Golden Opportunities and Surmountable Challenges: Prospects for Canadian agriculture in Asia

Executive Summary

Over the past several years, strong economic growth in emerging markets has been a major factor pushing up prices for a wide range of agricultural commodities. The World Bank, the United Nations’ Food and Agriculture Organisation and the Organisation for Economic Co-operation and Development have all predicted that the recent trend toward higher food prices and increased agricultural market volatility will continue over the coming decade. Population growth, rising incomes and urbanization in Asia in particular will contribute to increasing agri-food demand, which in turn will stimulate demand for farm inputs and handling and infrastructure facilities. Dominating the agri-food trade outlook is China, which is poised to become the world’s largest agricultural import market by 2020.

These developments augur well for countries such as Canada that are net agricultural exporters. Indeed, Asia’s expanding appetite for imported food provides Canadian agricultural producers with golden opportunities to grow and prosper – provided that the federal and provincial governments and industry work together to identify and overcome a variety of external and internal challenges.

A major challenge for the federal government is to ensure that Canada is not locked out of key preferential trade agreements that will increasingly shape the future of international commerce. In the short term, the government should maintain its focus on ensuring Canada’s participation in the Trans Pacific Partnership (TPP), a proposed regional trade agreement that aims to further liberalize commerce in the Asia Pacific region. At the same time, Canada needs to complete the alreadyinitiated bilateral negotiations with South Korea and India, and to follow through on Prime Minister Stephen Harper’s March 2012 declaration of support for a free trade agreement with Japan. (Down the road it may also become necessary to enter trade negotiations with China if it appears that Canada’s major export competitors are likely to gain preferential access to that market at our expense. However, the preferred outcome would be the eventual expansion of the TPP to encompass all major Asia Pacific economies.)

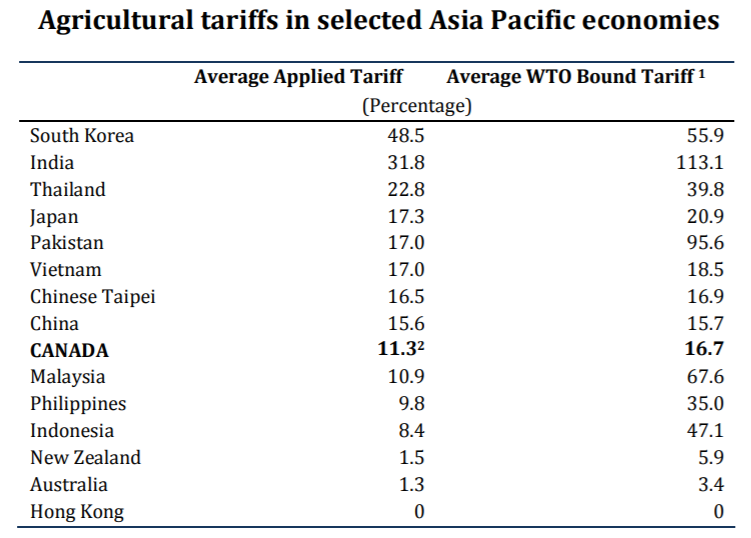

None of this will be easy. For one thing, the United States, Australia and New Zealand seem reluctant to let Canada join the TPP, at least in part because of Canada’s unwillingness to provide increased import access to Canada’s highly protected, supply-managed dairy and poultry sectors. In addition, Canada is far from the only country that imposes limitations on certain agricultural imports. Japan and South Korea have a long history of agricultural protectionism, especially in the rice sector, while the United States has an equally long history of restrictive import protection in the sugar and dairy industries.

The political sensitivities that surround farming in Canada and many other countries suggest that international negotiations over agricultural market access will be as difficult in the future as they were in the past. Having said that, there would likely be serious consequences for the rest of the economy – not to mention the 80 per cent of Canadian agriculture that is tied to world prices – if Canada were to be prevented from joining the TPP because of a reluctance to open up the dairy and poultry sectors. The consequences for Canadian agriculture would be especially adverse if the outcome of the TPP negotiations was an agreement that included Japan but not Canada.

Fortunately, there may be a way around these problems. Given the various sensitivities around the table, the most likely result of the TPP talks is partial rather than complete liberalization for a (limited) number of the most sensitive products. In such a scenario, the federal government could find itself with sufficient flexibility to permit increased dairy and poultry imports, enabling the supply-managed sectors to adjust and survive with a reduced but still dominant share of the Canadian dairy and poultry market. Supply management, in other words, need not be an insurmountable challenge to Canada’s broader trade ambitions.

Sommaire

Au cours des dernières années, la forte croissance économique des marchés émergents a grandement contribué à la flambée des prix de divers produits agricoles. La Banque mondiale, l’Organisation des Nations Unies pour l’alimentation et l’agriculture (FAO) et l’Organisation de coopération et de développement économiques (OCDE) prévoient que cette tendance à la poussée des prix des aliments et la volatilité accrue du marché agricole se poursuivront au cours de la prochaine décennie. La croissance de la population, la hausse des revenus et l’urbanisation en Asie contribueront en particulier à l’accroissement de la demande en produits agroalimentaires, ce qui se traduira par une pression sur la production agricole ainsi que sur les installations de manutention et les infrastructures. La Chine domine aujourd’hui le marché agroalimentaire et on s’entend à ce que ce pays devienne le plus important importateur agricole d’ici 2020.

Ces changements dans le paysage agricole sont de bon augure pour les pays exportateurs nets de produits agricoles, dont le Canada. En effet, l’appétit féroce de l’Asie pour les produits importés ouvre la voie à des occasions de croissance et de prospérité en or pour les producteurs agricoles canadiens, si l’industrie et les gouvernements fédéral et provinciaux collaborent afin de cerner et de surmonter les nombreux défis, tant à l’échelle nationale qu’internationale.

L’un des principaux défis pour le gouvernement fédéral consiste à s’assurer que le Canada n’est pas tenu à l’écart d’accords commerciaux préférentiels qui modèleront de plus en plus le commerce international. À court terme, le

gouvernement doit se concentrer sur l’inclusion du Canada au Partenariat transpacifique, un projet d’accord commercial régional visant à libéraliser davantage le commerce avec les pays d’Asie-Pacifique. Parallèlement, le Canada doit mener à terme les négociations bilatérales déjà amorcées avec la Corée du Sud et l’Inde et donner suite à la déclaration de mars 2012 faite par le premier ministre Stephen Harper au sujet d’un accord de libre-échange avec le Japon. (Il pourrait également être nécessaire d’entreprendre des négociations commerciales avec la Chine s’il appert que les principaux exportateurs en concurrence avec le Canada pourraient bénéficier d’un accès privilégié au marché, au détriment de nos exportateurs. Cependant, l’objectif escompté demeure l’expansion éventuelle du Partenariat transpacifique afin qu’y participent toutes les grandes économies des pays d’Asie-Pacifique.)

Les défis sont nombreux. Tout d’abord, les États-Unis, l’Australie et la Nouvelle Zélande semblent réticents à l’adhésion du Canada au Partenariat transpacifique, notamment parce que le Canada refuse de fournir un meilleur accès d’importation des produits laitiers et de volaille hautement protégés soumis à la gestion de l’offre. Pourtant, le Canada n’est pas le seul pays à agir de la sorte relativement à certains produits agricoles importés. Le Japon et la Corée du Sud pratiquent le protectionnisme depuis des années, notamment dans le secteur rizicole, tandis que les États-Unis favorisent depuis longtemps une protection de leurs importations de manière restrictive dans le domaine de la production laitière et sucrière.

Les sensibilités politiques entourant l’agriculture au Canada et dans d’autres pays laissent entrevoir que les négociations internationales en matière d’accès au marché agricole seront tout aussi ardues que par le passé. Cela étant dit, il faut savoir que les conséquences seraient fâcheuses pour le reste de l’économie – et pour les 80 % des agriculteurs canadiens à la merci des prix à l’échelle internationale – si le Canada n’adhérait pas au Partenariat transpacifique en raison de sa réticence à ouvrir ses secteurs des produits laitiers et de volaille. Ces conséquences seraient même désastreuses si les négociations au sujet du Partenariat transpacifique menaient à l’inclusion du Japon et à l’exclusion du Canada.

Heureusement, une solution existe. En raison des différentes sensibilités des intervenants, il est fort probable que les discussions sur le Partenariat

transpacifique se concluront par une libéralisation partielle plutôt que complète pour un certain nombre des produits les plus sensibles. Si tel est le cas, le gouvernement fédéral aurait suffisamment de souplesse pour autoriser une augmentation des importations des produits laitiers et de volaille qui ne mettrait pas en péril les agriculteurs soumis aux programmes de gestion de l’offre. Il y aurait une période d’adaptation, mais les agriculteurs canadiens demeureraient prédominants sur le marché quoique leur part serait réduite. En d’autres mots, la gestion de l’offre ne doit pas faire obstacle aux ambitions du Canada en matière d’expansion de la zone commerciale.

Introduction

Rapid economic growth in emerging economies, especially Asia, combined with recent higher but more volatile international food prices, have prompted some Canadians to wonder whether we are at the dawn of a new golden age for agriculture. After decades of declining real food prices and persistent preoccupations with agricultural surpluses and low farm incomes, has the situation changed so fundamentally that Canadian agriculture’s main policy objective going forward should be to maximize our country’s share of a rapidly growing and dynamic export market? Have we shifted to a new demand plateau, or are we simply experiencing the latest in a series of boom-and-bust fluctuations that have traditionally characterized agriculture? This analysis explores how Canadian agriculture could be affected as it, and its export competitors, seek to exploit Asia’s expanding food and agriculture market opportunities.

The paper begins with an overview of international demand and supply for agricultural goods, including an examination of key drivers and what appears to be an increasing correlation between food and oil prices. It then turns to an analysis of Canada’s recent agricultural trade performance, followed by an outline of the various export opportunities available to Canadian producers and companies in Asia. Finally, the paper examines Canada’s future prospects and challenges in the region, with a specific focus on the extent to which regional and bilateral trade agreements may influence trade flows, as well as various opportunities for enhanced industry-government cooperation in Canada.

Throughout the paper particular attention is paid to China, which over the next decade is expected to overtake the European Union and the United States as the world’s largest agricultural importer. Other developing countries in Asia are examined briefly, as are the three most highly developed economies in the region: Japan, Australia and New Zealand. Nevertheless, the primary focus is on China given its overwhelming dominance in terms of population, income and urbanization growth, all of which are contributing to an unprecedented expansion in the number of middle-class consumers and a consequent increase in demand for a more diversified and higher-value diet, including vegetable oils, meats, dairy products and sugar as well as processed food and restaurant meals.

International Demand for Agricultural Products

The two key drivers of food demand are population and income growth. To feed a world population expected to reach more than nine billion people by 2050 (up from seven billion in 2011), it is estimated that agricultural production will have to increase by about 70 per cent. Food demand in developed countries is virtually stagnant as a result of low population growth. Thus, most of the food demand increase will come from developing economies, where both population and income growth is much higher. The World Bank has estimated that three-quarters of the additional global demand for food in the next two decades will come from developing countries.

Growth in food demand is fastest in the early stages of a country’s economic development. As countries become wealthier, consumers switch from simply purchasing more rice, pulses and other staples to a more diversified diet. As incomes rise and urbanization continues, the increasingly affluent middle classes, particularly in the large emerging economies of Asia (China, India and Indonesia), are rapidly upgrading their diets to include more meats, fats and oils and fruits. Urbanization and income growth also drive changes in food distribution channels and food processing as consumers shift to supermarket purchases and demand more convenience foods.

Much of Asia’s recent economic growth has been led by exports of manufactured goods to advanced industrialized countries. But in the wake of the 2007-08 global financial crisis and subsequent recession, demand in the developed countries has weakened and is expected to remain sluggish. Hence there is a growing consensus that, in future, the export-led economies of Asia, especially China, will have to rely more on increases in domestic consumption. The need to ‘’rebalance” the Asian economies from export-driven growth to domestic-driven growth has already resulted in substantial increases in infrastructure investment as well as research and development expenditures.

Reinforcing the recent growth in food demand in Asia has been a stronger positive correlation between food and oil prices. Government support for biofuel production in a number of countries has become a major driver of grain and oilseed demand for non-food uses, helping to push up prices. Whether biofuels will become a larger or smaller drain on food supplies will depend on government policies, future fuel prices and technological progress in obtaining biofuels from non-food sources. On balance, it appears that biofuel demand will help keep world grain and oilseed prices higher than would otherwise be the case. Uncertainty surrounding the food/biofuel relationship is only one of a number of reasons why recent increases in food price volatility are expected to continue for the foreseeable future.

All of this stands in stark contrast to the situation that prevailed through most of the second half of the 20th century. For several decades the international market was dealing with chronic food surpluses made worse by increasing import protection and the pervasive use of export subsidies. Today governments in emerging economies are increasingly worried about food inflation and the social and political implications of high food prices given a rapidly growing urban population. As a result, a number of countries have temporarily opened their markets to increased food imports. At the same time, there are growing concerns about the ultimate reliability of the world food market in face of the proliferation of export restrictions as markets tighten.

Offsetting the view that global demand for food is set to explode is the very real possibility that developed economies have entered a prolonged period of weak economic growth, which if true is bound to reduce the rate of economic growth in the emerging economies. However, to the extent that emerging economies are successful in rebalancing their economies – and given the propensity to spend more on food as incomes increase – slightly lower income growth should have relatively less impact on demand for food as compared to other products.

The Supply of Agricultural Products

Until recently, governments in many developing countries treated agriculture as a low priority in allocating scarce public resources – understandably so given the multi-decade decline in real agricultural prices. However, price spikes in 2007-08 and more recently have convinced a number of countries of the need to increase agricultural productivity and production (which experienced declining growth rates over the last decade as compared to the previous decade).

There is an old saying among economists that the solution to high prices is high prices, since they stimulate increased production or reduce demand, or both. There is, to be sure, no doubt that producers in Asia will expand agricultural production in response to rising food prices. Hence, one can expect that much of the increased demand for food in Asia will be met by domestic and regional production. However, resource constraints – particularly of land, soil quality and water – suggest that there will also be a need for additional imports of food from outside the region. China in particular is likely to require higher imports of feed grains and oilseeds. In the interests of food security, Beijing has sought to maximize production of such staples, but it also recognizes that China’s comparative advantage in agriculture lies mainly in labour-intensive, higher value products such as meat, fruits and vegetables.

The extent to which imports from outside Asia will supplement growing domestic demand will depend on a number of policy factors. As noted, higher food prices have made agricultural production more of a priority in Asia, and government financial support to the sector is therefore on the rise. Those who caution that a “golden age” scenario for agriculture may be too optimistic point to the fact that previous spikes in world food prices have been short-lived as producers responded (albeit with a lag) to price incentives. Skeptics also note that small-scale farms still dominate agricultural production in the emerging economies and that, as rural

labour continues to migrate to the cities and specialization and commercialization of agriculture become more prevalent, significant increases in productivity are inevitable. Other observers, however, note that while China was successful for many years in remaining a net agricultural exporter, it has recently become a net agricultural importer and this position will be difficult to reverse given the expected growth in domestic demand.

In addition to increased domestic agricultural policy expenditures – Chinese agricultural subsidies doubled between 2005 and 2008 – many emerging economies, like some developed countries, continue to rely on tariff and non-tariff barriers to encourage domestic production in the name of self-sufficiency. Around the world, agricultural tariffs are much higher than industrial tariffs on average and frequently constitute a significant and sometimes prohibitive barrier to trade. Thus, although China’s agricultural tariffs are generally low as a result of its accession to the World Trade Organization (WTO), there remain a number of sensitive product categories for which imports in excess of a certain amount (typically equivalent to less than 10 per cent of consumption) are subject to a quantum jump in tariff protection. Certainly many agricultural tariffs in Asia are high enough that preferential access as a result of bilateral or regional trade agreements would have a significant market displacement impact on imports from other countries. For example, although China’s negotiations with Australia are currently deadlocked, it is clear that if Australia eventually succeeds in winning preferential access to China for agricultural products, those gains will come at the expense of competing grain, oilseed and meat exporters, including Canada.

Governments in Asia have an additional reason to want to maintain existing levels of food self-sufficiency, at least for the main staples: the fear that they will be unable to secure sufficient supplies of key agricultural products in the event of world shortages. In recent years there has been an increasing tendency for countries to impose agricultural export restrictions during periods of sharply higher prices. For example, in response to the food price surge of 2007-08, governments in a number of countries (including India, Vietnam, Russia, and the Ukraine) imposed partial or complete export bans on wheat or rice. Currently there are no effective international rules governing the use of quantitative export restrictions or differential export taxes. Lack of confidence in the international market’s ability to supply in tight supply/demand situations is one of the core reasons why many domestic policy makers continue to lean toward protectionism in the name of food security and self-sufficiency.

Canada’s Recent Agricultural Trade Performance

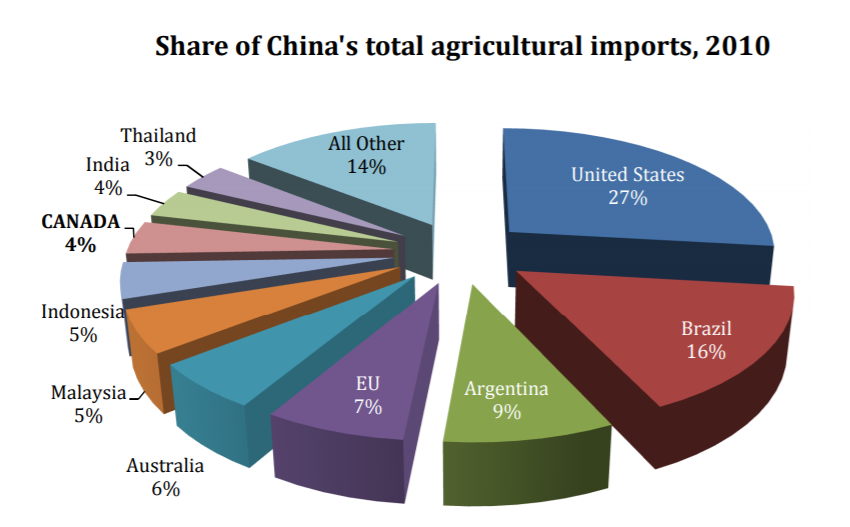

Over the 2006-10 period, Canada slightly increased its share of China’s rapidly growing agricultural import market, from less than three per cent to around four or five per cent. During the same period, Brazil significantly increased its share of China’s agricultural imports, while Australia’s share fell from more than eight per cent to less than six per cent. Canada’s positive performance was due to its strength in oilseeds and oilseed products, China’s largest and fastest-growing agricultural import category. Canada is the world’s largest exporter of canola and canola oil, fittingly so given that it was Canadian researchers who first bred canola from rapeseed in the 1970s. (Thanks to their efforts, canola oil is now recognized as a premium food oil rather than an industrial lubricant, rapeseed oil’s traditional use.) In contrast, Australia is a relatively small, albeit growing, producer and exporter of oilseeds.

In the past, Canada’s agricultural exports were dominated by wheat, which was primarily shipped overseas, including to a number of Asian markets. However, world trade in wheat has been relatively stagnant in recent years. As a result, Canadian grain producers have increasingly switched out of wheat acreage into higher-return crops, particularly oilseeds and pulses.

The canola industry is a tremendous Canadian success story, one that demonstrates what can be achieved when the public and private sectors work together to improve export opportunities. Taxpayer-funded research led to the original plant breeding breakthroughs, and the federal government has since pressed successfully for international recognition of canola as a high-quality edible oil. In the process, government officials, plant breeders, producers and processors have transformed what was once a relatively insignificant oilseed into a widely used premium food oil. Canola has displaced wheat as the most valuable crop in the Prairie provinces and is the main reason why Canada has been able to maintain and grow its share of China’s rapidly growing agricultural import market. More than 90 per cent of Canada’s canola production is exported, mainly in the form of seed but increasingly also as oil and meal for animal feed. More recently, the demand for canola has been augmented by its use in biodiesel production, both domestically and abroad.

Canada’s pulse industry is also a major success story. Dried peas, beans, lentils and chickpeas have grown over the past two decades from minor crop status to a $2.1 billion dollar export industry. Canada is now the world’s largest exporter of peas and lentils, and one of the top five exporters of beans. Like the oilseed sector, the pulse industry relies heavily on exports to Asia.

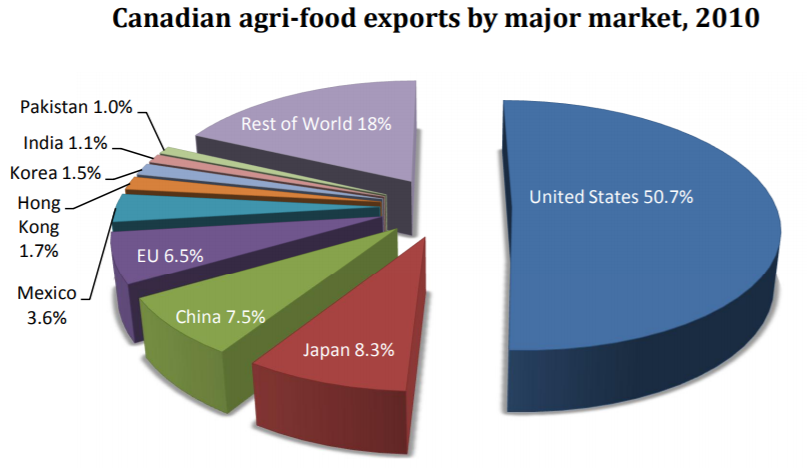

Although Canada’s pork and beef sectors are not as heavily geared toward exports as oilseeds or pulses, shipments to foreign markets are still extremely important and account for more than half of production. The United States is by far the largest market for Canada’s red meat exports and is expected to remain so for the foreseeable future. However, both livestock sectors are extremely conscious of the need to reduce their exposure to, and dependence on, the U.S. market, seeing Asia as the key diversification opportunity.

Canada is making impressive progress in diversifying its pork exports. Canada is the world’s third-largest pork exporter and Japan has long been the major offshore market. In more recent years, Australia, South Korea, Hong Kong, the Philippines, and Chinese Taipei (Taiwan) have all become significant markets for Canadian pork. As a result, the relative importance of the U.S. market has declined sharply. As recently as the mid-1990s the U.S. took more than 90 per cent of Canada’s pork exports; by 2010 this had dropped to 31 per cent.

The beef industry’s efforts to diversify have not been as successful. Although significant new markets have been developed in Asia, especially in Japan and Hong Kong, shipments to the United States still account for more than 75 per cent of Canada’s beef exports. During the past decade the beef sector’s efforts to diversify its export markets have been adversely affected by import restrictions imposed after a 2003 outbreak of bovine spongiform encephalopathy (BSE), commonly known as “mad cow” disease. It took more than eight years to regain entry to the South Korea market, which used to be Canada’s fourth-largest beef export market.

As that example illustrates, agricultural products are particularly vulnerable to import restrictions based on health and safety concerns. As economies develop, consumers become more conscious of health and safety and governments increase their efforts to monitor and test imports. Indeed, the impact of these technical regulations on trade is now often more significant than that of conventional tariff barriers. In accordance with the WTO agreements on Sanitary and Phytosanitary Measures and Technical Barriers, such restrictions are supposed to be based on science and should be no more restrictive than necessary to meet a legitimate objective. Despite that, once imposed they often require intensive and sustained efforts to remove or moderate them, either through technical discussions or, in extreme cases, by recourse to dispute settlement.

In recent years intensified public-private cooperation has enabled Canada to overcome a number of health-and-safety-based import restrictions in a wide range of markets, both developed and developing. These efforts will need to be sustained and augmented if Canada is to take full advantage of the growing market opportunities in Asia.

Export Opportunities in Asia

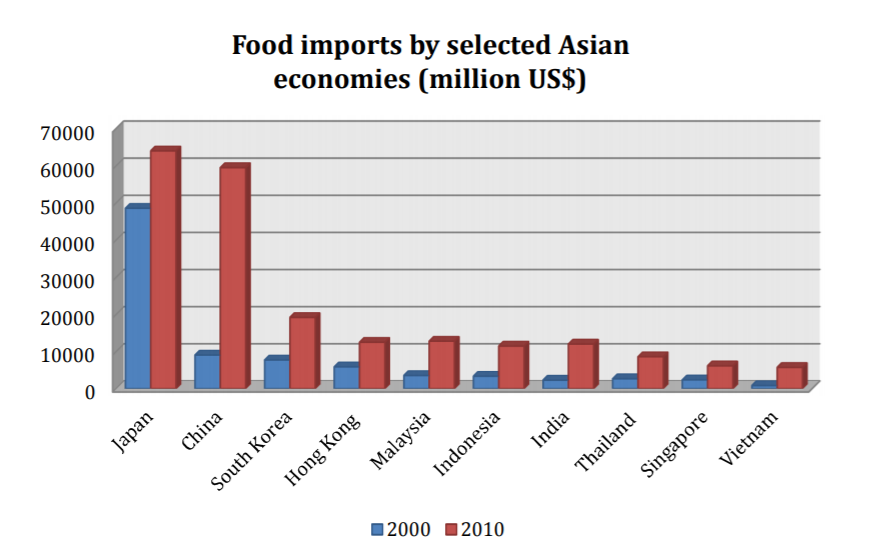

Three decades ago, Japan accounted for more than half of Asia’s total food imports. Although food shipments into Japan have continued to grow in absolute terms, Japan’s share of total Asian food imports has declined significantly, to just over 26 per cent in 2010. In contrast, China’s share has tripled since 1980 and now stands as just under a quarter. South Korea, India, Malaysia, Indonesia and Chinese Taipei have also significantly increased their food imports.

China

China’s imports of agricultural goods have been dominated by a handful of landintensive products, especially oilseeds, vegetable oils, cotton and dairy products. This is not surprising given China’s limited land and water resources. Most of the import growth (greater than 28 per cent a year on average) occurred in the 2005-2010 period in response to rising consumer incomes.

Roughly three-quarters of China’s agricultural imports consist of oilseeds and oilseed products (vegetable oil and meal). Soybeans and soybean oil combined account for more than half of the total; these are supplied mainly by the United States, Brazil and Argentina. Most of the balance consists of palm oil from Malaysia and Indonesia and rapeseed/canola and canola oil from Canada. China has become the world’s largest import market for soybeans, palm oil and rapeseed/canola.

China’s imports of wheat, corn and meats have been erratic and, until recently, relatively small in relation to domestic consumption. However, in the past few years China has shifted from being a net exporter of corn to a net importer, and its need for imported corn as animal feed is expected to grow as the country continues to expand its production of pork and poultry. Meanwhile, although domestic meat production has increased sharply, domestic demand has increased even faster. Hence, meat imports (mainly poultry and to a lesser extent pork) have also increased dramatically in the last few years, reaching $1.4 billion in 2010.

Wheat imports have continued to fluctuate widely, mainly reflecting government policies such as the goal of maintaining grain production at around 95 per cent of consumption. In recent years, in response to rising food inflation, China has introduced retail price controls which further reduced the need for wheat imports (which were already low as a result of expanded domestic production). Wheat was once Canada’s main export to China, and in the 1960s accounted for more than 60 per cent of Canada’s total exports to China. However, in more recent years Canadian wheat exports to China have ranged from nothing in 2008 to less than $150 million in 2010. To put that in context, the total value of Canada’s food and agricultural exports to China in 2010 was nearly $3 billion.

Other Emerging Economies in Asia

Among other emerging Asian economies, the leading agricultural importers in absolute terms are South Korea, India, Malaysia, Indonesia and Chinese Taipei. Thailand, Vietnam and the Philippines are also exhibiting tremendous growth. Although many of Asia’s emerging markets are traditional net agricultural exporters, strong economic growth has stimulated growing agricultural imports.

Canada’s agricultural exports to these economies are still dominated by wheat, particularly in the case of Indonesia, South Korea, the Philippines and Malaysia. However, exports of pulses have also grown dramatically, particularly to India, Pakistan and Bangladesh, while pork exports to the Philippines, Chinese Taipei and South Korea have been strong. Pakistan is a growing import market for canola while India has the potential to become a huge oilseed market, provided its exceptionally unpredictable market-access conditions can be improved and stabilized.

Japan, Australia and New Zealand

As recently as 2000, the three developed economies in the Asia region (Japan, Australia and New Zealand) imported more agricultural products than the rest of Asia, including China, combined. However, by 2010 agricultural imports into the three developed countries accounted for only one-third of the region’s total food imports.

As has been the case for much of the past half century, Japan is the world’s largest net importer of agricultural products, in part due to its limited export capacity. While Japan’s imports of agricultural products have grown relatively slowly over the past two decades, it still represents the second-largest market in Asia; it remains the world’s largest import market for pork and corn and the second largest for rapeseed/canola.

Japan remains Canada’s largest agricultural market after the United States and is still slightly larger than China and the European Union. However, there is little doubt that China will soon overtake Japan as Canada’s second-largest agricultural export market.

Japan has long been a large and stable importer of Canadian oilseeds. Unlike China, it is also a large and consistent importer of wheat and pork as well as a wide range of more processed foods. In contrast, Canada’s exports to Australia and New Zealand – both of which have experienced much stronger import growth than Japan – are less diversified, consisting mainly of pork.

Future Prospects and Challenges for Canada

Asia’s demand for agricultural products will continue to expand as a result of strong population, income and urbanization growth. However, the extent to which that demand will be fulfilled by imports will depend upon a number of policy decisions. Two in particular stand out: the extent to which individual Asian governments focus on improving domestic self-sufficiency; and the impact of regional and bilateral trade agreements on trade flows.

Agricultural self-sufficiency in Asia

As discussed above, Chinese agricultural policy will likely continue to promote a high degree of self-sufficiency in staple products such as wheat and rice, while allowing increased imports of corn and other animal feed imports to support China’s rapidly expanding production of pork, chicken and other meats. Agri-food exporters such as Canada could seek to allay China’s food security concerns by offering to negotiate supply commitments. To date, however, China seems more interested in maintaining the flexibility to impose its own export restrictions. China could also seek to address its food security concerns by stepping up its investments in foreign agricultural production, processing and marketing operations, an approach the China government has actively encouraged in recent years. Most of these investments have been in Central Asia, Africa and South America, but there have been a number of smaller deals in North America. In 2008, for example, China’s largest food importer and exporter, the state-owned COFCO Group, acquired a five per cent stake in U.S.-based Smithfield Foods, the world’s largest hog breeder and pork processor.

Trade policy development and agricultural trade in Asia

Whether Canada will be successful in maintaining or growing its share of China’s agri-food import market will also depend on future trade policy developments. China already has a number of free trade agreements with other Asian countries, including the ASEAN members (Brunei, Burma, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Vietnam), as well as Pakistan, India, Bangladesh, and Sri Lanka. It also has a bilateral trade agreement with New Zealand which, while limited in scope, provides eventual duty-free access for New Zealand dairy products. Of much greater to concern to Canada, however, would be a preferential agreement between Australia and China, given Australia’s more directly competitive export profile.

Although there are a number of existing free trade agreements among the Asian economies, most treat agriculture as a “sensitive” sector for which limited preferential tariff treatment rather than unlimited duty-free entry is the norm. Rice is particularly sensitive. The only preferential trade agreement in the region that provides unlimited duty-free entry for all agricultural products is the one between Australia and New Zealand.

a) The Trans-Pacific Partnership

The preferential trade agreement that would cause Canada the most difficulty were it not a member is the Trans-Pacific Partnership (TPP), which is currently the subject of negotiations involving Australia, Brunei, Chile, Malaysia, New Zealand, Peru, Singapore, Vietnam, and the United States. If Canada were to remain outside such an agreement it would find itself at a significant competitive disadvantage to the United States and Australia – especially in Malaysia and Vietnam, two of the fastest-growing agricultural importers in Asia.

If Japan joins the TPP, the stakes for Canada would be even higher. Canada’s agricultural exports to Japan are currently in the $3 billion range and most face high tariffs (canola seed is the main exception). If Japan signed on to the TPP agreement but Canada did not, Canada would undoubtedly lose market share in Japan and could well see its exports decline in absolute terms. Close to $1 billion a year in sales of Canadian pork would be particularly vulnerable to U.S. competition, as would canola oil. In the case of wheat, all imports into Japan are currently controlled by the Japanese Ministry of Agriculture on a duty-free basis, subject to an overall tariff quota for wheat and wheat products. If it were not a TPP member, Canada could easily lose its traditional position in Japan as a preferred wheat supplier.

In late 2012, Japan and Canada (as well as Mexico) indicated their desire to join the TPP negotiations. If they are successful, the greatest political challenge for both will be how to deal with their respective sensitive agricultural sectors, especially rice in the case of Japan and dairy and poultry in the case of Canada.

Of course, Canada and Japan are not unique in having extreme import sensitivities. The United States limits imports of sugar and dairy products, among other products. If past experience is any guide, the most likely outcome of the TPP negotiations is an agreement to phase out many, if not most, agricultural tariffs after some transition period, while only partially liberalizing trade in the most sensitive sectors. This could be done by, for example, permitting tariff-rate quotas (TRQs). Under a TRQ, imports up to a certain quantity are allowed to enter at preferential tariff rate, or tariff-free. Imports above that level are subject to much higher tariffs.

In the months following Prime Minister Harper’s decision to seek entry to the TPP, there has been considerable debate over whether Canada’s participation in the negotiations would inevitably require the end of supply management for dairy and poultry products. Introduced in the 1970s, these programs impose individual farm production quotas in an attempt to align national output and domestic demand, thereby avoiding boom-and-bust price cycles.

Currently, imports account for only about three to four per cent of Canada’s milk and dairy product consumption and eight or nine per cent of chicken consumption. These numbers suggest that there is scope to provide expanded import opportunities for all supply-managed sectors. The pragmatic question is not whether supply management can survive partial liberalization, but rather what changes may be necessary to allow the system to coexist with a more open but still protected trading environment.

Depending on the extent of the changes required (and the degree to which they reduce the value of the quotas owned by farmers, which in the dairy sector alone total some $25 billion), it may be necessary to provide some level of financial assistance to help farmers adapt to the new import regime. There is a precedent for such assistance: in the late 1980s a joint federal-provincial trade adjustment package enabled Canada’s grape and wine industry to adapt (with great success) to the Canada-U.S. Free Trade Agreement. A similar adjustment package, tailored to the specifics of the supply-managed dairy and poultry sectors, could also be developed. This would need to be done in collaboration with all industry stakeholders, including the provinces – which, with the federal government, are jointly responsible for creating and regulating the supply management system through marketing boards that control production, tax, set prices, and manage interprovincial trade.

b) Bilateral Trade Agreements

In addition to any possible challenges represented by the TPP, Canada risks loss of market share in two of Asia’s other large agricultural import markets: South Korea and India.

Both the EU and the United States have concluded free trade agreements with South Korea, and the EU is currently in negotiations with India. Canada’s current share of the South Korean agri-food market will undoubtedly be at risk as the preferential access in favour of our two largest agricultural competitors is phased in. Of course, Canada has initiated its own trade negotiations with South Korea, but those talks have been deadlocked for several years and will need to be pushed to a conclusion if Canada is to avoid being displaced in its third-largest agricultural export market in Asia.

India, for its part, has the potential over the longer term to outstrip South Korea as an agricultural import market given the rapid growth of its middle class. The main constraints on Canadian exports to India are that country’s extremely high WTO tariff bindings (ceilings) and the unpredictable use of applied tariffs which, although lower, are often still very high.

The recent announcement of the start of bilateral negotiations with Japan, while welcome as an interim step, does not negate the long-term value to Canada’s agricultural sector of Canada becoming a TPP member. The extreme political sensitivities of agriculture in Japan (even greater than those in Canada) are such that it is doubtful that Canada alone will be able to match the access improvements achievable using the combined negotiating leverage of the United States and the other agricultural exporting countries of the TPP. However, as long as Japan remains outside of the TPP, Canada will benefit from any preferential access negotiated as a result of a bilateral FTA. An additional consideration for Canada is that a bilateral negotiation will not require any concessions on dairy or poultry since Japan has no export interests in these products and will want to exclude a number of its own agricultural import sensitivities. Nevertheless, at some point, both Canada and Japan will need to find pragmatic solutions to their agricultural import sensitivities if they are ever going to be invited to participate in the TPP.

How the United States squares its own agricultural import problems in the TPP will provide a good indication of how far Canada and Japan will need to go in agriculture. This is not likely to be discernible until after the U.S. Presidential election later this year. In the meantime, it appears that the United States, Australia and New Zealand are, to varying degrees, reluctant to allow Canada and Japan to join the TPP – at least for the time being. Clearly, one of their major concerns is the defensive posture of Japan and Canada in agriculture. It is not surprising that they are trying to obtain some up-front commitments from Canada and Japan before allowing them to join the negotiations. Nor is it surprising that the applicant countries are unwilling to make commitments until they are at the table and can see what others, particularly the United States, are prepared to give up.

The bottom line is that while all sectors are on the TPP table, it remains to be seen how far the U.S. Congress is really prepared go in liberalizing sugar, dairy and other sensitive products.

Among Canada’s agricultural export competitors, Australia has the most aggressive trade agreement agenda in Asia. It currently has FTAs with New Zealand, Singapore, Thailand and the 10 member states of the Association of Southeast Asian Nations (ASEAN). In addition, Australia is currently negotiating agreements with China, Japan, Korea, Malaysia, Indonesia and the prospective members of the Trans-Pacific Partnership.

The proliferation of bilateral and regional FTAs in Asia offers an important lesson for Canada: if our goal is to protect and increase our country’s share of the region’s agri-food imports, we must be at least as aggressive as our competitors in negotiating improved and more secure market access. Of particular importance will be the need to secure a seat at the table in the TPP negotiations. Particularly now that Japan and Mexico have indicated their willingness to join, the TPP has the potential to become the core of a much larger Asia Pacific regional trading bloc.

Potential Opportunities for Industry-Government Cooperation

The prospect of continued higher prices and rising demand for Canadian agricultural products in emerging markets might suggest to some that, over time, the sector’s need for government support – $8.4 billion in federal and provincial assistance in 2009 – will decline. Unfortunately, things are rarely that simple. One might just as easily ask what government resources will be required in future to help keep Canadian agriculture competitive in a growing but likely more volatile world market.

For example, in recent years Canada’s competitive position in pork production relative to the United States has declined as feed grain yields in Western Canada (mainly barley and feed wheat) have not kept up with corn yield increases in the U.S. midwest. How many additional research dollars will be required to boost feed grain yields north of the border so that pork producers in Canada are at least as competitive as those in the United States? What additional resources will be required to ensure that Canada’s health and safety regime is second to none and capable of certifying compliance with foreign regulatory requirements? How much will it cost to upgrade transportation and storage infrastructure so as to handle significantly increased export volumes, particularly to and beyond the B.C. coast? What needs to be done to enable the private sector to invest in improved processing facilities that are capable of meeting foreign specifications (which may well differ from North American requirements)? Finally, what changes in government income support programs ($3.3 billion in 2009) will be required to encourage producers to continue to farm, bearing in mind that a tighter linkage between global supply and demand will also make markets more vulnerable to weather-induced supply fluctuations?

In a number of areas – including research, infrastructure and improvements to health and sanitary inspection systems – the need for government spending is almost certain to grow. In other areas the challenge may be for governments to find ways of increasing efficiency – for example, by reducing the time it takes to obtain regulatory approval for inputs such as veterinary drugs and pesticides, particularly when such inputs have already won approval in other jurisdictions. One specific way in which the federal government can encourage increased agricultural exports is by negotiating greater international regulatory harmonization and cross-recognition. Increasingly, agricultural exporters report that uncertainties caused by changing health and safety and other regulatory requirements are among the greatest barriers they face.

Finally, as noted above, there may well be significant adjustment costs associated with the opening up of Canada’s supply-managed sectors. In view of the potential gains for the rest of the Canadian economy – including the 80-per-cent share of the agricultural sector that is currently exposed to international competition – one could argue that some of the savings from reduced farm income support should be used to help the dairy and poultry sectors adapt to increased imports.

The Canola Experience

To get some idea of the potential impact of higher exports on Canadian agriculture, it is useful to recall the experience of the canola industry. Over the past four or five years a number of agricultural sectors have developed, in conjunction with government, export market development and access plans. In the case of the canola industry, this translated into a goal of expanding sustainable production from nine million tonnes in 2006 to 15 million tonnes by 2015. Most of this increase will be for export, primarily to Asia but also to the United States and Mexico.

The results of this initiative have been impressive. In 2010, canola for the first time overtook wheat and dairy products as a generator of Canadian farm income, ranking second to cattle. If as anticipated, producers meet their 2015 goal of 15 million tonnes, canola will likely become the single most important source of farm income in Canada. Much of this increase is expected to come from expanded canola seed crushing in Canada and hence more value-added exports in the form of canola oil and meal. The benefits for the seed crushing, oil refining, and handling and transportation sectors will be considerable, as will the impact on the farm input industry, including seed, fertilizer, pesticide and farm machinery suppliers.

The canola industry’s success demonstrates what can be accomplished when industry and government work together to exploit export opportunities. As global food demand increases, driven by the rise of emerging markets, Canada’s challenge is to ensure that all agricultural sectors live up to their export potential, and to help import-sensitive sectors adjust to a progressively more open trading environment.

Conclusion

If Canadian agriculture is to grow and prosper it must be able to take full advantage of market opportunities in Asia, where an expanding, urbanized middle class is driving major changes in global agri-food demand. While much of this demand growth in Asia will be supplied by local producers, it is already evident that imports will continue to grow as demand outstrips the domestic capacity to supply. This will be particularly true for land-intensive crops such as feed grains and oilseeds. Although food security concerns will continue to encourage a certain minimum level of self-sufficiency in most Asian markets, especially for rice and wheat, there will be expanding opportunities for exporters to supply higher value products, including vegetable oils and meats, as well as a wide range of more highly processed food products.

If Canadian agricultural producers are to maximize their export potential in Asia, they cannot allow themselves to be placed at a competitive disadvantage compared to other exporters. The most urgent trade policy challenge, therefore, is to ensure that Canada is not locked out of the preferential trade agreements that will increasingly shape the future of trade in the Asia Pacific region. At the same time, it will be essential to help import-sensitive industries in Canada adjust to further trade liberalization. Political sensitivities notwithstanding, the rest of the economy, including the 80 per cent of Canadian agriculture that is tied to world prices, cannot afford to be held hostage to demands by dairy and poultry producers to preserve the status quo.

While improved and more secure access to Asian markets is imperative, it is

equally important to ensure that Canada’s capacity to supply world-competitive agri-food products is maintained and strengthened by a growth-oriented research, regulatory and investment environment. Our export competitors also have their eyes trained on the Asian market and Canada will have to compete hard for a share of this demand growth. Fortunately, policymakers in Canada are beginning to recognize that problems such as chronic agricultural surpluses and depressed farm incomes will in future be more the exception rather than the rule. The rise of China, India and other emerging markets has dramatically changed the outlook for Canadian farmers and agricultural processors. Canada’s agri-food sector has the potential to become a growth engine for the entire economy if governments work with producers and processors to take the steps necessary to maximize export opportunities.