenda that prepares displaced workers for new careers, expands work-integrated learning opportunities for students and post-secondary graduates (see below), and helps Canadians to continuously hone their skills to stay relevant and improve their employability as technology and society evolve. The specific elements of that agenda can be refined, but should include:

- Expanded training and paid placements to help unemployed Canadians pivot to well-paid and more secure opportunities in the digital economy. Palette, a pilot project led by Dr. Arvind Gupta of the University of Toronto, is a promising example of what could work. Palette is an upskilling platform that connects workers from disrupted industries with fast-growing companies that are struggling to fill high-demand jobs.

- Leadership development for the digital economy. As the economy evolves and new industries arise, there is an ever-increasing need for new leadership competencies. That includes innovation management training and mentorship programs as well as exchanges and internships for new and mid-career managers. Whether they work for established companies or startups, managers need opportunities to learn from firms in Canada and internationally that have effectively managed innovation and growth.

- A broad-based and fundamental review of the Employment Insurance system. When unemployment insurance was introduced in 1940, it was intended to be a joint responsibility of employers, workers and government. Today “there are virtually no mechanisms to facilitate and secure input from business and labour,” the late Donna Wood, one of Canada’s foremost experts on EI, wrote in a 2017 paper for the Mowat Centre. That is “despite the fact that almost all the costs incurred . . . are paid for by mandatory social insurance premiums levied on their constituents.”8 To better meet the evolving demands of the labour market, there needs to be a much greater emphasis in the EI system on skills training and labour market adjustment. Currently Canada is one of the lowest spenders on labour market adjustment programs in the industrialized world.9

Helping young Canadians build rewarding careers

If it was challenging before the pandemic for young people to transition successfully from school to work, COVID-19 has made it vastly more difficult. The good news is that there is already broad support for one of the solutions. Students, employers and post-secondary educators agree on the need for more experiential and work-integrated learning opportunities such as apprenticeships, co-ops and internships. In 2003, Mitacs, a Vancouver-based not-for-profit research and training organization, launched an internship program aimed at finding private sector opportunities for highly educated math and science graduates. Four years later, the program was expanded to all disciplines. Over the years Mitacs has supported more than 10,000 research internships, trained more than 19,000 student and postdoctoral participants, and supported more than 1,300 international research collaborations.

The Business+Higher Education Roundtable (BHER), which the Business Council of Canada launched in 2015, brings together the leaders of Canada’s largest companies and post-secondary institutions to advance and strengthen opportunities for young people to transition to the labour market. These include expanding the work-integrated learning ecosystem. One of its current priorities is to find ways to connect students with companies that are dealing with myriad COVID-19-related challenges.

As policymakers look to expand work-integrated learning programs, they will also need to focus on students with vocational inclinations and young people for whom a conventional four-year university degree is not the right option. Labour shortages in the skilled trades represent a significant barrier to investment and economic activity in many parts of the country, and the demand is projected to increase as baby boomers retire. Here, too, we need to expand training opportunities for new labour-market entrants. We cannot sacrifice a generation of talent because of the economic carnage COVID-19 has caused.

Growing our workforce and attracting talent

Canada’s immigration system has long been a source of highly educated, talented newcomers, simultaneously benefiting the country’s labour market and its innovation ecosystem. Canada has achieved what few other jurisdictions have: relatively high levels of public support for relatively high levels of immigration. It is a key strength for the country and, if public support can be maintained, will become an even greater advantage as Canada seeks to attract skilled workers to counter the effects of an aging population. As a result, we should be doubling down on attracting skilled immigrants. Pandemic-related border and travel restrictions have interrupted the flow of new permanent residents in 2020, but as soon as conditions permit we should be raising immigration levels substantially from where they are now.

Launched in 2017, the Global Skills Strategy has been highly effective in facilitating the entry of immigrants with specialized skill sets and international experience. In 2019 the strategy brought 12,000 high-skilled workers into Canada, earning recognition around the world as a major policy innovation that helps fast-growing companies find the talent they need to succeed and grow. Similarly, innovative firms have found great value in the Global Talent Stream, which allows them to bring in highly skilled global talent on an accelerated basis. But there is more to be done to attract top talent and leverage the network effects of Canada’s ambitious immigration policy.

Another key priority is attracting and retaining international students. Canadian universities, colleges and polytechnics have made tremendous strides in attracting international students over the past decade. The numbers have increased from roughly 240,000 in 2011 to 495,000 in 2017. This large cohort of talent represents a huge opportunity for Canada. It makes eminent sense – particularly in parts of the country where the labour supply is declining – to retain young graduates who have a Canadian education, relationships and connections to the country. Currently, in the context of COVID-19 and severe limitations to the entry of foreigners, this represents a significant challenge.

Increasing participation in the labour force

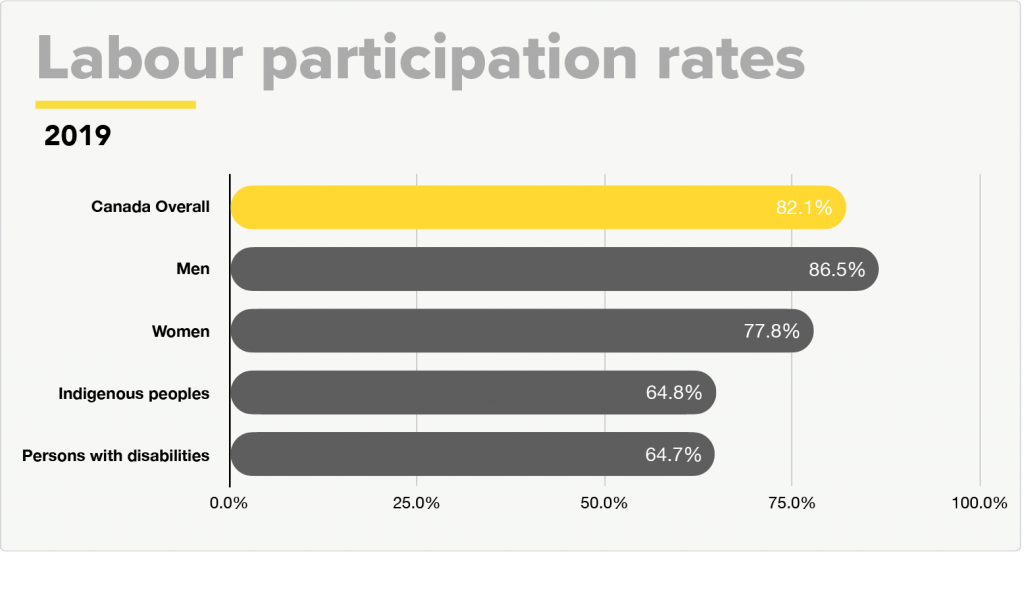

Alongside immigration, the other obvious way to grow Canada’s workforce is to increase labour force participation – the share of the adult population that is working or looking for work. Overall, Canada performs well internationally in terms of labour force participation, in part because of growth in the percentage of women in the labour market.

In 2019, just over 82 per cent of Canadians aged 25 to 64 were in the labour force – an all-time high. But that statistic masks some significant underlying disparities.10 Women and Canadians from a wide range of marginalized backgrounds typically have access to fewer labour market opportunities than men. While the paradigm is slowly changing, women devote more time to caregiving tasks than men, resulting in occupational segregation and a predisposition for more women to have occupations that are subject to employment risks such as automation in the service sector. In fact, a survey completed by Randstad in 2019 found that 30 per cent of employed Canadian women expect they will lose their jobs within a decade due to advances in technology, such as automation and artificial intelligence.

While these fundamental challenges remain and need to be addressed, the impact of COVID-19 on women in the workforce has been devastating. In April, women’s participation in the labour force fell to its lowest level in three decades: 55.5 per cent compared to 61.5 per cent a year earlier.11 Although employment among women has recovered to some extent since then, the pandemic has dealt a heavy and potentially lasting blow to several sectors in which women play an outsized role, including retail, accommodation and food services. This will only amplify gender disparities in the labour force and puts women at a higher job-separation risk, compounded by future wage penalties.

The pandemic has also brought into sharp focus the employment equity challenges facing racialized Canadians and Indigenous peoples. Heading into the health crisis, the unemployment rate among Indigenous peoples – the fastest-growing segment of Canada’s labour market – was roughly twice as high as the rate for the population as a whole. In September 2020, there was a full five percentage point gap in post-shutdown job recovery for Indigenous peoples compared to non-Indigenous Canadians.12 Lower rates of educational attainment, substandard living conditions, and health factors including disproportionate rates of infant mortality and suicide are among the many complex issues that need to be addressed in order to grow and sustain Canada’s Indigenous workforce.

As with other marginalized groups, people with disabilities have a long history of being unemployed, underemployed and paid less as a consequence of negative attitudes and incorrect assumptions about their skills and abilities. The employment rate for persons with disabilities sits at approximately 65 per cent compared to nearly 82 per cent for persons without disabilities, while the rate of poverty is 40 per cent higher for persons with mild disabilities and 200 per cent higher for those with severe disabilities.13 These challenges have been compounded by the pandemic: nearly 36 per cent of people with a long-term condition or disability have reported temporary or permanent job loss since the crisis began.

For the sake of fairness as well as economic growth, Canada must strive to increase labour force participation rates across all segments of the population. We can start by expanding access to affordable childcare, which enables more women to participate in the labour market and is also an important source of employment for women — an economic driver in and of itself. Initiatives such as the federal government’s recently launched Black Entrepreneurship Program and the business-led BlackNorth pledge are promising examples of the work that will be required to end systemic racism and expand employment opportunities for marginalized groups. Governments and employers must stay focused on the need to create more inclusive and accessible workplaces.

Capital

Canada’s economy cannot grow – and Canadians cannot look forward to improvements in their standard of living – without higher levels of private-sector investment. Business investment drives labour productivity, which creates well-paying jobs and allows companies to survive and thrive in the face of intense international competition. In the words of Carolyn Wilkins, Senior Deputy Governor of the Bank of Canada, “Investment makes workers more productive by increasing the capital that they have to work with. You can clear your driveway faster with a snowblower than with a shovel.”14

Unfortunately, business investment as a share of GDP is weaker in Canada than in many other advanced economies – a worrying sign from a competitiveness standpoint. In 2019, figures from Statistics Canada and the Organisation for Economic Co-operation and Development (OECD) showed that Canadian businesses were investing roughly $15,000 per worker in machinery, buildings, engineering infrastructure and intellectual property. By contrast, businesses across the OECD were investing $21,000 per worker, while U.S. businesses were investing $26,000. That same year, Deloitte reported that Canada’s private gross fixed capital investment as a share of GDP was just 10.8 per cent, second-lowest among 12 peer nations. Since 2008, business investment in Canada has been consistently lower than in countries such as South Korea, Australia, and Sweden.15

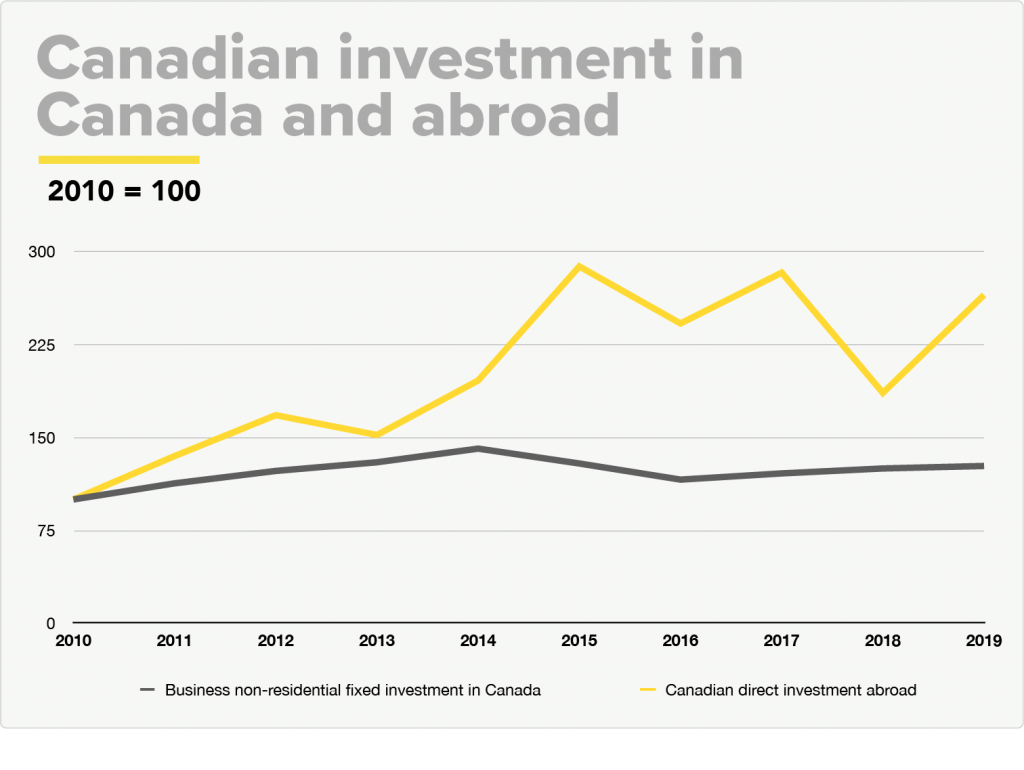

By shaping the business environment, public policy plays a critical role in helping to persuade domestic and foreign investors to invest and take risks in Canada. For a variety of reasons, however, Canada has acquired a reputation as a country in which it is difficult and extremely time-consuming to get large capital projects off the ground. The cancellation of major projects such as the $16-billion Energy East pipeline, Teck’s $21 billion Frontier project and Pacific NorthWest’s $36-billion liquid natural gas facility will substantially reduce the level of new capital investment in Canada for many years. Of equal concern is the growing tendency of Canadian-headquartered companies to choose to expand outside of the country, in jurisdictions that offer a more attractive environment for private investment. In fact, by the end of 2019 the market value of Canadian direct investment abroad outweighed foreign direct investment in Canada by $804 billion16.

While the number of factors that influence business investment in Canada is long and complex, this paper focusses on four priority areas to help unlock future capital spending: infrastructure, interprovincial trade, regulatory reform, and tax competitiveness.

A new approach to infrastructure

Most discussions about the need for high-quality public infrastructure in Canada tend to focus on conventional assets such as roads, bridges, water treatment facilities, community centers and the like. While important and necessary, such projects are insufficient to ensure the country’s economic competitiveness in the 21st century economy.

Investments in infrastructure can be among the most powerful levers governments have at their disposal to achieve both short- and long-term economic objectives. But investments that raise a country’s growth trajectory don’t just happen. They require careful planning, a clear set of priorities, and political leadership. The COVID-19 pandemic has driven Canada’s governments deep into the red, so it is more important than ever to focus on projects that will modernize our economy and make us more productive as a country, such as advanced digital connectivity, major transportation and urban transit networks, and low-carbon electricity grids.

As a country that relies heavily on trade with the rest of the world, Canada should also be investing strategically in infrastructure that improves our ability to deliver goods and resources to global markets. This requires enhancements to gateway transportation infrastructure to the United States, as well as east and west across the country and into global markets. Tax incentives and a recapitalization of the National Trade Corridors Fund – a successful, merit-based program that is now fully subscribed – are two important levers that can unlock private and public sector investment in trade-enabling infrastructure in Canada.

A dual-track approach that encourages innovation and creates the right environment for further investments in Canada’s critical digital infrastructure can also enable economic opportunity and raise living standards. For example, additional investments in 5G connectivity and broadband coverage would have far-reaching benefits for Canadians in areas ranging from agriculture and healthcare to energy management and transportation.

Another challenge for Canada will be to leverage the private capital necessary to support new investments. The Canada Infrastructure Bank (CIB) was created in 2017 to leverage private capital and project management expertise in order to advance the federal government’s infrastructure strategy. The bank was seeded with $35 billion and given a mandate to work with private and institutional co-investors in support of revenue-generating projects. Although only a handful of deals have been announced so far, few would question the need for such an agency to catalyze important investments.

As Bank of Canada Governor Tiff Macklem wrote in 2018 when he was Dean of the Rotman School at the University of Toronto: “The simplest and clearest operational metric to identify strategic infrastructure would be its ability to generate future revenue streams. When businesses and households value the service provided by the infrastructure, they should be willing to pay for the service through freight, electricity, broadband, water rates, transit fares and road tolls. These revenue streams provide a ready litmus test of the economic value of the project. Revenue streams that exceed the cost of borrowing provide a rationale for debt finance by the public sector and are also more likely to attract private capital.17”

Another way to generate the capital necessary for new infrastructure is to engage in asset recycling –either selling or leasing existing public assets to the private sector and using the proceeds to finance new projects without raising additional public debt. Australia’s recent experience with asset recycling offers a number of useful lessons for Canada. By creating a two-year window during which states and territories were encouraged to sell off assets, Australia’s national government helped unlock more than $17 billion in new infrastructure developments, including new port, highway and freight infrastructure and light rail systems18.

Falling behind

- Canada’s current infrastructure deficit is estimated to be between $110 billion and $270 billion.

- Canada’s per capita infrastructure investments have tended to lag those of similar OECD countries since 1960.

- The World Economic Forum’s latest ranking on infrastructure quality ranks Canada 14th out of 28 OECD countries, adding that 10 to 20 per cent of the country’s infrastructure is in poor or very poor condition.

Sources: Boston Consulting Group, World Economic Forum, 2016 Canadian Infrastructure Report Card

Enhancing interprovincial trade

Economists, policy experts and even many politicians have for decades lamented the existence of interprovincial trade barriers, yet the pace at which they are being dismantled can only be described as glacial. It’s time to end the foot-dragging. According to Statistics Canada, restrictions on trade and labour mobility between provinces have an impact equivalent to a 6.9 per cent tariff.19 Canadians rightly protested when President Donald Trump imposed duties on Canadian steel and aluminum, yet we tolerate the significant limitations that our own governments place on goods and services moving between provinces and territories. It is perverse and self-defeating.

The Bank of Canada has estimated that removing interprovincial trade barriers could add 0.1 to 0.2 percentage points to potential annual output. A recent Bank of Montreal study concluded that the positive impact from free interprovincial trade “would cumulate over a decade to add as much as two per cent to national GDP, or nearly $50 billion.”20 That is more than twice Canada’s annual exports to China, our country’s second-largest trading partner.

Governments could do the Canadian economy an immense service by accelerating their efforts to open up the Canadian marketplace. What is lacking now is a clear path, process and schedule to reform interprovincial trade, accompanied by accountability metrics and specific targets.

Removing regulatory barriers

A survey of Business Council members in January 2019 identified regulatory inefficiency as the single most important issue weighing on Canadian competitiveness. Often, the problem stems from duplication and inadequate alignment of regulatory processes across federal, provincial, territorial, and municipal governments. In Canada, the full burden of regulation remains unknown and as a result the impacts on businesses are unchecked.

Overly burdensome and time-consuming regulations are more than an inconvenience. They directly influence international perceptions of Canada as a place to do business and undermine our country’s ongoing efforts to attract foreign direct investment. They raise costs for consumers, reduce employment opportunities and limit the ability of businesses to invest in new, productivity-enhancing machinery and processes.

Examples abound of major projects that have encountered lengthy delays because of duplicative and inefficient regulatory processes. The Quebec Port Authority’s proposed Laurentia deep-water container terminal and the Roberts Bank 2 Terminal project in Delta, B.C. have each been on the drawing board for close to a decade. Each would drive investment, generate growth, and expand market opportunities for Canadian companies at a time when Canada’s economy and Canadian workers need all the help they can get – and when governments urgently need the tax revenues that flow from higher levels of business activity.

As we argued in last year’s report A Better Future for Canadians, what is needed is an independent, arm’s-length oversight agency with the ability to issue public reports and a legislated mandate that transcends the political cycle. The agency’s mission would be to shine a light on the cumulative impact of regulation on Canada’s national economy, helping governments at all levels prioritize their efforts to reform and modernize the system. In recent years both Germany and Denmark have created similar watchdog institutions, improving the transparency and accountability of the regulatory system while reducing the regulatory burden on businesses and citizens. British Columbia, for its part, maintains a “net-zero” policy commitment that requires the government to keep the overall number of regulatory requirements below 2004 levels until 2022.

While we recognize the recent efforts put forward by the Government to act on the advice provided by the External Advisory Committee on Regulatory Competitiveness, a stronger sense of urgency is required to fix Canada’s regulatory mess and create a higher burden for new regulations.

Regulatory hurdles

- Canada consistently ranks as one of the most restrictive countries for Foreign Direct Investment on the OECD Regulatory Restrictiveness FDI Index.

- Canada’s position on the World Bank’s Doing Business ranking has fallen from fourth in the world in 2006 to 22nd in 2019.

- Canada ranks 34th out of 35 OECD countries in terms of the time required to obtain a permit for a new general construction project—168 days longer than the United States.

Sources: OECD, World Bank

Keeping our taxes competitive

Tax policy can be a powerful tool for attracting and retaining investment as well as talent. If we allow tax rates in Canada to rise above those of our major trading partners, companies and investors will have more incentives to build and grow elsewhere, and highly mobile skilled workers will relocate to jurisdictions where they can keep more of what they earn. Conversely, a competitive tax system acts as a magnet for both capital and highly skilled workers, fueling labour productivity and economic growth.

Economic recovery from this unique crisis will be uneven and challenging, so now is not the time for tax increases. In the post-pandemic period, countries around the world will be competing harder than ever to attract capital, and those with money to invest will have many options. Canada cannot afford to be seen as a high-tax jurisdiction.

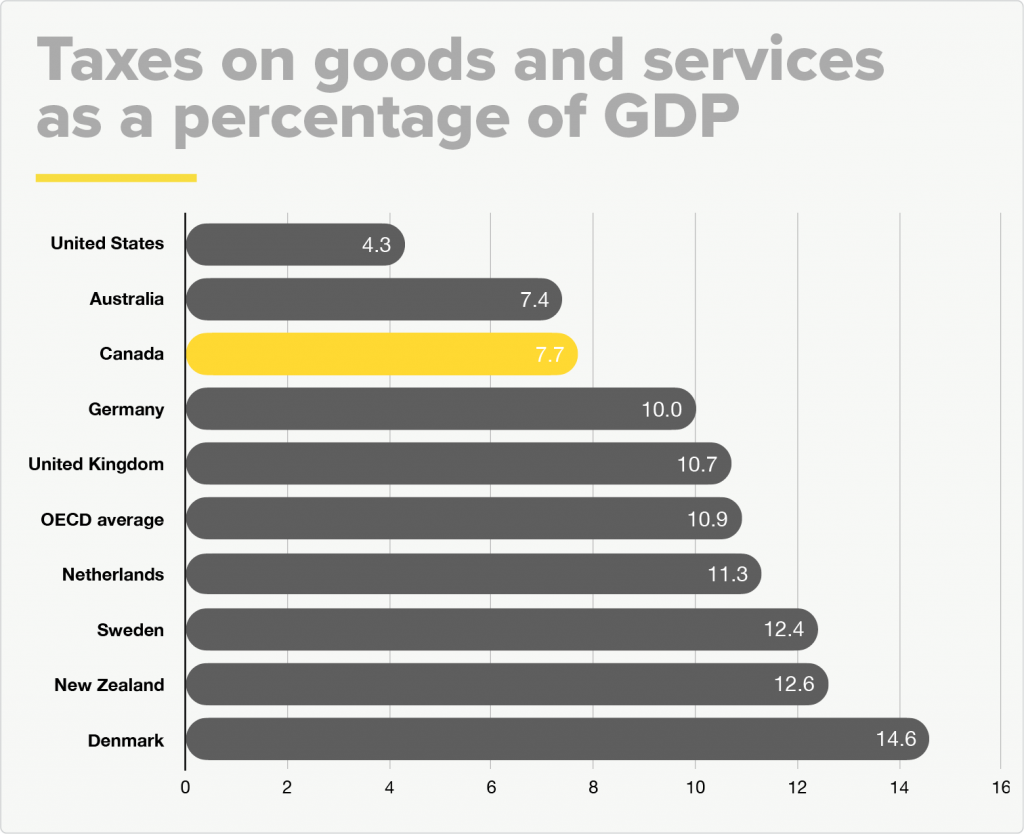

Currently, Canada’s tax-to-GDP ratio – the overall level of taxation relative to the size of our economy – is slightly below the OECD average. But as a share of GDP, Canada’s taxes on corporate profits and payroll taxes are both significantly higher than the OECD average. Germany, the United States, the United Kingdom, France, Australia, Sweden and Denmark (among other countries) all collect less than Canada in corporate taxes as a share of GDP.22

Similarly, Canada’s taxes on personal income are higher, as a share of GDP, than in such countries as Germany, the United States, France, the United Kingdom, Japan, Korea and Australia. The average top marginal personal income tax rate in Canada – federal and provincial rates combined – is 53.5 per cent. That compares with 47.5 per cent in Korea and Germany, 47 per cent in Australia and the United Kingdom, 46 per cent in the United States, and 33 per cent in New Zealand.23

How, short of significant cuts to personal and corporate tax rates, can Canada make its tax system more globally competitive? One way would be to gradually shift the focus of the tax system more toward consumption taxes, as is the trend in most advanced economies. Another would be to modernize and simplify the tax system, eliminating inefficient tax expenditures while reducing compliance costs. An analysis by the World Bank in 2019 ranked Canada 19th globally for the ease of paying business taxes, well behind countries such as Ireland, Denmark and New Zealand. The same study found that Canadian companies of all sizes needed an average of 131 hours a year to prepare and pay their taxes. Their counterparts in Australia and the United Kingdom required just 105 hours to do their taxes, while firms in Finland only needed 90 hours.

To be sure, governments must be committed to fighting tax avoidance, including through the Base Erosion and Profit Shifting (BEPS) framework led by the G20 and OECD. The ultimate goal of policymakers should be a tax system that promotes growth, productivity and innovation, creating a competitive advantage for Canada rather than deterring investment and job creation.

Ideas

More than ever, Canada’s economic success depends on harnessing our human intellectual capital. Innovation drives productivity growth, which in turn raises living standards. Our collective well-being depends on it.

Yet our innovation ecosystem is weak and out of balance. True, Canada performs relatively well at the beginning of the innovation chain, as measured by public investments in basic research and the number of business start-ups. But we rank poorly when it comes to scaling up innovative companies and developing globally competitive firms. Too many promising companies leave Canada, particularly in industries such as information and medical technology. It’s as though we were training high-potential athletes, only to send them abroad to win Olympic medals for other countries.

Getting better at commercializing our research

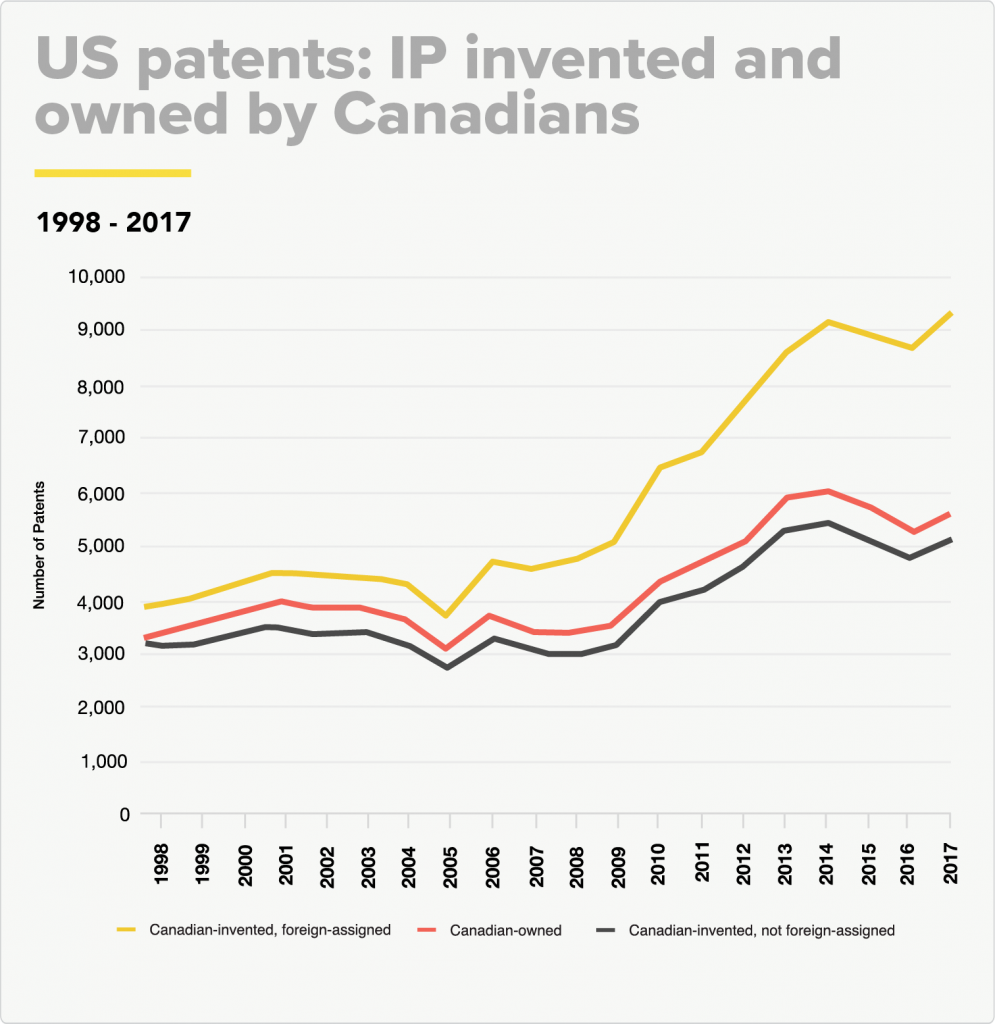

For Canada to reap the benefits of our collective investments in innovation, we must become better at transforming knowledge and intellectual capital into commercial products and services. Historically we have undervalued our intellectual property as a source of economic wealth and have given it away to foreign firms too easily.

Part of the problem is that Canada’s public spending on R&D is not a significant driver of domestic economic growth. Funding distributed by the three granting councils to universities, research institutions and public labs should serve to strengthen Canada’s innovative capacity and productivity. It should support a broader innovation ecosystem and help close the gap between public benefits and private costs. The case for such spending is weakened, however, when intellectual property developed in Canada, with the help of public dollars, winds up being acquired by foreign companies, resulting in most of the commercial benefits of that IP being realized in other countries.

The challenge for Canada is to create a more robust innovation ecosystem that contributes to growth, productivity and higher living standards. Traditional supply-side incentives – such as grants for academic research or tax-based subsidies for R&D – increase the economy’s capacity for innovation but do not address the demand side of the equation. In other words, our innovation policies do not do enough to accelerate the diffusion and adoption of new technologies, to create new markets, and to translate scientific strengths into economic performance.

In recent years, a growing number of experts have recommended that the federal government rebalance Canadian innovation policy by placing greater emphasis on the demand for innovation. “The bottom line is that demand-side innovation policy, by creating new market opportunities and/or intensifying competition, can directly affect the profit-seeking behaviour of firms and prompt them to innovate,” Peter Nicholson, founding president of the Council of Canadian Academies, wrote in a 2018 paper published by the Institute for Research on Public Policy.

Governments can stimulate demand for leading-edge innovations in the economy in several ways, including through the strategic use of public procurement (see below). But among the other tools at their disposal, Canadian policymakers should consider the adoption of a mission- or challenge-driven approach to driving innovation, creating new markets and accelerating the commercialization of Canadian goods and services. In the United States, mission-oriented organizations such as DARPA (the Defense Advanced Research Projects Agency, created in 1958 in response to the Soviet Union’s launch of Sputnik) and ARPA-E (the Advanced Research Projects Agency-Energy, established in 2009) operate as public sector intermediaries between science and industry to pursue breaththrough research. As observed in a recent paper published by the Public Policy Forum: “DARPA’s mandate is ‘high-risk, high-reward’ initiatives. Its list of failures is no doubt longer than its successes, but its net effect on U.S. innovation and commercialization is profound.”24

Leveraging and protecting our ideas

In a world in which economic value is increasingly derived from intangible assets, we need to create, leverage, and retain more intellectual property in Canada. The reality, however, is that Canada performs poorly in terms of both patent creation and intellectual property investments as a share of GDP. Investment in IP represented 2.3 per cent of Canadian GDP in 2005 but fell to 1.7 per cent as of the third quarter of 2019. That is in sharp contrast to the situation in the United States, where IP investment rose from 3.6 per cent of GDP in 2005 to 4.8 per cent in the fourth quarter of 2019. These numbers help to explain why there is not a single Canadian company among the world’s 200 largest private-sector spenders on R&D, according to data compiled by Bloomberg.

The field of artificial intelligence offers a dismaying example of the challenge ahead of us. Although it is often suggested that Canada has a comparative advantage in this fast-growing area, the truth is we are nowhere to be seen on patent filings. China, the United States, Germany, France, the United Kingdom, Japan and South Korea account for almost all the patent filings in this field.25 Yes, Canada can lay claim to impressive R&D capability in AI, but we have yet to translate this into significant commercial outcomes and world-leading firms.

How can we turn this around? One approach would be to learn from the experience of countries that perform better than Canada in IP production. For example, the German Patent and Trade Mark Office (DPMA) is a key service provider in the field of industrial property protection. The office has the main duty to grant, register, administer and publish IP rights, including patents, utility models, designs and trademarks. The German approach, exemplified by the number of patents filed by Fraunhofer institutes, places a high priority on patent creation and retention. DPMA acts as a proactive advisor and facilitator to build a strong IP portfolio to the benefit of German firms. In sharp contrast, Canada’s patent office role is essentially to grant IP rights and provide general IP awareness and information.

Ensuring procurement fuels Canadian innovation

There is currently little connection between Canada’s innovation agenda and public procurement, including investments in infrastructure and our country’s defence capabilities. For the most part they are treated as separate and distinct policy objectives. Fostering homegrown innovation is simply not considered an important objective in procurement. Nor is developing technologies for the export market.

Canada needs to rethink procurement so it becomes not only a means to acquire goods and services, but also a driver of innovation and economic growth. This will require fiscal and policy adjustments. In particular, the federal government should allow individual departments and agencies that are responsible for procurement, including the Canadian Space Agency and the Department of National Defence, to support procurement-led innovation. Past examples of successful Canadian innovation – such as the Canadarm and canola – benefited from this approach.

Backing Canadian leaders

Governments cannot avoid decisions about which market outcomes they prefer and which economic goals they choose to prioritize. Full market neutrality is not possible. The question for Canada, therefore, is not whether it is time to pursue an industrial policy. The federal government already spends billions annually on industrial programs and initiatives that favour certain market outcomes over others. The more practical question is whether we should stick with the status quo – a fragmented and unconvincing industrial policy – or pursue an industrial strategy that is more focused and intentional.

The evidence from the United States, the United Kingdom, Japan, Germany and the Netherlands seems clear: the post-COVID-19 paradigm will include a more active role for the state in supporting technological innovation and shaping market outcomes within domestic borders. A bipartisan political consensus in Washington, D.C. that once favoured economic engagement with China has been replaced with a new consensus that views China as an economic and geopolitical threat based in large part on its emerging technological leadership. As a result, the Committee on Foreign Investment in the United States (CIFIUS) is now closely scrutinizing Chinese investments and imposing enhanced restrictions. This “decoupling” means the United States is now aggressively supporting its tech companies and financing and building new capacity to become self-reliant across the supply chain.

In 2019, Germany’s economy minister put forward a series of proposals for a new industrial strategy, including the creation of a state investment fund that would step in to prevent foreign takeovers of leading German companies. “It is necessary to reshape Germany’s industrial policy so that industry will remain a strong core of the German economy,” Germany’s Minister for Economic Affairs and Energy said, citing digitalization, climate change, and demographic change as key forces challenging German competitiveness.

Meanwhile, the European Commission has set out a framework for developing a series of cross-sectoral missions such as curing cancer, adapting to climate change, making cities greener and ensuring healthy oceans. Last January, it announced an ambitious new Green deal with the goal of reaching climate neutrality by 2030. The plan is to invest in environmentally friendly technologies, support industry to innovate, roll out cleaner, cheaper and healthier forms of private and public transport, decarbonize the energy sector, and ensure buildings are more energy-efficient. For its part, the U.K. government has laid out an industrial strategy based on four “grand challenges”: the rise of artificial intelligence and data, the needs of an aging society, clean growth, and the future of mobility.

It’s worth asking ourselves whether a similar approach makes sense for Canada. Would an industrial strategy focused on sectors of comparative advantage – such as agri-food, energy and renewables, health care and life/bio sciences and advanced manufacturing – help Canadians better leverage their domestic strengths and equip them to compete for global market share? To be sure, the federal government has in recent years announced a series of new (or redesigned) innovation-focussed programs, including the Superclusters initiative, the Strategic Innovation Fund and Innovative Solutions Canada. But given the speed at which other countries are moving, it may be time for a much more robust, comprehensive and deliberate review of our current toolkit.

To see how this could work in practice, consider the energy and renewables sector. The federal government could do more to position Canada as a leader in the low-carbon transition, including by promoting exports of products and technologies that would enable other countries to reduce their emissions. It could help to maximize the value of Canada’s resources while shrinking their environmental footprint. An industrial strategy that supported private sector research, the cost-effective adoption of low carbon technologies, and the scaling up of promising technologies could generate significant economic and environmental benefits.

Conclusion

For years, economists and policy analysts have voiced concern about Canada’s slowing pace of economic growth. Countless studies and reports have reached similar conclusions: our country’s population is aging, our labour productivity growth lags that of many other industrialized countries, and we are falling behind when it comes to attracting and retaining business investment. A year ago, the Business Council of Canada’s Task Force on Canada’s Economic Future cautioned that, over time, these trends would seriously threaten Canadians’ standard of living and quality of life. “Slower economic growth over the long run,” the Task Force said in its final report, “will inevitably mean fewer opportunities for our children and grandchildren, higher rates of unemployment, and less money for cherished public services such as health care, education and transit.”

As discouraging as that finding might have sounded at the time, the COVID-19 pandemic has significantly intensified the challenges confronting Canada’s economy. We entered 2020 with a national unemployment rate of 5.5 per cent; it is now nine per cent. The federal budgetary deficit in 2020-21 was originally forecast to be $28.1 billion but is now on track to reach at least $343 billion. Untold thousands of small businesses have been driven to the brink, entire industries have been disrupted, and many towns and cities face a fiscal reckoning. In short, Canada’s economy is more fragile now than at any time since the 1930s.

There is only one way out of this abyss: Canadian policymakers must move decisively to expand the country’s economic potential and create the conditions for long-term growth. To be sure, there are no quick fixes and no single silver bullet. Tackling the underlying causes of Canada’s economic malaise will demand ambition, leadership and a lot of hard work. We must squarely acknowledge our weaknesses, reject complacency, and resolve to make Canada the country it has the potential to be: the best place in the world in which to live, to work, to invest and to grow.

Building a more prosperous future for Canadians will require action on three fronts: people, capital, and ideas.

People: We need to cultivate and enhance our human capital by developing a more agile and adaptable workforce, doing more to help young Canadians build rewarding careers, and building on the success of our immigration system to make our country an even more powerful magnet for international talent.

Capital: We need to strengthen business investment by adopting a more focussed approach to infrastructure, enhancing interprovincial trade, removing unnecessary regulatory barriers, and ensuring that our tax system is globally competitive.

Ideas: In a world in which wealth creation is driven by knowledge and innovation, we must get better at commercializing our research, protecting intellectual property, harnessing the power of public procurement, and pursuing a more intentional industrial strategy that leverages Canada’s domestic strengths for success in the global market.

Over the coming months, the Business Council will be reaching out to policy experts, partners and stakeholders across the country. We will be seeking their advice and input as we work to define a path forward with concrete and detailed recommendations in each of the priority areas identified in this paper. Simultaneously, we will be developing recommendations on how the country can be set on a path toward achieving net-zero GHG emissions by 2050 – a goal that will require the financial capacity, skilled workforce and demonstrated commitment to innovation of Canada’s energy and resource sectors.

Only by working together, as Canadians and their governments did in addressing the COVID-19 crisis, can we realize our shared objectives. We are convinced that Canadians are up to the challenge.

Footnotes

1 https://ppforum.ca/publications/two-mountains-to-climb-canadas-twin-deficits-and-how-to-scale-them/

2 https://www150.statcan.gc.ca/n1/daily-quotidien/190930/cg-a003-eng.htm

3 https://www.budget.gc.ca/efu-meb/2019/docs/statement-enonce/chap01-en.html#s5

4 https://www.brookings.edu/wp-content/uploads/2018/06/Canadas-Advanced-Industries_18-06-05_FINAL2.pdf

5 https://www.cdhowe.org/intelligence-memos/paul-jenkins-%E2%80%93-long-%E2%80%A6-and-short-finding-equilibrium

6 Conversations with Tyler. December 5, 2018. Paul Romer on the Unrivalled Joy of Scholarship. [Podcast]

7 https://www.linkedin.com/pulse/how-win-skills-game-10-ideas-2020s-john-stackhouse/

8 https://munkschool.utoronto.ca/mowatcentre/the-seventy-five-year-decline/

9 https://munkschool.utoronto.ca/mowatcentre/fixing-canadas-ei-system-is-critical-for-the-future-of-work/

10 https://www.budget.gc.ca/efu-meb/2019/docs/statement-enonce/efu-meb-2019-eng.pdf

11 https://thoughtleadership.rbc.com/pandemic-threatens-decades-of-womens-labour-force-gains

12 https://www150.statcan.gc.ca/n1/daily-quotidien/201009/dq201009a-eng.htm

13 https://ppforum.ca/publications/barriers-to-employment-for-people-with-disabilities-in-canada/

14 Bank of Canada, 2019. Economic Progress Report: Investing in Growth.

Available at: https://www.bankofcanada.ca/2019/05/economic-progress-report-investing-in-growth/

15 Deliotte, 2019. Canada’s Competitiveness Scorecard.

Available at: https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/finance/ca-bcc-deloitte-scorecard-interactive-pdf-aoda-en-updated-final.pdf

16 https://ppforum.ca/publications/two-mountains-to-climb-canadas-twin-deficits-and-how-to-scale-them/

17 https://on360.ca/30-30/strategic-infrastructure-transition-briefing/

18 Address by The Hon. Joe Hockey to the Federal P3 Conference. November 27, 2018.

19 Bemrose, R., Brown, W.M. and Tweedle, J., 2017. “Going the distance: estimating the effect of provincial borders on trade when geography matters (No. 2017394e),” Statistics Canada, Analytical Studies Branch.

20 Porter, D. and R. Kavcic. October 26, 2018. Sizing Up Provincial Trade Barriers. BMO Capital Markets Corp.

21 https://on360.ca/30-30/strategic-infrastructure-transition-briefing/

22 https://data.oecd.org/tax/tax-on-corporate-profits.htm#indicator-chart

23 https://data.oecd.org/tax/tax-on-personal-income.htm#indicator-chart

24 https://ppforum.ca/publications/new-north-star-2-revisited/

25 https://www.wipo.int/edocs/pubdocs/en/wipo_pub_1055.pdf