Navigating Change

2018 Business Council Skills Survey

Executive Summary

Advancements in technology are changing today’s work environment at an ever-increasing pace. Nevertheless, Canadian organizations recognize the ongoing need for the “human touch” and are taking steps to ensure they have employees with the necessary skills and attributes. Based on a survey of 95 leading Canadian employers, Navigating Change: 2018 Business Council Skills Survey examines the shifting nature of the Canadian labour market. Respondents—HR executives at Canada’s largest companies—were asked to reflect on major challenges and opportunities in finding, training and retaining talent. This report does not attempt to quantify the overall impact of innovation on jobs, but to understand how Canadian businesses are responding to this and other trends.

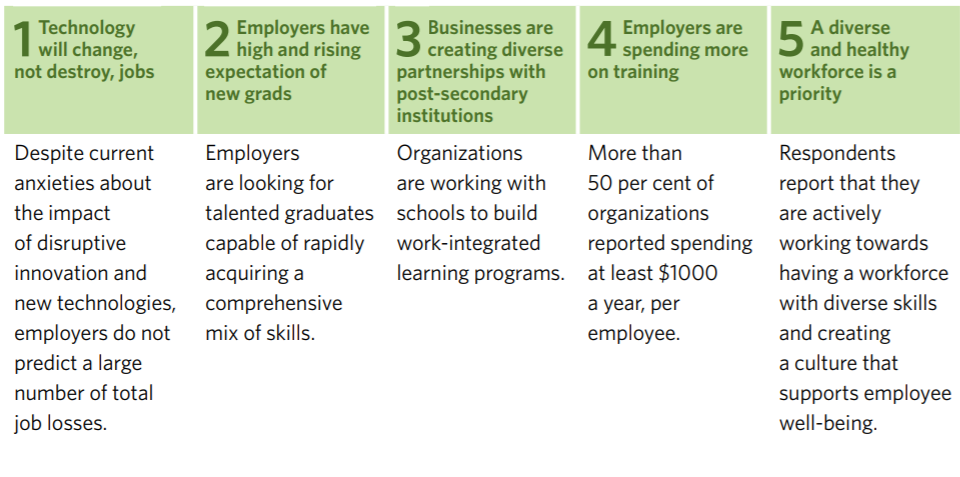

Major takeaways from the survey include:

Introduction

“Technological innovation means that organization models will change. They’ll become more oriented around autonomous and high-performing teams. Constant up-skilling will become essential. Creativity and critical-thinking skills will be key.”

Today’s work environment is one of constant change

Recent graduates stress about finding jobs; parents worry about children moving back home; and employers are concerned that their workforces won’t have the skills needed for an increasingly global, competitive environment. Technological advancement, shifting demographics and economic highs and lows create challenges for Canadian employers and employees alike.

This is the third iteration of a biennial survey by the Business Council of Canada (formerly the Canadian Council of Chief Executives). The previous reports, released in 2014 and 2016, have:

- informed public policy;

- supported the development of programs to help young Canadians transition from school to work; and

- deepened discussions of Canada’s skills and talent needs.

The surveys also spurred the launch of the Business/Higher Education Roundtable, a tangible initiative to strengthen the relationship and level of co-ordination between businesses and post-secondary leaders. The 2018 Skills Survey is grouped into themes, each of which offers insight into the major trends facing Canadian employers. Questions focus on:

For the first time, the survey asked respondents about disruption in the workforce due to artificial intelligence (AI) and automation, and the impact of these trends on employee well-being. It is important to note that the period of this survey coincided with an overall buoyant Canadian economy, including a tightening labour market.

Methodology

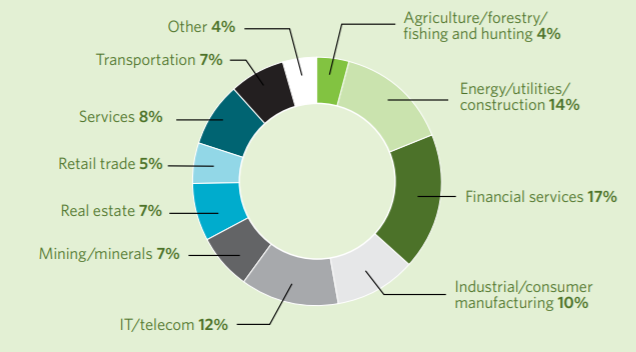

This report is based on a survey of 95 large Canadian private-sector employers, conducted between August and October 2017. The companies that participated in the study employ more than 850,000 Canadians across the country in a wide range of industries.

It is the product of a partnership between Morneau Shepell, a global leader in human resource solutions, and the Business Council of Canada, an association representing 150 of Canada’s largest firms. The methodology of the Skills Survey has remained consistent over the three times it has been conducted (with reports produced in 2014, 2016 and now, 2018). This consistency facilitates year-over-year comparisons.

The structure of the 2018 survey (conducted in 2017) covers the following categories, many of which were aligned with those in the 2016 survey (conducted in 2015):

- Expectations of employers and new graduates

- Relationships with post-secondary institutions

- Learning and development

- Hiring and skill availability

- Impact of innovation (new in 2018 survey)

- Health, disability and diversity (new in the 2018 survey)

About the survey

The new sections on disruption in the workforce due to AI and automation increased the survey from 33 to 38 questions. The sample distribution by industry sector is depicted in the chart below.

Survey tool

Questions were developed by Morneau Shepell and the Business Council of Canada, in consultation with a range of stakeholders in the post-secondary and business communities. These consultations focused on ensuring that the questions reflected current Canadian research, and on aligning the survey’s terminology with that used by other groups.

The survey was completed online using a browser-based data collection tool, with each company invited to complete the survey using a unique URL. Respondents included chief human resources officers, vice presidents or directors of HR, and/or HR managers. Results were aggregated and grouped by industry. Quotes from survey participants have been anonymized, and edited for clarity. This survey is a snapshot of a sub-group of the Canadian economy. It does not purport to reflect the workforce trends and challenges of all Canadian employers.

Gauging the future: The impacts of change

“With the increased application of technology in business, including automation and AI, organizations are seeing the elimination of entry-level positions.”

There is a growing body of research on the potential impact of disruptive innovation on Canada’s labour market. Researchers generally agree that: the brunt of the impact will be borne by those who lack a post-secondary degree or diploma; Canada’s diversified economy offers some protection against widespread job displacement, at least over the short term; and individuals with a broad mix of skills will be best-equipped to succeed in an era of increasing automation.

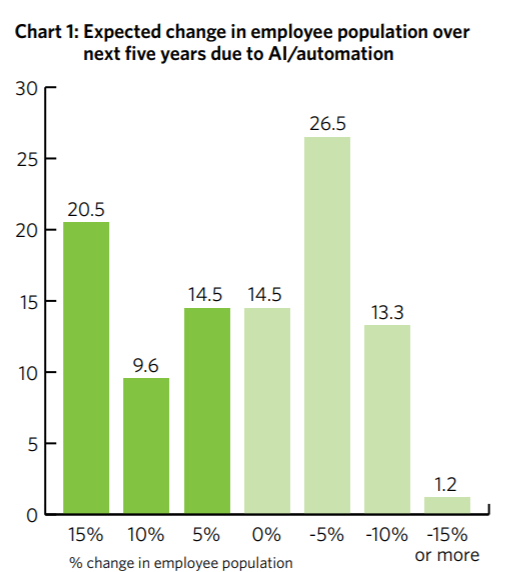

The hiring managers of Canada’s largest firms believe the overall outlook is positive. Forty-six per cent predict AI and automation will result in an increase to their workforce. Forty-one per cent predict a decrease. However, employers cautioned that the sheer rate of change makes it difficult to project long-term trends with great confidence. What the 2018 survey respondents had to say:

“Too soon to predict—but we anticipate some impact.”

“AI and automation will increase our ability to support growth and new business. Efficiencies are anticipated, but we expect customer expectations to continue to grow. AI and automation will allow our employees to provide higher levels of service to customers.”

“We will create more jobs because we are building AI tools for our clients, but there will be hundreds lost in other roles because of it. We’ve already seen dozens leave because of automation.”

Great Expectations: Asking more from new graduates

“Our company moves at a faster pace today than five years ago. In general, both new grads and employees have more accountabilities today.”

In terms of job requirements, 70 per cent of respondents indicated that they expect more from new graduates as compared to five years ago. Respondents attributed these increased expectations to a changing work environment resulting from technological advancements, with one saying:

“Technology has always changed—and will continue to change—how work is done. The rate and speed of change are significant, particularly with the advancement of AI and automation.”

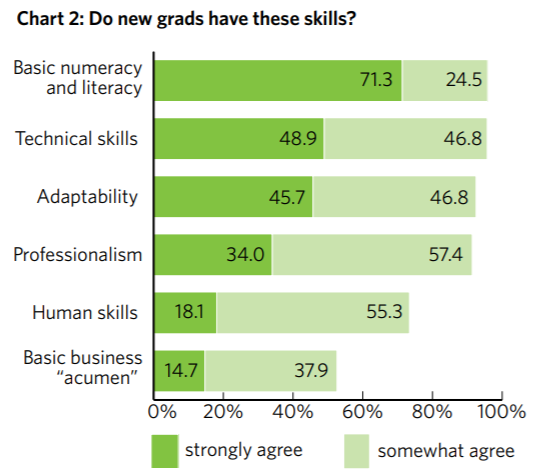

Underlying this trend is a running theme: the skills new graduates should bring to the job are different. Fortunately, as shown in Chart 2, for the most part, Canadian graduates have strong foundational skills, and have risen to the challenges. Overwhelmingly, respondents believe that new grads are well-equipped with numeracy and literacy skills, and score well in the technical sense. Employers also emphasize adaptability—the ability to manage change, learn new skills, and show resilience.

As one respondent stated:

““New grads are highly adaptable, self-sufficient and resourceful today”

By contrast, employers are less impressed with the human skills and basic business acumen of new graduates.

Improvement in the last 5 years

“Technical skills and adaptability are generally where they need to be for new graduates. The gaps typically are visible in human skills (soft skills) and business acumen. The business acumen gap is not limited to new graduates and is a bigger concern for junior to intermediate staff.”

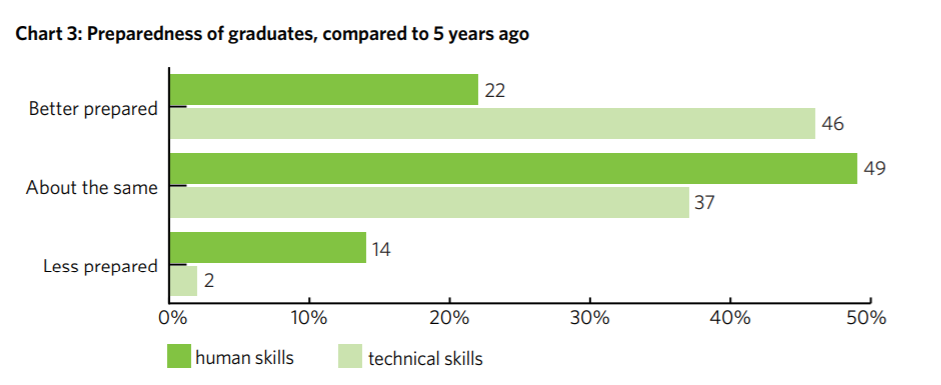

Investments in post-secondary education continue to pay off. In terms of technical skills, 53 per cent of respondents said university grads are as well prepared as they were five years ago. A total of 44 per cent say that they are better (37 per cent) or much better (7 per cent) prepared. Regarding college graduates, employers said that 45 per cent are as well prepared as five years ago, while 53 per cent said they were better (47 per cent) or much better (6 per cent) prepared.

Employers also said there has been some improvement in human skills over the past five years. Twenty-six per cent stated that university graduates are better or much better prepared with respect to human skills than they were five years ago, while 24 per cent noted improvement among college graduates. While institutions have made progress in fostering the development of human skills, graduates’ abilities still lag behind employers’ expectations.

New graduates also have higher expectations

“New grads tend to expect higher salaries than their experience would traditionally merit for entry-level or junior positions. Quick vertical promotion is expected while lateral promotion or movement is not seen as offering an equal opportunity for growth and development. Work/life balance and flexibility in work location (working remotely) are key considerations. Ongoing feedback and/or recognition is required.”

Running parallel to the rise in expectations for new graduates are the increased expectations of new graduates. Ninety per cent of respondents said that new graduates expect more from the workplace than their predecessors five years ago. Recent graduates are looking for more money, challenging assignments, increased flexibility and mobility, and quicker advancement. Managing these expectations can be a challenge for employers.

A compounding factor for some employers is the perception that their workplaces are less exciting or offer less opportunity than technology companies or start-ups. Even though they may offer competitive salaries, some employers noted that the prestige of high-growth tech firms attracts many new grads with highly specialized skills.

Finding the Right Fit: Hiring and skills availability

“Students who have undertaken a practicum, internship or co-op may be better prepared for the workforce, in terms of human skills.”

Evaluating and hiring candidates

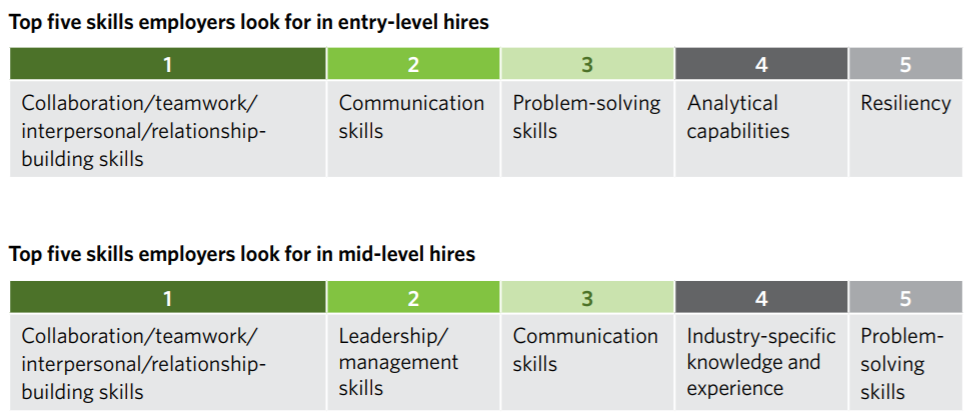

Organizations are looking for qualities that go beyond technical capabilities when they hire new graduates. The most sought-after skill is the ability to work in teams. It should be emphasized that these are the characteristics that differentiate top candidates who already meet the required threshold for functional knowledge.

Experience is broadly defined

“Graduates coming from schools that offer co-ops or work-terms are better prepared for our jobs.”

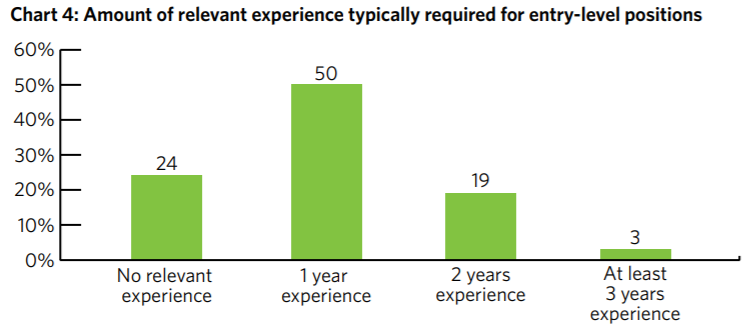

Respondents were asked about the nature and level of experience they looked for in entry-level candidates. About three-quarters of employers say they require one year or less of work experience when hiring entry-level employees. Providing clear, realistic expectations about the skills and experience needed for a role would help new graduates on the job hunt.

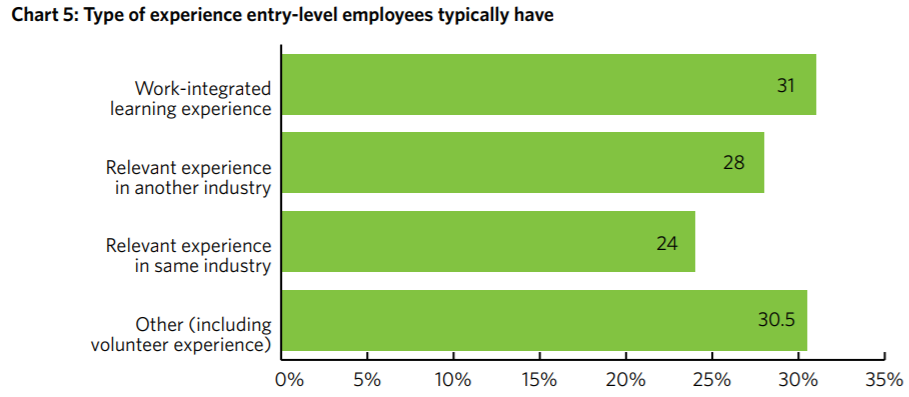

Asked what kind of work experience grads had, employers most often said that typical entry-level employees had a combination of work-integrated learning, industry experience, and non-industry experience (Chart 5). “Non-industry experience” includes experiences such as customer service jobs or leadership positions (for example, at a summer camp) that can foster human skills.

Talent recruitment

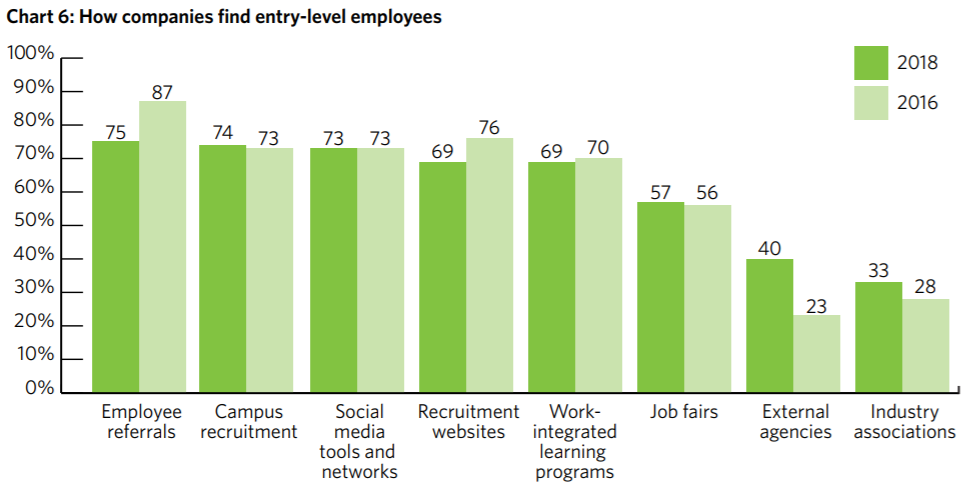

There has been little change since 2016 in recruitment strategies, with the top methods still including employee referrals, campus recruitment and social media (Chart 6). Interestingly, there has been a significant increase in the use of external agencies to fill entry-level positions.

Strong hiring continues

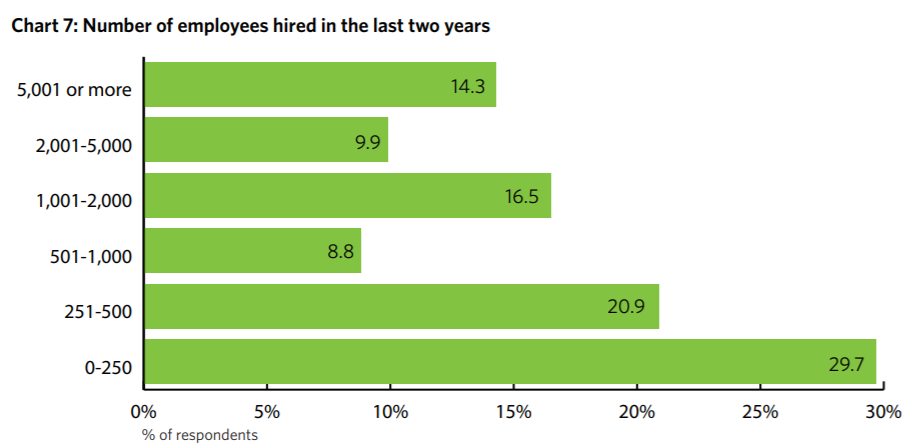

Many of the employers participating in the survey have hired additional staff over the last two years and have plans to continue to grow their workforces. Chart 7 shows the number of employees hired in Canada by respondents in the last two years.

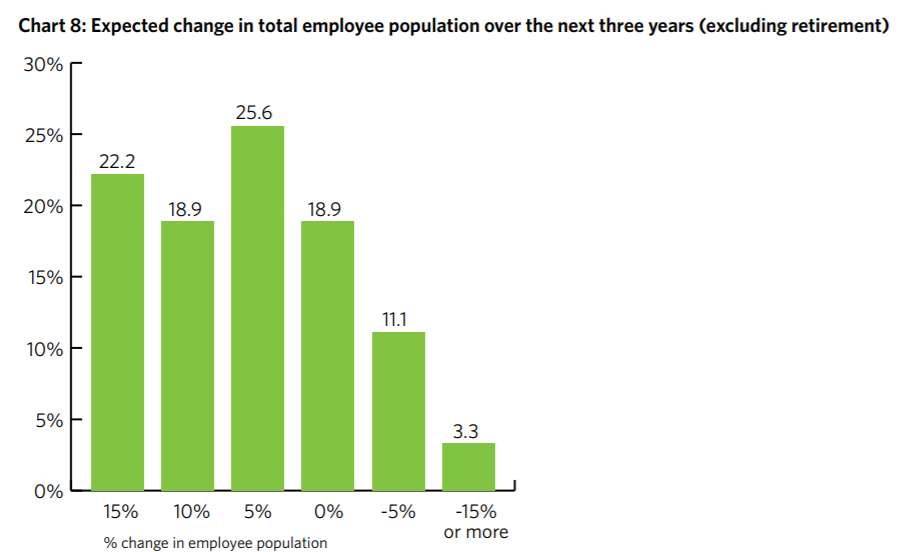

Looking ahead, two-thirds of employers expect to expand their workforce by at least five per cent in the coming three years. This is up from 2016, when 56 per cent of employers expected this level of growth over the following three to five years.

Replacing retirees

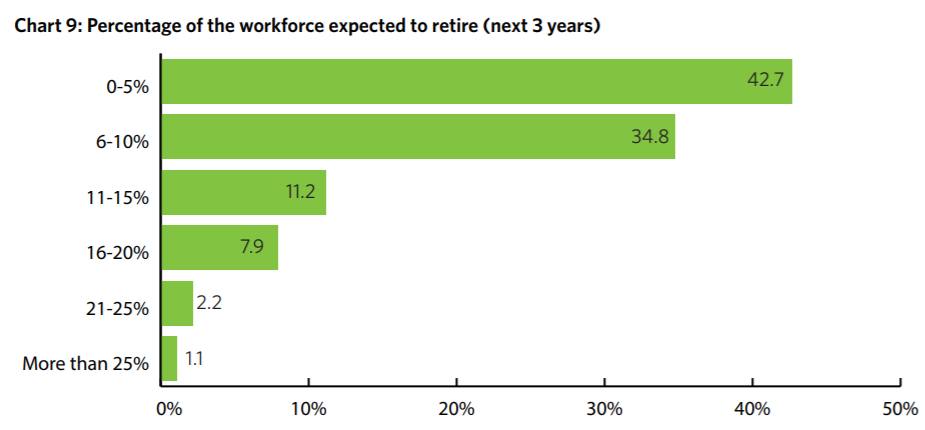

Canada’s workforce is aging. In 2016, Statistics Canada found that 36 per cent of Canada’s workforce was over the age of 55—the highest proportion on record. Despite predictions that Canada’s labour market will face a major shock from a sudden wave of baby-boomer retirements, survey respondents anticipate a smoother transition. When asked about managing retirements, respondents pointed to targeted recruitment and the training/development of existing staff as ways to manage the departure of senior-level employees.

The majority of employers (88 per cent) expressed confidence that they will be able to replace the needed skills and knowledge of retiring workers, which is comparable to the response from survey participants two years ago. However, comments from respondents indicate that some uncertainty still exists:

“It is very difficult to replace the skills and knowledge of retiring workers. New graduates bring with them new skills and knowledge relevant to changes and advances in the industry, but experience and exposure are difficult to replace.”

Current skills shortages

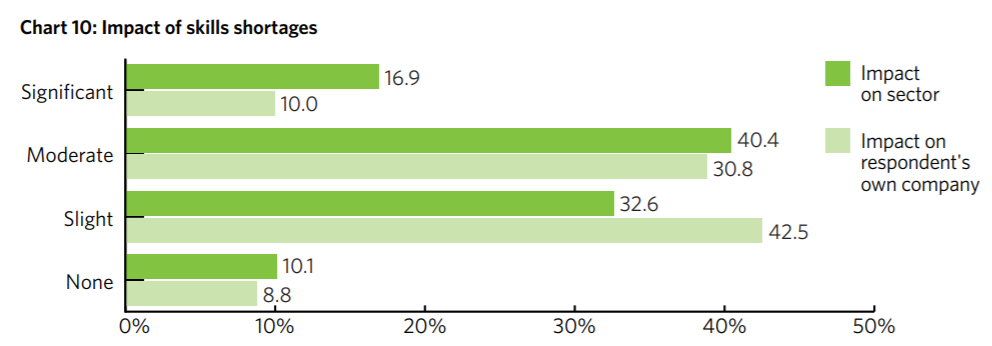

Most respondents said that their companies are affected to some degree by skills shortages, with 41 per cent characterizing the impact as either moderate or severe. Of greater concern is the impact of shortages within industry sectors.

The discrepancy between the impact of skills shortages on a respondent’s sector as compared to a respondent’s business could reflect the respondent’s confidence in the ability of his or her organization to find the talent it needs. Another factor could be that the companies surveyed, in general, have larger HR departments than small or medium-sized businesses within their sector, which with greater resources for recruitment.

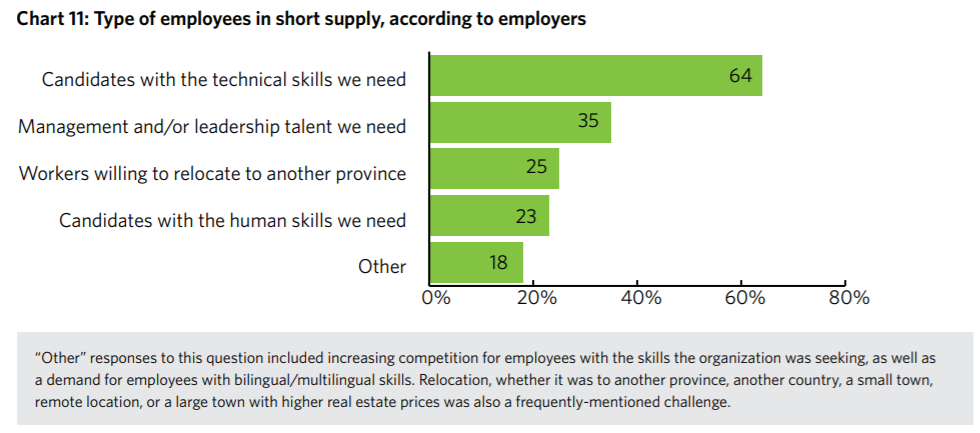

Factors that can influence skills shortages include challenges in attracting/retaining talent, constraints on hiring from outside of Canada, and inability to deliver anticipated compensation. Whereas Chart 2 (page seven) underscores that new grads generally possess high levels of technical skill, Canada’s tight labour market means that candidates can be difficult to attract.

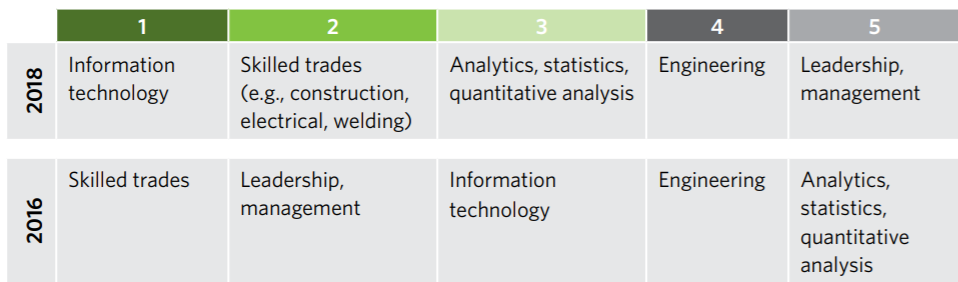

Top 5 areas of skills shortages

Employers were asked to predict the top five areas where they expect to experience skills shortages, over the next three years.

As it did in 2016, cyber security/risk management ranked sixth in terms of anticipated skills shortages.

“There is a definite shortage of skills in areas such as robotics, process automation, AI, blockchain, and cyber. Some of our more traditional areas of business would be experiencing a ‘moderate shortage.’ However, if we experience any sustained growth in the next few years in Canada, these will all become significant shortages.”

“There’s a specific challenge in engineering, as competitors enter our industry and as we expand beyond our traditional focus.”

Working Together: Partnering with post-secondary institutions

“We are currently working with a number of post-secondary institutions on co-op programs. We are looking to hire more co-op students to better prepare them for our company and attract top talent.”

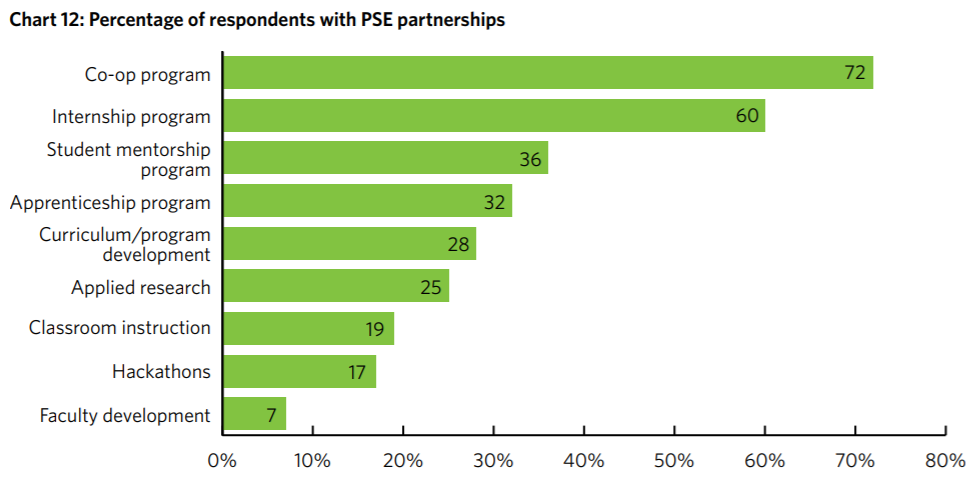

For Canada’s largest businesses, collaboration between post-secondary institutions and large private-sector organizations is on the rise. Eighty-three per cent of respondents report that they are currently working with one or more post-secondary institutions to better prepare students for the workplace— an increase from 76 per cent in 2016.

Businesses are also developing increasingly diverse partnerships with academic institutions. Many of these partnerships meet the definition of work-integrated learning (WIL). While co-ops and internships are the most well-known forms of WIL, other forms—including applied research projects, hackathons, and field experiences—are gaining in popularity.

Quotes:

“We support a lot of site visits. We bring undergraduate and graduate classes from across Canada to tour our work locations and meet with management personnel to pose technical questions.”

“Annually, we participate in career fairs organized by the local universities. In addition, for 2017 – 2018, we are working on establishing more partnerships involving information sessions, co-op programs, sponsorship and business cases.”

“We have a co-op program, and we’re working with three different colleges in our sector. Students will attend classes, then work for us for a year before returning to school to finish their degrees. This approach ensures that we are grooming students to address our needs. At the end of their degree, some students – depending on their performance and our business needs – will get a job offer. This is a new program that was implemented in 2017.”

Employer perspectives on relationships with post-secondary institutions

When asked about their partnerships with colleges and universities, respondents stressed clear communication and dedicated points of contact as integral to their success.

“Non-traditional disciplines struggle with articulating the competencies their grads possess. Many students that come out of (i.e. political science) say they don’t have the skills to be successful in business. We would like to see these disciplines reach out so we can help highlight the value their grads have to us.”

“We’d like an easy-to-access and up-to-date directory of who to connect with. Often there are opportunities to create more efficient and impactful partnerships when the right contacts are involved.”

“Educational institutions are very open and collaborative, but the execution is slow.”

The Business/Higher Education Roundtable (BHER), established by the Business Council of Canada in 2015, continues to bring together senior leaders from Canadian industry and post-secondary institutions. BHER’s mandate is to develop, support and promote collaboration between Canada’s post-secondary institutions and private-sector employers and enable their leaders to work together on solutions to Canada’s skills and innovation challenges.

Investing in People: Employers are spending more on training

“Continuous learning is a key part of our culture. All interested employees have a Leadership Development Plan, and are offered various forms of learning—ranging from informal/on the job, to formal college or university programs.”

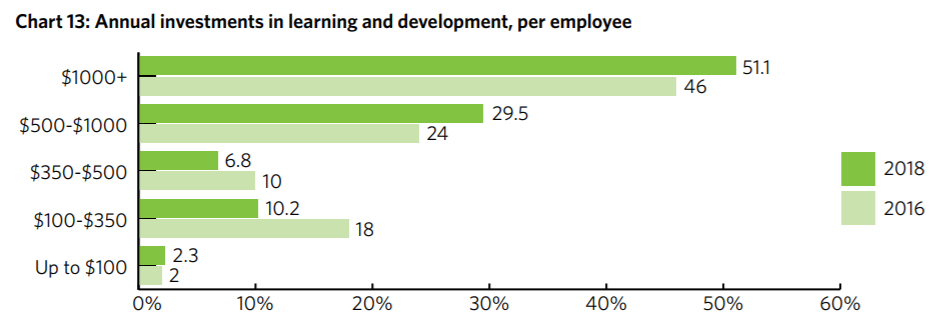

As expectations for entry-level and mid-career workers increase, investments by large, private-sector employers in learning and development have increased over the past two years. Over 50 per cent of respondents reported spending over $1,000 per employee per year on training.

Sixty-five per cent of employers reported plans to increase their investment in employee learning and development over the next three years, as compared to 40 per cent in 2015. More than half (52 per cent) of 2018 respondents stated that the increase will be a moderate one (up from 34 per cent in 2016).

Although the amount spent on employee training is not necessarily an indicator of overall training quality, the current and projected increases appear to reflect a recognition that employers have a responsibility to help workers continually update and improve their skills.

Looking forward, respondents plan to increase the amount they spend on training employees.

Building Resilience: Diversity, health and disability

“We value diversity and are always looking to increase diversity within our employee population.”

The vast majority of respondents highlighted the value of diversity when it came to hiring, including:

• diversity of skills;

• diversity of perspectives;

• diversity of professional backgrounds; and

• the degree to which the company’s workforce mirrors the wider population.

Organizations offered the following feedback with respect to their diversity initiatives:

“As part of our interviewing approach, we are working towards offering hiring managers a candidate pool that is 50 per cent female for all senior-level roles.”

“Diversity is integrated into our business planning. We’ve set goals for Indigenous employment, and have PAR (Progressive Aboriginal Relations) certification. We are members of the Canadian Council for Aboriginal Business and work with First Nations communities in training and employment initiatives.”

Mental health

“Mental health is an emerging strategic priority, and it will gain increased emphasis and focus in coming years as a key component of our employee health and wellness programming.”

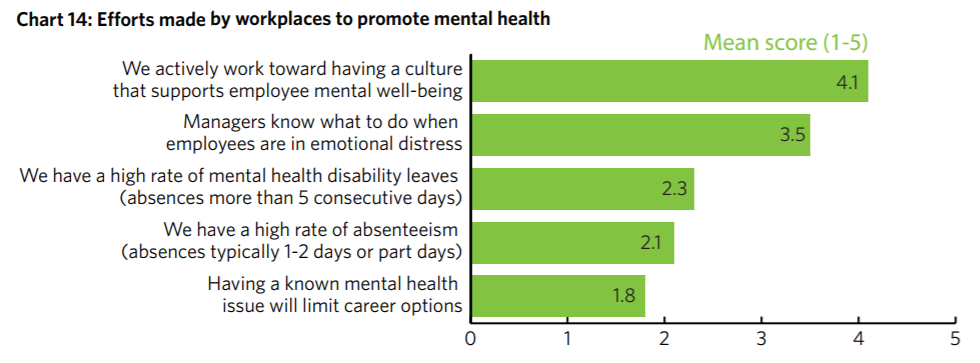

Employers were surveyed regarding their companies’ efforts to create a healthy workplace. Respondents were asked to rate the following statements from one to five, where one was “not true at all” and five was “consistently true.”

It is important, however, to realize that achieving a healthy work environment is an ongoing process. Many employers are taking the first steps in developing mental health policies, and must ensure that policies are clearly communicated and supported throughout their organization.

One respondent noted:

“Mental health issues have been the primary driver of absenteeism for consecutive years. We are in the early phases of addressing the need to increase the knowledge and skills of our people leaders and our employees on mental health, including stigma, self-care and the roles and responsibilities of managers to drive a psychologically healthy and safe work environment.”

Morneau Shepell’s 2015 Workplace Mental Health Priorities initiative surveyed employers and employees on perceptions of workplace mental health. The results highlighted a disconnect with the above data: when surveyed, employees were afraid of what people would think of them (71 per cent) and of losing career opportunities (77 per cent) for disclosing mental health issues.

Disability management

“Internally, employees with a disability work with their manager, HR and the well-being team to identify the most reasonable accommodations with consideration of the bona fide occupational requirements.”

Businesses were also asked about their efforts around workplace accommodation. Specifically, they were asked to identify strategies they have to accommodate new employees with disabilities or those returning to work after a disability leave. Employers identified the top three accommodation strategies as follows, in this order:

- Job reassignment

- Skill building/retraining on the job

- Unbundling and re-bundling of specific tasks.

Morneau Shepell’s research report, The True Picture of Workplace Absenteeism, highlights how effective measures to help employees with disabilities return to work can reduce the length of absences. Accommodation has been found to be most effective when it fully engages the employee and the supervisor in continuing a relationship that supports workplace productivity.

Final Thoughts

At the time the survey was conducted, the Canadian economy was experiencing:

- GDP growth stronger than in the previous decade.

- Uncertainty about the future of the North American Free Trade Agreement, given repeated threats by President Donald Trump to scrap the deal.

- Unemployment near record lows.

- Significant increases in the minimum wage in Ontario and Alberta.

This survey provides a snapshot of how 95 large, private-sector companies are reacting and adapting to change. Although these firms represent different sectors and regions of the country, the survey results highlight several common themes:

- Technology will change, not destroy, jobs

- Employers have high and rising expectations for new grads

- Businesses are creating diverse partnerships with post-secondary institutions

- Employers are spending more on employee training

- A diverse and healthy workforce is a priority

Our hope is that these results provide insight into Canada’s skills challenges, offering useful information to students, educators, policy makers and employers as they work to make Canada a more competitive, prosperous country.

About the Business Council of Canada

Founded in 1976, the Business Council of Canada is a non-profit, non-partisan organization composed of the chief executives and entrepreneurs of 150 leading Canadian companies, from every region and sector of the economy. Member companies collectively employ 1.5 million Canadians, have annual revenues in excess of $1.1 trillion and are responsible for most of Canada’s private-sector exports, investment and training.

Through supply chain partnerships, service contracts and mentoring programs, Business Council members support many hundreds of thousands of small businesses and entrepreneurs in communities of all sizes across Canada.