From Bronze to Gold

A Blueprint for Canadian Leadership in a Transforming World

In June 2005, the Canadian Council of Chief Executives launched a new initiative aimed at improving Canada’s competitiveness within a transforming global economy. We spoke out because, despite all the good economic news that Canadians have enjoyed in recent years, we believe that Canadians had become dangerously complacent about a wide range of emerging challenges to our country’s ability to sustain the wellbeing of its citizens. We also were discouraged by the extent to which Canada’s political process had become dominated by short-term partisan tactics at the expense of strategic decision-making.

In the months since, we have engaged in research and consultation across a wide range of issues that matter to the long-term future of Canada. On January 23, 2006, after an unusually long and intense election campaign, Canadians chose a new Parliament and a new Government. We in turn would like to take this opportunity to offer the results of our work to date to Canada’s new Prime Minister, to the members of his Government and to Members of Parliament from all political parties. We are pleased to share our views as well with Canada’s Premiers and legislators and with decision-makers across the country.

This paper, From Bronze to Gold: A Blueprint for Canadian Leadership in a Transforming World, reflects our perceptions from the front lines of global commerce about the nature of the challenges facing Canada and about how our country could make the most of its formidable strengths in meeting these challenges. We put forward ten specific suggestions for actions that we believe could be taken quickly and could win support across party lines. We also advance five bolder ideas that we hope will provoke a broader national discussion about how to position Canada for even greater success in the decade ahead.

We believe that it is time for leaders in all sectors of our society to work together and to think big about what our country can achieve and how to get there from here. We offer these thoughts as our initial contribution to what we hope will become a broad national discussion, and we promise to continue our efforts toward the goal we set in 2000, that of making Canada “the best place in the world in which to live, to work, to invest and to grow”.

Our Vision for Canada

We believe in Canada. We believe in our country as a bastion of hope and freedom in an unpredictable and often dangerous world. We believe in the creative potential of every Canadian and in the right of each person to an equal opportunity to make the most of his or her talents. We believe that our open and diverse society offers us a critical advantage in shaping a future of prosperity for our nation within a world of change.

As business leaders, we are no more entitled than any other Canadian to criticize our nation’s path, but neither can we shirk our responsibility to stand up and be counted when we see our country missing vital opportunities. The contest of ideas is the central strength of a vibrant democracy.

In June 2005, disturbed by what we saw as an excessive focus on short-term politics at the expense of long-term national strategy, the Canadian Council of Chief Executives (CCCE) launched a new initiative aimed at boosting productivity and positioning Canada to compete more effectively in the global economy.

In a statement titled Canada First! Taking the Lead in a Transforming Global Economy, we suggested that what matters most to Canadians is not where political parties stand in the polls from one day to the next, but what kind of a country our children will inherit over the next generation. We said that Canadians must work together to deal with the threats and opportunities our country faces and to forge a new strategy for our country.

Canada has many strengths. The hard choices made by Canadians during the 1990s have produced real dividends. Canada today seems to be in great shape. It is the only major industrialized country enjoying consistent surpluses both in its federal budgets and in its trade and current accounts. Its economic growth has been the best in the G-7 over the past five years, driving the unemployment rate to its lowest levels since the 1970s and producing impressive gains in family incomes, profits and tax revenues.

Canada cannot afford to be complacent. Despite this impressive progress, Canada faces very real threats to its future. There are threats to our safety and security, threats to our environment and to our health, threats to our social stability, threats to our economic wellbeing, threats to the unity of our country. If we fail to recognize these threats and to take action to address them, our lives and those of our children will be poorer.

In the face of these challenges, Canada’s performance is slipping in relation to that of key competitors. As the Conference Board of Canada pointed out in its 2005-06 Performance and Potential report, other countries are outperforming Canada even in areas that have been traditional sources of strength: “Although our overall performance is decent, our star does not shine to the degree that it once did.”

Even the world’s strongest economies are not resting on their laurels. In his 2006 State of the Union address, President George W. Bush warned that the United States cannot afford to be complacent and launched a US$136 billion American Competitiveness Initiative focused on improving his country’s performance in research, innovation and education. Similarly, European Commission President José M. Barroso has warned that the European Union must breathe new life into its growth and jobs strategy, concluding that “we have no time to lose!”

Canada must build on its success. We speak of success not only in terms of business profits and economic growth. Economic performance is not an end in itself, but it is our economic progress that gives us the means, as individuals and as a country, to do more for ourselves and our families, more for our less-fortunate fellow Canadians, more for those in need beyond our borders.

In shaping a path forward, we see Canada as a place more open than anywhere else to new people and new ideas, a hub of creativity in advancing human progress. We see a Canada where people live longer and healthier lives, regardless of income. We see a Canada in which cleaner air and water go hand in hand with growing prosperity. We see a Canada where earning a living does not preclude a satisfying life with family and friends. We see a Canada in which citizens connect easily with one another and with the world. We see a Canada that remains proud of its past and confident in its place, yet determined to do better.

To achieve such a vision, Canada needs efficient and trustworthy governments, the basic infrastructure of democracy. We need to maintain our commitment to giving of our strength to others, to supporting the rule of law, human security and the free flow of people, goods and ideas around the world. But above all, our future success as a country depends on our determination to build a true society of opportunity. To shape our collective destiny, we must tap the entrepreneurial and creative energy in every sector of our society.

To express a vision is not to achieve it. To achieve such a vision will require action by leaders in our governments, in our businesses and in our communities. We each must act in our own spheres, but above all, we must work together constructively.

In this statement of our commitment as business leaders, we focus on what we know best: how to strengthen the economic base that expands our opportunities as individuals and as a country. We propose a series of specific steps forward that we believe are necessary to secure Canada’s success and that are capable of attracting broad, multi-party support in the new Parliament. And we go further, putting on the table several bolder ideas to address fundamental issues that Canada faces today.

In offering these ideas, our goal is not to push a specific policy agenda. We are asking all Canadians to acknowledge the scope of the challenges we face as a country and to enter the debate about our future with all of their energy and creativity.

The time has come to set aside complacency. It is time to think big about what Canadians can achieve and how to get there from here. It is time for all sectors of our society to work together to produce the greatest possible increase in the wellbeing of Canadians over the next decade, as individuals, as families and as a nation. It is time to take action to ensure that the next chapters in Canada’s great story are even more inspiring than the ones that already have been written.

Making the Most of a World of Change

To make sensible decisions about national strategy, it is vital to understand what is happening in the world around us.

We live in an increasingly open world. Openness is one of Canada’s greatest strengths, and we have been a prime beneficiary of the growing flows of goods, services, money, ideas and people across borders. Being open to opportunities also means being open to competition. Canada has done well in competition with other industrialized nations, but the rise of large developing economies such as China and India is transforming the competitive landscape for companies in every sector.

With increasing openness, however, comes recognition that issues such as health and the environment do not respect national borders. Acid rain, greenhouse gases, water pollution and hazardous waste disposal, along with avian flu and the potential for global pandemics: these threats all demand action at both the national and global levels.

We live in a dangerous world. International terrorism has replaced superpower confrontation as the greatest threat to world peace and human security. Canada must be resolute both in defending our interests and in contributing to international efforts to increase security without choking off the global flows that hold the key to greater prosperity around the world.

We live in an urbanizing world. In developing and industrialized countries alike, cities have become the engines of economic growth. Rural communities still play vital roles, but it is the large cities that have become overpowering magnets for people and their skills. This relentless migration brings with it myriad new challenges. Canada must aim to create clean, efficient and well-governed urban environments that will attract the best and brightest from around the world.

We live in an aging world. Across the industrialized world, people are living longer and healthier lives and having fewer children. This is leading to a steady aging of the population in advanced economies, with relatively more people living in retirement and dependent on social services that will have to be funded by a shrinking cohort of taxpayers with jobs. As a result, industrialized countries are becoming more aggressive in looking abroad for younger and skilled immigrants. Demographic trends also underscore the need to invest in new and more productive technologies, to enable

each young person to achieve his or her full potential and to make full use of the talents of every Canadian at every age.

We live in an innovative world. The intense competition that flows from an open world generates a relentless flow of new ideas. Prosperity flows not just to those who generate new knowledge, but in even greater measure to those who find ways to make effective use of such knowledge. Investment in research is important for countries and companies alike, but investment in the adoption of new technologies and in the development and marketing of new products for world markets is critical.

This open, dangerous, urbanizing, aging and innovative world poses challenges to governments, businesses and workers in every corner of our society. It affects different people in different ways, but no enterprise and no community is immune. To preserve our leadership, our jobs and our quality of life, we must learn how to adapt and succeed in this new environment.

The Critical Role of Good Governance

For countries as for businesses, good governance is essential. Without good governance, companies find it harder to attract and keep customers, employees and investors. Without good governance, countries face similar challenges in attracting both investment and talented people.

The degree of public trust in what governments do and how they do it has an immense impact on the ability of any economy to produce more jobs and generate higher incomes. While economic growth is driven primarily by private-sector energy, initiative and investment, government policies have a pervasive influence. Public policy in turn is shaped not just by political priorities, but also by the way the country organizes itself, by its governance structures and practices. In forging a strategy for strengthening Canada’s competitiveness, addressing issues of governance is a necessary condition for sustainable growth.

In recent years, private-sector investors have come face-to-face with the consequences of poor corporate governance. The result of major corporate scandals has been both stricter rules imposed by governments and far-reaching governance reforms adopted by individual companies. Both have been critical in restoring investor trust. Canadian citizens are facing a similar crisis of faith in their governments.

During the recent federal election campaign, the sponsorship scandal prompted every party to put forward significant proposals for improving public governance. More recently, the final report of the inquiry headed by Mr. Justice John Gomery presented further recommendations for reform. While specific recommendations vary, and we would strongly maintain that the Prime Minister must always retain the right to shape the senior Public Service at the deputy level, there is a clear consensus both on the need for action and on the broad priorities. We support action in the following areas in particular.

- Responsibilty of ministers and deputy ministers. Politicians and public servants each play distinct roles in making government work, but the sponsorship scandal exposed both a muddling of these roles and a troubling lack of clear personal accountability for key decisions. In the private sector, chief executives now certify personally that their corporate reports are fair and complete, that everything they say is accurate, that nothing has been left out that might make what is said misleading and that the CEO is aware of all material facts. The federal sponsorship scandal suggests that a similar degree of personal accountability could be helpful in restoring the trust of citizens in the accountability of elected officials, and perhaps of senior public servants as well.

- Parliamentary reform. A central requirement for addressing the “democratic deficit” is a strengthening of the powers of individual Members of Parliament and of parliamentary committees. In particular, committees need to have greater funding that would enable them to undertake independent research. They should become an important vehicle for fostering cross-party cooperation, notably through consideration of complex proposals while legislation is being drafted and not just after bills have been presented. And they should be used to provide greater public scrutiny of major government appointments.

- An innovative and professional public service. Whatever governments do, they must do well. Canada’s highly professional and non-partisan public service is a vital national asset. To continue to be effective, however, public service at the federal, provincial and municipal levels must be capable of attracting its share of talented and motivated people. To do this, governments must offer more than just competitive compensation. Public servants must feel empowered and encouraged to challenge established practice and put forward innovative ideas for improving the value they generate for each dollar raised from taxpayers. Only by constantly re-examining the performance of existing programs can any government be sure of delivering value for money and meeting the evolving needs of Canadians.

In considering how to improve public governance through greater transparency and accountability, our experience with the impact of the Sarbanes-Oxley Act in the United States and its Canadian equivalents suggests that it is essential not to over-react. The goal of personal certification or of other new accountability measures must be to improve the value that governments deliver to taxpayers, not to stifle creativity, bog down decision-making or create excessive costs. To put this another way, the aim must not be to provide more opportunities for opposition politicians to collect ministerial or bureaucratic scalps, but rather to ensure full and accurate reporting by senior public servants and by ministers on what the government is doing and how it is moving to fix the problems that inevitably emerge in the complex process of running a country. Rules that force business executives to spend too much time talking with lawyers and accountants instead of growing their enterprises do not serve shareholders well; new rules in government that stifle innovation and flexibility would be equally counterproductive for taxpayers.

In addition to considering reforms to public governance at the federal level, Canadians need to take a hard look at how well the federation as a whole is working. Issues that must be addressed include how Canada’s various levels of government distribute responsibility for the work they do and for raising the necessary taxes, as well as the more fundamental question of how best to strengthen Canadian unity.

- Organization of the federation. The recent federal election has renewed debate about the way the Canadian federation is working. Talk of constitutional change, an idea abandoned after the collapse of the Meech Lake and Charlottetown accords, is bubbling up again. So is the possibility of another Quebec referendum on separation, this time matched by a worrying degree of autonomist thinking in Western Canada.

We support the principle of subsidiarity, the idea that who does what within the federation should be determined by which level of government can provide the greatest value for each tax dollar. Past attempts to reassign responsibilities through constitutional change have met with little success, but nothing prevents any government from voluntarily delegating particular responsibilities to another government.

In some cases, the evolving needs of Canadians can best be met by delegating authority from the federal level to the provinces, municipalities or First Nations. In other cases, such as the regulation of securities markets, the time has come for the provinces to delegate responsibilities either to the federal government or to a new pan-Canadian regulator.

Each level of government must be accountable for the proper and effective use of the money it raises through taxation. We therefore would support measures to improve transparency and accountability at every level of government: federal, provincial, Aboriginal and municipal. - Fiscal federalism. Even within the Constitution, there is a growing consensus that the building blocks of fiscal federalism are crumbling. The division of responsibilities established a century and a half ago no longer reflects the array of public policy issues that governments now face. In fact, most issues of vital importance to economic competitiveness cross jurisdictional boundaries.

This confusion has been compounded by the perception of a fiscal imbalance, one that sees federal government awash in persistent budget surpluses even as many provincial governments struggle to cope with the seemingly limitless costs of public health care. Inter-provincial jealousies are on the rise as well, fed by a series of ad hoc deals. As well as rethinking who does what within the federation, Canada needs to make sure that each responsibility is matched with the necessary taxing capacity. - National unity. Finally, let us state the obvious. There is no point in forging a new national strategy if we let Canada fall apart. Quebeckers came within a whisker of opting for independence a decade ago. The years since have seen determined efforts to make the Canadian federation work better within the existing Constitution, with important but modest results. We have seen the development of new institutions such as the Council of the Federation, but also persistent reluctance to act decisively in strengthening the economic and social union.

In terms of competitiveness, Canada already faces a significant disadvantage in attracting jobs and investment because of the small size of our economy relative to that of our closest neighbour and largest trading partner. Continuing barriers to the flow of people and money within our borders undermine our competitiveness further, and a political split would entrench and deepen these disadvantages.

We can conceive of no circumstances in which any Canadian would be better off as a result of a break-up of the Canadian federation. The melding of our founding peoples and generations of immigrants has created a unique success story. We must strengthen that success, not abandon it.

The Need for a Creative Economy

Good governance is an essential enabler of progress, but the quality of life of Canadians ultimately flows from men and women who invest and work to create wealth. The extent of our prosperity as a country depends on how much value Canadians can create through their labour and what returns they can earn on their savings.

This is why concepts such as productivity and competitiveness matter to all Canadians. Other countries are passing us by in raising their standards of living because they have found ways to attract more investment, generate higher returns and create more jobs that pay higher wages. Higher productivity produces more money for individuals and families to improve their quality of life directly. It also generates more tax revenue for governments to provide better public services and infrastructure.

Canadians today are feeling the competitiveness challenge in different ways. Canada’s manufacturers are facing intense pressure from the combination of a rising Canadian dollar, high energy costs and the rapidly expanding economies of Asia. This has led to the loss of almost 200,000 jobs since 2002. In order to maintain production from a Canadian base, manufacturers must justify extensive investment in new equipment and technologies that will boost efficiency even as their profits are squeezed. In the resource sector, by contrast, high energy prices have generated plenty of cash for investment, but also created growing competition for the limited supply of skilled workers and incentives to invest in higher-cost sources of energy — a combination that by definition reduces productivity despite high levels of profit and investment.

Future strong growth in real incomes will depend primarily on productivity growth. This in turn requires moving up the value chain, abandoning activities in which Canadians cannot compete in order to focus our energies on activities that make better use of our time and investment. The focus on value is most obvious in the private sector, but it is just as important in the public sector. Governments too must make better use of their people and resources if Canada as a whole is to enjoy rising prosperity.

In practical terms, this means that Canada must move decisively to shape its future as a creative economy, one in which each Canadian in each region and each industry brings more value to his or her labour.

To forge a prosperous future as a creative economy, Canada must compete much more effectively on three fronts: people, ideas and money. It must do better at unleashing the creative potential of all Canadians and at attracting more talented people to our country. It must do better at encouraging Canadians to generate innovative ideas and to put these ideas to effective use. Finally, Canada must make itself a much more attractive place for individuals and companies to invest in innovative technologies and new ventures.

Competing for Skilled People

Canada is midway through a profound demographic shift. In the 1990s, the central challenge in economic policy was how to generate enough jobs for our people. A decade from now, the policy focus will be on ensuring that Canada has enough skilled people for the work that needs doing.

Canada’s economic performance therefore will be heavily influenced by how successful we are in making the most of our human talent and in attracting more talented people from other parts of the world. Key issues include:

- Education. Canada has a strong record in ensuring access to basic education for all, and one of the best in the world in terms of participation at the post-secondary level. Even so, too many children fail to complete high school. Too many of those who do finish high school need higher standards of literacy and numeracy to function effectively as global citizens. Too few young people succeed in pursuing apprenticeships in skilled trades. Too many are discouraged by financial and other barriers from attending college or university. Where jobs are plentiful, too many are lured into the labour force before achieving the level of education they need for a stable and satisfying career. Where jobs are scarce, too many are seduced by government programs such as Employment Insurance that encourage dependence on low-skill or seasonal work and that undermine interest in further education.

- Training and lifelong learning. Whatever education young Canadians receive before entering the labour market, it has become obvious that learning must continue throughout their careers. Large companies have, for the most part, accepted the need to invest heavily in their employees both to improve productivity and to attract and retain talented people. While large employers can engage in training cost-efficiently, smaller businesses and the self-employed face greater obstacles. So do individuals who want to pursue self-development outside the boundaries of their employers’ programs.

- Labour mobility. Canada’s overall unemployment rate is at a 30-year low, but it remains high in many parts of the country. By the end of this decade, employers in Western Canada may need to fill as many as 350,000 net new jobs even as almost half a million unemployed Canadians continue to live in Quebec and Atlantic Canada. While communities must compete to attract investment and the jobs it creates, national policy must go beyond helping the unemployed to adapt to new job needs and should encourage people to move to where their skills are in demand.

- Aboriginal development. Aboriginal Canadians represent the fastest-growing segment of Canada’s labour market, but the outcomes of past policies have been appalling. The country’s fundamental values demand equality of opportunity, a goal that can be achieved only if Aboriginal youth become far more successful in completing secondary studies and moving on to post-secondary learning.

- Immigration and integration. Canada’s growth and prosperity have been built on immigration. The diversity of our communities is becoming an increasingly important competitive advantage in a global economy, yet the evidence suggests that it is taking immigrants longer to find work related to their qualifications and to catch up to the incomes of Canadian-born workers. As other countries compete more aggressively for skilled and mobile people, Canada will need to do a much better job of recruiting skilled immigrants, assessing and recognizing their credentials and filling any gaps in knowledge that may limit their full and equal participation in the labour force.

Competing for Ideas

The importance of innovation has been a public policy mantra for years. In a world of change, developing new ideas and putting them to use are keys to competitiveness and growth. There are several dimensions to the innovation challenge. These include:

- Research and development. Government investment in R&D has increased dramatically in recent years. While private-sector activity has grown as well, its overall performance is only middling by global standards. Some of this shortfall relates to industrial structure: Canada has more small companies that tend to do less research, and its biggest companies are in sectors that are less research-intensive globally. Other reasons appear to relate to public policy and management attitudes.

- Commercialization of research. Canadian universities and colleges are no slouches when it comes to developing new ideas. Where Canada seems to fall short is in transforming these ideas into successful products and services. In addition to the impact of the overall business environment, possible causes include inconsistent attitudes toward intellectual property rights, a lack of business expertise among researchers and universities and a shortage of venture capital.

- Adoption of new technologies. Competitive advantage flows not just from the development of new technologies, but from the way they are put to work. Information and communications technologies in particular are powerful enablers of corporate productivity, but the record of Canada’s private sector in adopting such tools is spotty. Again, larger companies that are internationally engaged tend to be the leaders; smaller businesses and those focused on domestic markets appear slower to adopt and invest in new technologies.

- A culture of entrepreneurship. People who risk years of their lives and much of their personal wealth to start new businesses are motivated by more than money. Entrepreneurs are drawn to countries and to communities where hard work, risk-taking and success are met with approval rather than envy or criticism. The evidence shows that Canada does well at encouraging people to start businesses. We are not as good at encouraging small ventures to grow into big ones, and social attitudes toward entrepreneurship matter at least as much as the business environment.

Competing for Investment

Economic growth requires investment. By shaping the business environment, public policy plays a critical role in helping to persuade investors both here and abroad to take risks in Canada. Key policy levers include:

- Personal taxation. Business investment is heavily influenced by the availability of talented managers and workers. In today’s global economy, these people are increasingly mobile. A country’s ability to attract investment by virtue of its supply of skilled people therefore is affected by personal tax rates. So is the willingness of individuals to risk their money in starting and building new businesses.

- Corporate taxation. By reducing the potential returns to investors, corporate taxes have a direct impact on decisions about when and where to invest. Corporate tax policy therefore can be a powerful tool for attracting and retaining investment. Across the industrialized world, corporate tax rates have been falling, leaving Canada with one of the highest effective tax rates on business investment in the world.

- Regulatory policy. Rules and regulations can encourage or discourage investment in many ways. Regulations are important in protecting the public interest, but rules need to be clear and the costs of compliance should be kept as low as possible. Regulators need to focus on achieving desired outcomes, not on micromanaging corporate strategies. Regulatory processes have to be open and predictable. Overlap and duplication among governments must be avoided. Domestic rules should mesh as seamlessly as possible with the highest international standards and practices.

- International policy. A more open economy is the key to a more productive economy. Domestic policy choices in areas such as competition and foreign investment have a direct impact on productivity and innovation. So does a country’s degree of access to large markets. A country’s openness to trade and investment, and the way it manages its bilateral and multilateral relationships, have a powerful impact on its ability to attract investment.

The Foundations of a Creative Economy

Before considering what Canada could do better, it is important to recognize that Canada already has built a solid foundation for growth. We must continue to strengthen that foundation even as we examine what needs to change.

- Fiscal prudence. Continued commitment to running balanced budgets or surpluses is the best way to give Canadians more choice in future about what we want our governments to do. Surpluses lead to repayment of Canada’s still-huge national debt. Debt reduction cuts the share of current taxes needed to pay interest on past deficits and shifts this money instead to current services and useful investments in future growth. Federal debt as a share of the economy has dropped from a high of about 70 percent to less than 40 percent today, and is on track to reach 20 percent within a decade. Interest payments that once consumed almost a third of all taxes paid by Canadians still consume about one tax dollar in six; the goal should be to reduce this burden to less than one dollar in ten.

- Competitive taxation. With deficits eliminated, the federal government and some provinces have recognized the importance of competitive taxation. Tax rates went up in the struggle against deficits, but have declined significantly in recent years on both personal and corporate income.

In using tax policy to improve competitiveness, what matters is not just the absolute level of taxation, but also what governments tax. Taxing investment, for instance, does much greater damage to competitiveness and future growth than raising the same amount of money through a consumption tax. - Spending growth. Recent federal surpluses have been driven by higher tax revenues rather than reduced spending. The initial assault on deficits in the mid1990s did require cutbacks, but these have been more than fully restored. Federal program spending has jumped by almost 50 percent in the past five years and 15 percent in the last fiscal year alone. Federal spending, both for transfers and programs, has been growing faster than the economy that supports it.

Governments should never increase spending just because money is available. There may be times when specific needs or public choices warrant an increase in the size of government relative to the economy. On balance, though, we believe that Canada tends to suffer from too much government rather than too little. As a general rule, program spending should rise no faster than the sum of population growth and inflation. - Health care. Canada’s universal public health care system is part of our country’s competitive foundation, but it also has become the fastest-growing area of public spending. In recent years, the robust growth of federal tax revenue has permitted huge increases in transfer payments to provincial governments for health care. This pace of increase cannot be sustained indefinitely. Federal and provincial governments need to put more emphasis on measuring the effectiveness of current practices, learning from what works and what does not at the local level and reforming the delivery of health care to ensure that it generates better health outcomes for every dollar spent.

- Spending review and reallocation. To ensure that they have the money to deal with new or growing needs, governments should commit themselves to the rigorous and continuing review of existing spending. In 2003, our Council proposed that the federal government adopt a “five percent solution”, which would require that each year, each minister and each deputy minister identify the least effective five percent of spending under their direction. This identification of relatively ineffective spending would provide a pool of resources that could be reallocated to new purposes if and when needed. The government adopted such an approach in its 2004 expenditure review exercise, but did not put in place a specific process for reviewing expenditures on an ongoing basis.

- Monetary policy is another area where Canada has established a sound foundation. The extraordinary efforts of the 1990s to bring down inflation have paid off with remarkable monetary stability. Canadians now take low inflation and low interest rates for granted. While the Bank of Canada must remain vigilant in response to both external shocks and the domestic business cycle, its targets have proved effective and should be maintained. We also continue to agree with the central bank that Canada is well served by the maintenance of a floating currency that enables independent monetary policy.

- Trade, aid and investment policy. Canadian trade policy consistently has recognized the need for our country to balance the dominance of our trade and investment links in North America with strong support for the multilateral rule of law through institutions such as the World Trade Organization. Canada’s traditional leadership role at the global level has been eroded in recent years and needs to be restored. The 2005 federal review of international policy did set an important new direction in calling for a doubling of the aid budget while focusing Canada’s support on a smaller group of countries. This approach would make Canada’s assistance more effective and should be pursued.

Given the slow pace of multilateral negotiations on trade and investment liberalization, Canada also needs to reinforce its focus on strengthening bilateral ties with key partners including the European Union, Japan, China and India. Trade policy must include continued efforts to strengthen representation abroad and to expand the limited pool of Canadian companies that trade and invest internationally. - North American strategy. The Canada-United States and North American free trade agreements were transforming in their impact and vital spurs to the economic growth that Canadians have enjoyed over the past decade and a half. But the tone of the Canada-United States relationship has been frayed badly in recent months by election-driven rhetoric. Whatever the personal dynamics between leaders and however deep the disagreements between our countries on specific issues, the way Canada chooses to manage this bilateral relationship will have a huge impact on our future economic growth.

Important progress in deepening Canada’s North American relationships continues to be made across a wide front through the Security and Prosperity Partnership, signed by the leaders of Canada, Mexico and the United States in March 2005. The four key priorities remain: transportation and border infrastructure; regulatory cooperation; North American energy and environmental strategy; and development of continental approaches to managing shared risks, including terrorism and global pandemics. But as our Council and other organizations in all three countries have recommended in recent years, we should consider the benefits of more far-reaching strategies to strengthen North American competitiveness. - Sovereignty and security. In North America and globally, maintaining the open flow of goods and people requires governments to address the threat of international terrorism. Canada remains committed to support for multilateral institutions in providing peace and human security. In addition, it has recognized the need to work closely with the United States in strengthening our mutual security while ensuring the smooth flow of people and goods between our two countries.

Finally, the federal government has recognized that to fulfill its responsibilities to protect Canadians and to contribute to continental and global security, it must make substantial new investments in Canada’s military. Canada has yet to decide, however, whether its economic development will be served best by focusing on greater efficiency and value for money in procurement or through the conscious use of military spending to foster business research, innovation and product development.

Ten Solid Steps Toward a Creative Economy

Maintaining policies that have proven effective is relatively easy, but Canada needs to do more. On the following pages, we offer ten specific recommendations that should be capable of attracting broad support in Parliament and nationally. Together, these ten measures would lead to meaningful progress in strengthening Canada’s ability to compete for people, ideas and investment.

- Start with families and communities. If Canada is to succeed in forging a creative economy, we cannot afford to waste the talents of a single Canadian. In this context, Canada needs to reduce the financial burden of raising children and preparing them for productive lives as global citizens. Businesses need to sharpen their focus on providing an appropriate work-life balance for employees in order to attract and retain the people they need in an increasingly competitive labour market. Governments must do more to enable parents to give their children the best possible start in life. The federal government should start by reducing the steep clawback provisions of the Canada Child Tax Benefit that penalize families with modest incomes and by providing new support for child care, whether in the home or in institutional settings.

In addition, government policy should do more to recognize the vital support families receive from non-profit organizations in their communities. Whether in supporting families or in devising solutions to other economic and social challenges, community-based organizations are fountains of innovation. Businesses increasingly recognize that the development of vibrant, creative communities has a direct impact on their competitiveness, in particular by helping them to attract, develop and motivate employees. Public policy should do more to reinforce grassroots creativity. Personal tax rules should provide more generous treatment of charitable contributions, including the elimination of capital gains tax on donations of appreciated property and an increase in the charitable donations tax credit to make it at least equivalent to the credit for donations to political parties. A creative economy must be built from the ground up.

- Learn from our children’s schools. Access to good education and lifelong learning is the essential foundation both of equality of opportunity and of economic competitiveness. Canada’s record in providing education is strong, but we have weaknesses and we need to keep raising our sights. Delivery of education is largely a provincial responsibility, but the federal government has a duty both to ensure that individuals have access to learning and to provide a policy framework that encourages the highest possible quality of education.

The recently established Canadian Council on Learning is fostering a wide range of new research across every aspect of learning and is working with the provinces and Statistics Canada in developing new measures of educational outcomes. Efforts to date, however, just scratch the surface of what Canadians ought to know. Parents should be able to compare the performance of their communities’ schools against others across town and across the country. Employers should be able to assess the value of a graduate’s diploma and marks in terms of relative levels of knowledge and skills. Teachers, principals and school boards need to know what works and what does not so they can learn and deliver better results.

In the United States, the private sector has been an important contributor to cooperative ventures. One example is the program known as Just for the Kids, which brought together policy makers, educators, parents and corporate sponsors to develop a detailed database that allows parents to see how their children’s school is doing, in each major subject and each grade, over time and in comparison with the top-performing schools serving comparable groups of children. In 2006, the United States Chamber of Commerce will conduct independent research to identify and rank student performance by state and even by county to help businesses decide where to locate. The need for good information about educational performance is critical to economic competitiveness as well as to individual opportunity. Provincial governments should take the lead in assessing how well students and schools are doing and sharing this information as widely and completely as possible. The federal government should assist, and Canada’s private sector should be prepared to do its part.

- Help immigrants do better, faster. The importance of maintaining strong flows of skilled immigrants is widely understood, and the barriers to more effective integration of immigrants into the labour market are well known. What is needed is coordinated action. The federal government must focus on more effective marketing to potential economic migrants as well as faster and simpler processing, especially when companies are bringing skilled people to this country on a temporary or permanent basis. Assessment of foreign credentials might be done more effectively on a national basis. Most of what needs to be done to speed up integration of new immigrants into the economic mainstream is within provincial jurisdiction, including the roles of education providers and self-regulated professions. In addressing these issues, federal and provincial governments should avoid imposing one-size-fits-all approaches, and should focus on enabling the creative energy of non-profit organizations at the community level.

- Turn creative ideas into businesses. The federal government has poured billions of dollars in new funding into university research in recent years. Now the emphasis is on how to turn more of the discoveries flowing from this research into viable businesses. The Leaders’ Roundtable on Commercialization, sponsored by the Conference Board of Canada, produced six “quick hit” recommendations in April 2005 and is working on longer-term strategies. More recently, the interim report of Industry Canada’s Expert Panel on Commercialization identified a series of measures that could be taken to improve Canada’s performance. We support in particular its call for a new model of leadership built around a Commercialization Partnership Board. This would be a business-led body to review and make recommendations on proposals for new programs and changes to existing programs. It would assess their results on a regular basis so that commercialization policy continues to evolve based on real-world experience. In addition to adopting this model for commercialization policy, the government should consider extending the idea of independent public review of proposals and performance to other federal programs that address industrial development and competitiveness.

- Forge an environmental advantage. Clean air and water, unmatched scenery and attractive cities are among Canada’s most important advantages in competing for investment, and a commitment to sustainable development is central to our national brand. As the beneficiary of so many natural resources and custodian of so much of the world’s land and fresh water, Canada has both an opportunity and a responsibility to make the best use of its natural wealth. Canadian businesses need to expand their efforts to develop and deploy new technologies for reducing the impact of their production on the environment. Public policy should encourage greater conservation and waste reduction as well as more investment in renewable energy and innovative environmental technologies. A creative economy must be an environmentally sustainable economy.

Our performance as a country in turn will determine our effectiveness as a leader in addressing worldwide environmental issues such as climate change. On this issue, there is an urgent need to work with others both inside and outside the framework of the Kyoto Protocol to develop a long-term and global solution.

- Develop a Canadian energy strategy. Rising energy prices have raised fears that the federal government might repeat the mistakes of the early 1980s. Canada does need to develop a national energy strategy, but it should be focused on how to serve the growing demand for energy in Canada and North America while improving environmental performance. This will require coordinated action by federal and provincial governments in areas that include taxation and regulation. A

Canadian energy strategy must address the needs of both energy consumers and producers, use competitive market forces to expand the supply of the full range of energy forms, reduce the stresses and strains within our electricity transmission network and ensure that Canadian energy resources remain an important source of national advantage. - Cut the cost of regulation. The Netherlands has shown that it is possible to cut the cost of regulation without in any way lowering regulatory standards. The first step was to develop a simple way to measure how much it costs businesses to fill out forms. This regulatory burden is calculated by an independent body, and each government department has been told to cut its burden by 25 percent by 2007. In just four years, this strategy will generate 4 billion euros in savings, a 1.7 percent increase in labour productivity and a 1.5 percent rise in economic growth. Departments that fail to meet their targets will see their own budgets cut by an amount equal to the excess costs they charge to others.

In Canada, the Canadian Federation of Independent Business (CFIB) estimates that the cost to business of complying with regulations is at least $33 billion a year. The federal Smart Regulation initiative, and in particular its Advisory Committee on Paperwork Burden Reduction, has opened the door to a Netherlands-style approach in Canada. Keeping the cost of compliance as low as possible is essential in maintaining high regulatory standards within a competitive economy.

- Invest creatively in infrastructure. A country’s productivity and prosperity are strongly linked to the quality of its physical infrastructure. This is particularly true in Canada, given its vast size and dependence on international trade. Many forms of infrastructure matter to Canada’s competitiveness, including:

- Transportation. The state of Canada’s roads, railways, airports, seaports and land border crossings has a direct impact on trade and economic growth.

- Information and communications. Information and communications technologies are critical both in connecting Canadians and in enabling businesses to be more innovative and productive.

- Environment. Air and water quality together with parks and recreational facilities play a vital role in improving the overall quality of life and in making Canadian communities attractive places to live and to invest.

- Culture. The quality of a community’s cultural infrastructure also has a direct impact on quality of life and therefore on the competitiveness of communities in attracting people and investment.

The private sector invests directly in some forms of infrastructure such as railways and communications networks. It has a responsibility to contribute to a healthy environment. It is a major supporter of cultural institutions in our communities. And it has an essential role working with governments to expand Canada’s stock of public infrastructure, whether in competing for construction contracts or in investing in public-private partnerships. Canada has the resources to catch up with its infrastructure shortfall and prepare for future growth. There is no excuse for failing to move quickly.

- Cut taxes on investment. To foster growing enterprises that create jobs and raise family incomes, tax policy should encourage people to invest in businesses and businesses to invest in growth. Personal tax rules therefore should do more to encourage savings. At the same time, the federal and provincial governments must work together to reduce Canada’s effective marginal tax rate on business investment, which is now one of the highest in the world. (We note that even high-tax Scandinavian countries have recognized that low corporate taxes are critical drivers of business investment.)

As a small economy next door to the vast market of the United States, Canada must offer compelling reasons for investors in North America to build businesses north of the 49th parallel. The top priority should be the elimination of federal and provincial taxes on capital. While further cuts to statutory corporate income tax rates would be the best way to improve Canada’s competitiveness, targeted measures such as better capital cost allowance rates and investment tax credits may be cheaper in the short term. Governments also should consider how to make research and development tax credits more effective and how the tax system could encourage more business investment in employee training.

- Repair the Canada-United States relationship. Friendship and respect are the hallmarks of Canada’s relationship with its closest neighbour and largest trading partner. As our Council made clear in launching our North American Security and Prosperity Initiative in 2003, it is in Canada’s fundamental interest to pursue bilateral and trilateral agreements that will keep our border with the United States as open as possible, and this requires hard work on issues related to security as well as the meat and potatoes of economic linkages.

The immediate priority is to rebuild the mutual respect between leaders that was left in tatters by the recent campaign. Canada must stand firm in insisting that the United States respect the terms of the NAFTA in addressing trade disputes such as softwood lumber. At the same time, it must continue to work vigorously with the United States and Mexico on the broad agenda laid out by the Security and Prosperity Partnership signed in 2005, where progress on regulatory issues, for instance, may remove much of the basis for launching trade actions within North America.

On the security front, Canada must: work closely with the United States as it develops an alternative to passports for travel within North America; carry through on its commitment to reinvest significantly in its military capability; and support an expanded mandate for the North American Aerospace Defence Command (NORAD) agreement to include maritime as well as air approaches. In this context, we would restate our view that it is in Canada’s interest to participate in the ballistic missile defence program.

Five Creative Leaps to Consider

When tackling issues of long-term strategy, it is critical not to limit the scope of our thinking to mere adjustments in current models and practices. We therefore want to put on the table a handful of more ambitious proposals in the hope that our ideas will spur the development of innovative new approaches to Canada’s public policy framework.

- Abolish taxes on creativity. One fundamental principle of taxation is to avoid taxing what you wish to encourage. If Canada’s future prosperity will flow from its ability to attract talented people, develop new ideas and put them into action, an obvious step would be to slash the tax burden imposed on economic gains from intellectual property. The value of making Canada a haven for creative minds is not limited to the patents that flow from technological research. There is growing evidence that artistic and cultural creativity plays an important role in transforming communities into destinations of choice for skilled people in any occupation. While we and others have made much of the importance of low corporate income taxes to the phenomenal success of Ireland’s economy, that country since 1969 has exempted artists and writers from income tax on earnings from their works of art. Royalties and other earnings from patent rights also are taxexempt. In its 2006 budget, Ireland put a cap on tax-free artistic earnings, but it still covers the first 250,000 euros. This is about ten times the $30,000 exemption on copyright income unsuccessfully proposed a few years ago by the Canadian Conference of the Arts and a similar provision adopted in Quebec in 1995.

- Offer a new deal to learners. Education and training is the foundation of individual opportunity and national prosperity. While education is a provincial responsibility, the federal government has a vital role to play in ensuring access to learning opportunities throughout each Canadian’s working life, whether through colleges and universities, apprenticeships or ongoing training, and whether funded by an employer or an individual.

Some countries focus on providing low or free tuition, offset by higher personal tax rates. In our view this is counterproductive and tends to lead both to underfunded institutes of learning and successful graduates who move elsewhere to work. We would prefer to see an environment in which colleges and universities compete freely on the basis of quality and fees, with government support focused on two areas: reducing barriers to access and improving the rewards for graduates. The first can be achieved through expansion of scholarships, grants and loans on terms that reduce the risks that students assume. The second can be achieved either through lower general tax rates or targeted measures such as tax credits that reward graduates over time if they continue to work and pay taxes in Canada.

Challenges to access are not limited to formal college and university programs. We need to encourage Canadians to engage in learning throughout their working lives. Large companies are generally supportive of such efforts because they understand that investing in training pays off in many ways, including the recruitment, retention and

development of talented people. The biggest issue is how to encourage more training by smaller employers and how to enable the self-employed and employees without employer support to upgrade their skills. What is needed is a combination of financial incentives for individuals and companies along with determined efforts to work with public and private providers of learning to expand the available range and flexibility of training opportunities.

- Hand the GST to the provinces. In 2002, Quebec’s Seguin Commission on the Fiscal Imbalance called for the elimination of all health and social transfers from the federal government to the provinces and the abolition of the Goods and Services Tax. This reduction of federal taxation would enable provincial governments to replace federal transfers by raising their own taxes. Many experts have suggested responding to the perceived fiscal imbalance through a similar approach although to a lesser degree, and most favour the GST as the best place for the federal government to vacate tax room.

This approach has several important virtues. It would give the provinces assured access to a stable and growing source of revenue. It would encourage the federal government to focus on its core responsibilities instead of continuously looking for ways to intrude in provincial jurisdiction. It would make provincial politicians directly accountable for the tax dollars they spend.

On the other hand, a shift in tax room would (for better or worse) reduce the federal ability to ensure national standards in areas of provincial jurisdiction. Absent offsetting changes in the equalization program, transferring tax room would widen the gap between have and have-not provinces. And giving up the GST, its most stable revenue source, would leave federal budgets subject to greater cyclical volatility.

A less radical alternative would be to maintain the current formula for distributing social transfers, but to tie the size of the transfer pool to the GST. Health and social transfers now account for about 6 cents out of every 7 cents raised by the GST. Assuming that the new federal government is able to follow through on its promise to cut the GST by one percentage point immediately, the remaining GST revenue pool would closely match current social transfers and would continue to grow in line with the economy. This approach would maintain the administrative efficiency of a national tax and the redistributive impact of the way transfers are now allocated to each province. At the same time, provinces that have not yet done so should convert their sales taxes to value-added taxes. This would have a major impact in reducing Canada’s effective tax rates on new investment. Linking the GST to health and social transfers would tie Canada’s least popular tax to its most popular public service. To open the door to greater accountability, the federal government also could give the provinces control over the size of the transfer pie by allowing them collectively to set the GST rate. The more directly and permanently the provinces agreed to take this responsibility, the less room the federal government would have to intrude in the way provinces chose to use the funds.

A similar approach could be taken to meeting the needs of Canada’s urban communities. Cities have been promised revenue from the federal gasoline tax. Without changing the planned method of distributing this revenue, the federal government could improve accountability by delegating responsibility for setting the gas tax rate to municipal governments, perhaps through the Federation of Canadian Municipalities. Because municipalities are creatures of provincial law, any such decision would need the concurrence of provincial governments.

One way or another, Canadians have made it clear that their priorities for increased public spending for the foreseeable future will be largely in areas of provincial jurisdiction, notably health care. The current ad hoc approach is unstable and muddles accountability. A formal transfer either of tax room or of the revenue from a designated tax source would improve both stability and accountability, and the GST is an appropriate tax source because it is tied closely to the rate of economic growth, which in turn should determine the base for sustained funding of social services.

- Support people rather than places. The responsibility to attract investment, jobs and people to particular communities belongs to provincial and municipal governments. Once reform of taxation, transfers and equalization have ensured that provinces have the tax capacity they need for their responsibilities, the federal government should focus its support on individual Canadians, without regard to where they live. This is already the case for seniors and for children.

Adopting the principle of supporting individuals across the board would have a significant impact in three other spheres: Employment Insurance, regional development and First Nations. First and foremost, respecting this principle would dramatically improve labour mobility. Canada has regions of high unemployment, yet the country as a whole is facing a growing structural labour shortage. Federal policy should stop encouraging people to wait for jobs to come to them. This would mean fundamental reform of the Employment Insurance system, returning it to its central purpose of protecting people against short-term job loss and eliminating its regional biases. It also would mean dramatic reductions in regional development subsidies to businesses. The federal

government should use tax and regulatory policy to create a business environment that encourages profitable growth no matter where in Canada a company sets up shop. Provinces and communities should take responsibility for creating the conditions that would attract particular companies to particular places.

A similar approach could significantly improve the lives of Aboriginals — for whom federal spending through existing programs of close to $9 billion a year is achieving far too little impact. In this case, the principle of supporting people rather than places would imply a reduction of federal bureaucracy and an increase in direct transfers to Aboriginals, whether they choose to live and work on or off reserves. Taken to its ultimate conclusion, this principle might even see all federal support directed to individual Aboriginals, with First Nations then imposing taxes of their own choosing and being accountable to their own residents for the uses made of this money in providing services and improving the quality of life on reserves.

- Tax spending rather than earning. To encourage the investment that drives personal incomes and business growth, the personal income tax structure should continue to shift toward a consumption base. In the short term, this could be done by further expansion of RRSP contribution limits, creation of a supplementary tax-prepaid savings plan (no deduction for contributions but no tax on withdrawal), and additional cuts in the tax rate on investment income. As a basic principle, Canada should tax people for living like millionaires rather than penalizing them for earning a million dollars.

All the Scandinavian countries, for instance, have what are called “dual income” tax systems, in which dividends, capital gains and interest income is taxed at a much lower rate than other personal income. The Netherlands follows a similar policy. In the United States, the recent report of the President’s Advisory Panel on Federal Tax Reform proposed a “Growth and Investment Tax Plan” that would shift the personal tax system toward a consumption base while continuing to collect taxes in a progressive manner.

This approach enables governments to raise the money they need today while doing as little damage as possible to future economic growth and thereby adding as much as possible to their future spending capacity.

From Ideas to Action

nIthe 1990s, Canadians waited for a crisis before acting decisively. Today, many Canadians feel satisfied with our country’s progress, and without a sense of urgency, it is difficult to mobilize consensus around controversial issues. We would suggest, however, that the best time to contemplate fundamental change is when we can build on our strengths rather than when we have our backs against the wall.

The most recent federal campaign produced a remarkable and welcome degree of debate about policy choices. Elections, however, are exercises in competition, not consensus building. Now that the votes have been counted, it is up to the new Parliament to decide how to proceed in shaping and advancing our national priorities. Parliament’s work must be mirrored in our country’s provincial legislatures.

We believe that most Canadians would support wholeheartedly the goal of a country that is more prosperous as well as safer, cleaner, healthier, more balanced, more creative and more connected with the world. To move from broad ideas to effective action, Canada needs some means of bringing people together to discuss specific goals and proposals. While Parliament has every right to take the lead, its preoccupation with day-to-day political tactics suggests that Canadians cannot rely on Parliament alone to lead a discussion about long-term strategy.

In the past, governments have turned to Royal Commissions to examine grand strategic issues. While such commissions have been effective in the past and may be helpful now, their broad mandates and long timelines also have been used as an excuse for inaction.

Another option is a consensus-building process that would exist independently of government. This approach can involve more than one strand and may proceed alone or in tandem with government initiatives. Any credible independent process of course would have to be inclusive in its participation and not be seen as a front for any one sector or group. At the same time, its inclusive nature should not prevent its members from being passionate about the cause and focused on producing meaningful results in a short time frame.

The members of the Canadian Council of Chief Executives will continue to contribute to the national dialogue. In doing so, we are not trying to drive some mythical “corporate agenda”. Rather, because we care about our country’s future, we are willing to take the risk of provoking open and honest debate about complex and controversial topics and to do our best to help our country reach consensus wherever possible with a minimum of delay. We have faith in Canada’s entrepreneurial spirit. Canadians take pride in our past but also recognize that we must learn from our experience and that we must show more determination and creativity than ever before if we want our children to prosper in the decades ahead.

We do not expect every Canadian to agree with every idea we have put forward. We do believe that all Canadians are tired of political deadlock and eager to move on to a more productive and cooperative discourse about our aspirations as a country and about what we must do to achieve a shared vision. We believe in Canada’s immense potential within an open global economy, and we are committed to working with others to realize the goal we described six years ago in our Canada Global Leadership Initiative, that of making Canada “the best place in the world in which to live, to work, to invest and to grow”.

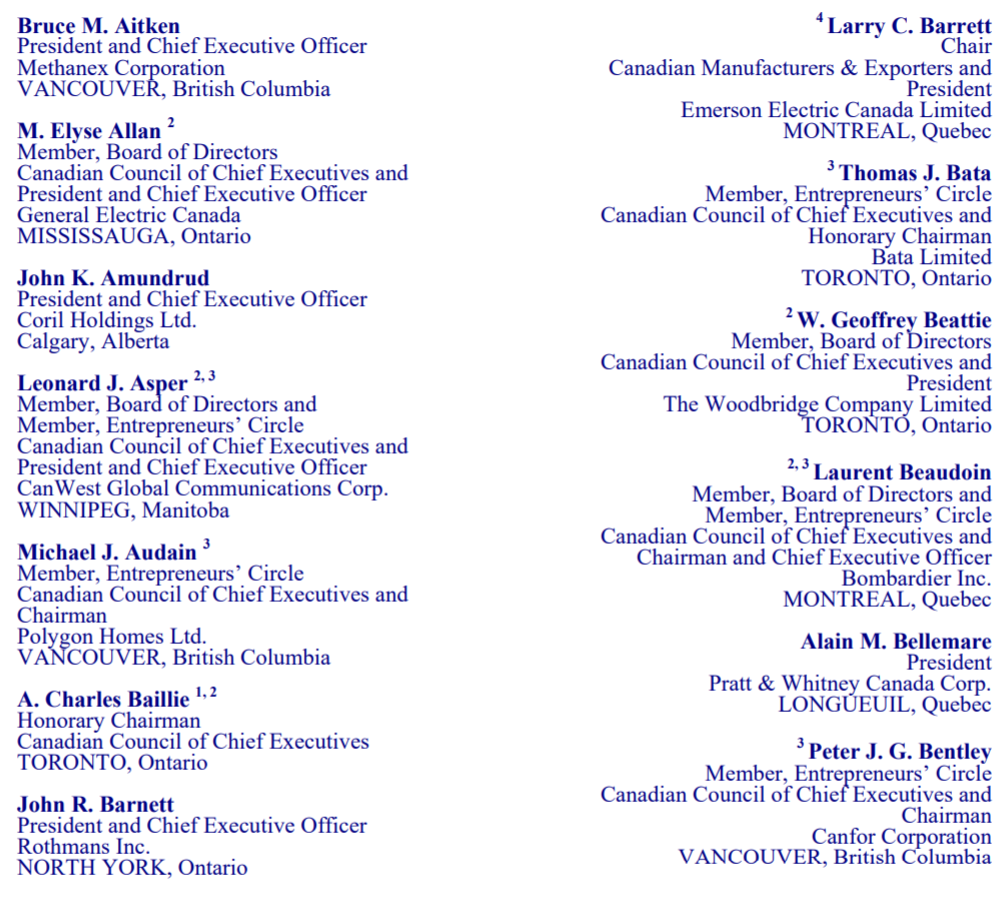

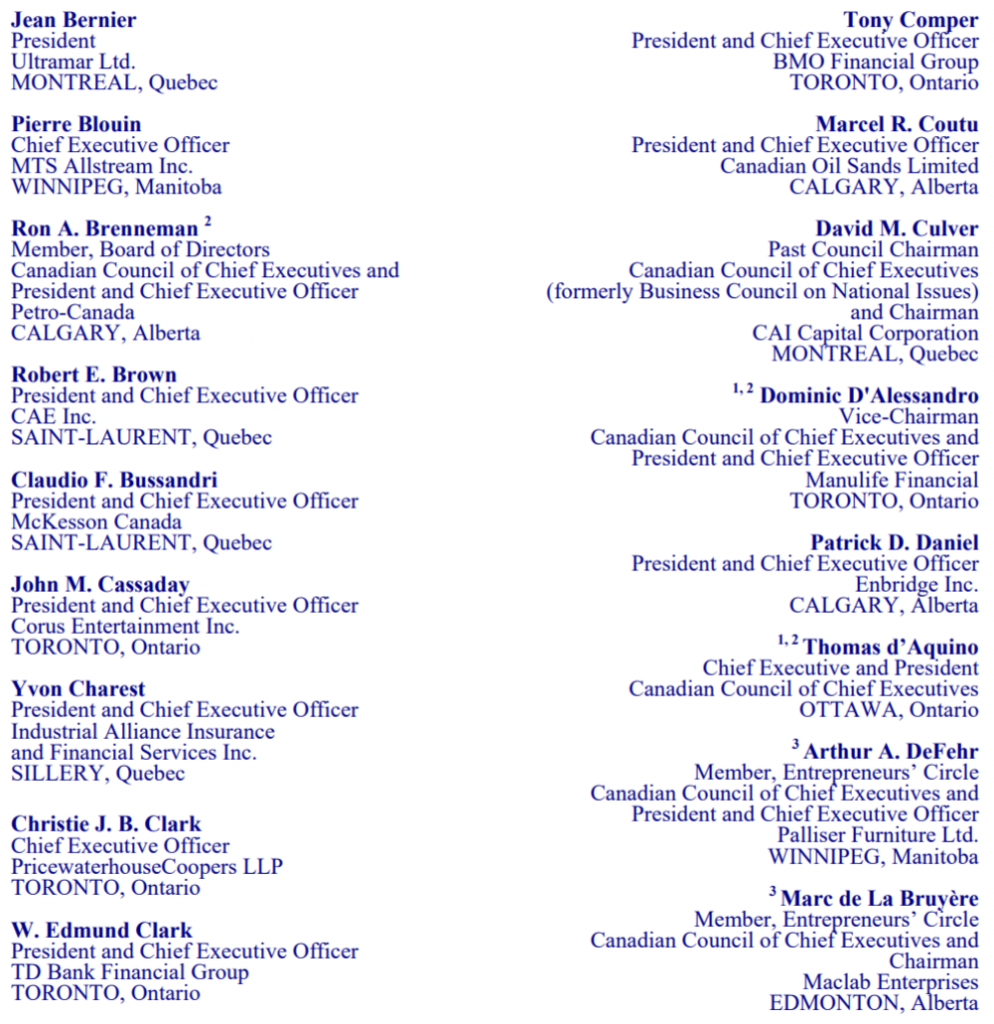

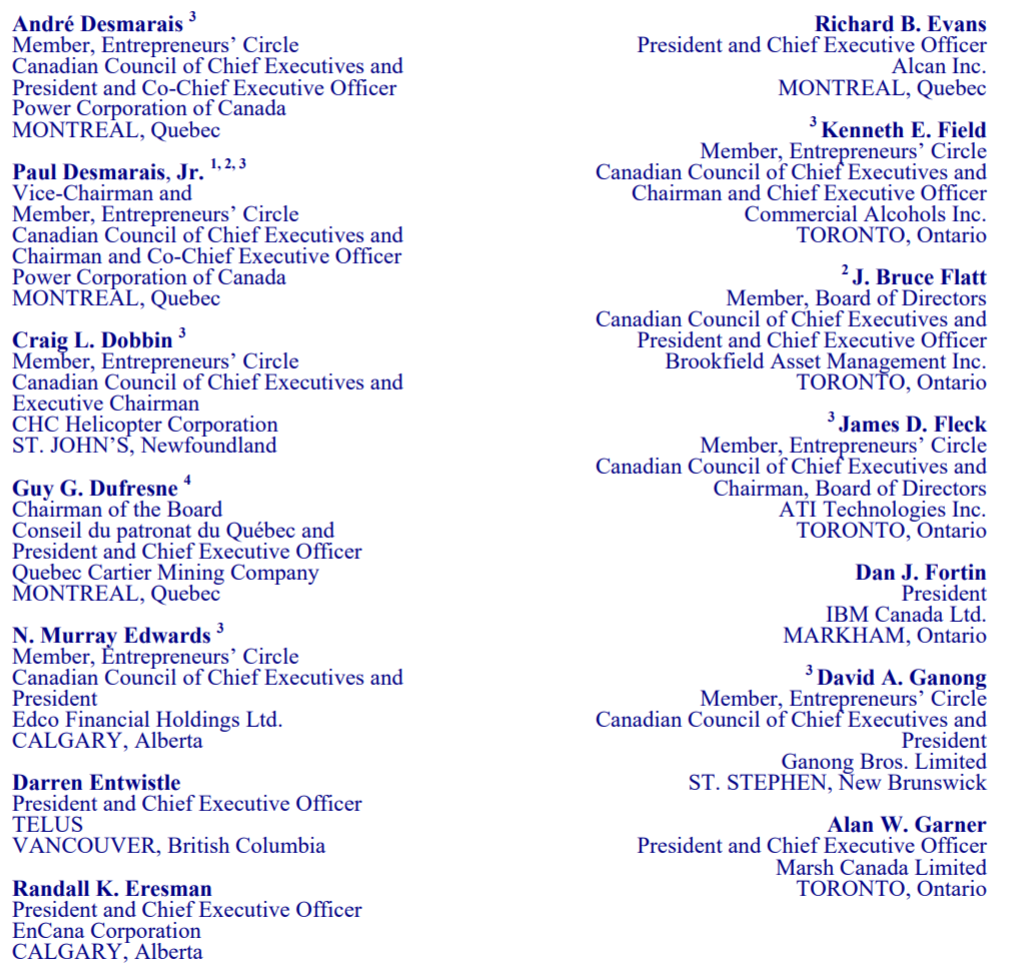

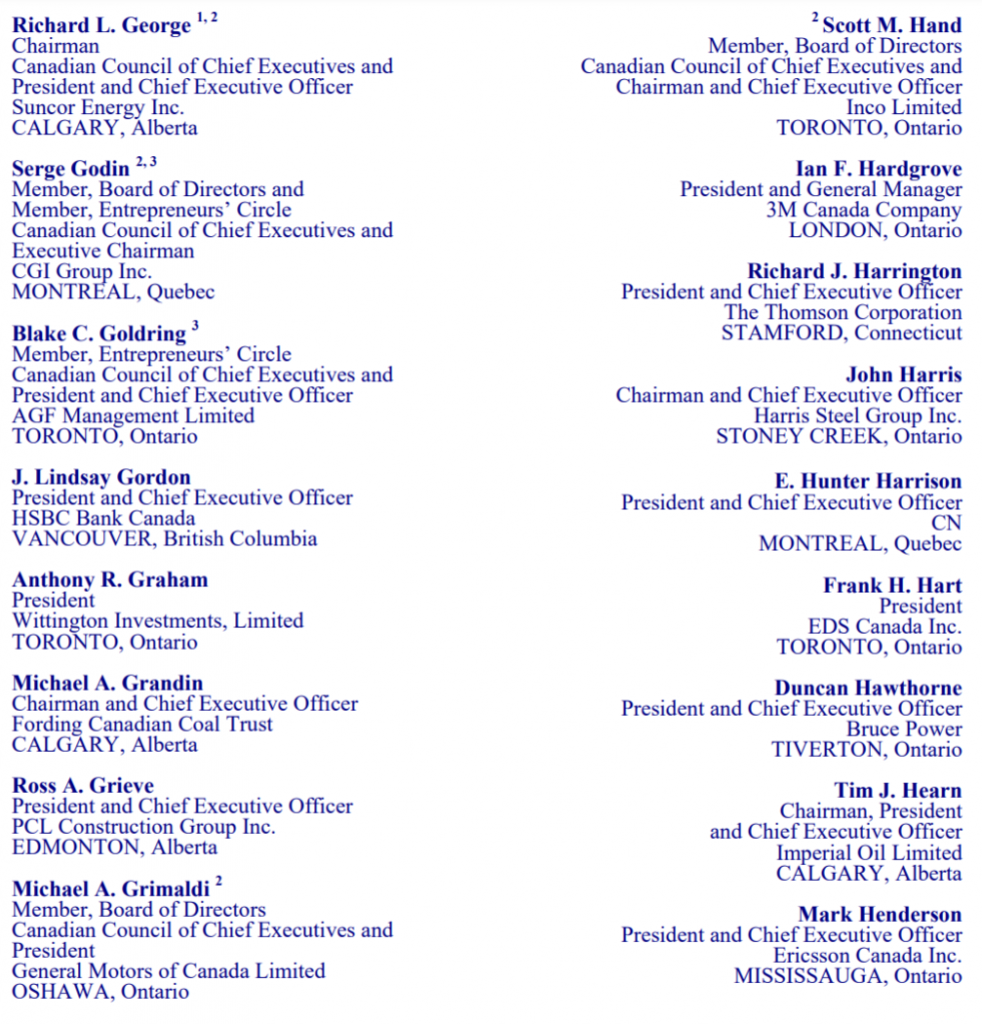

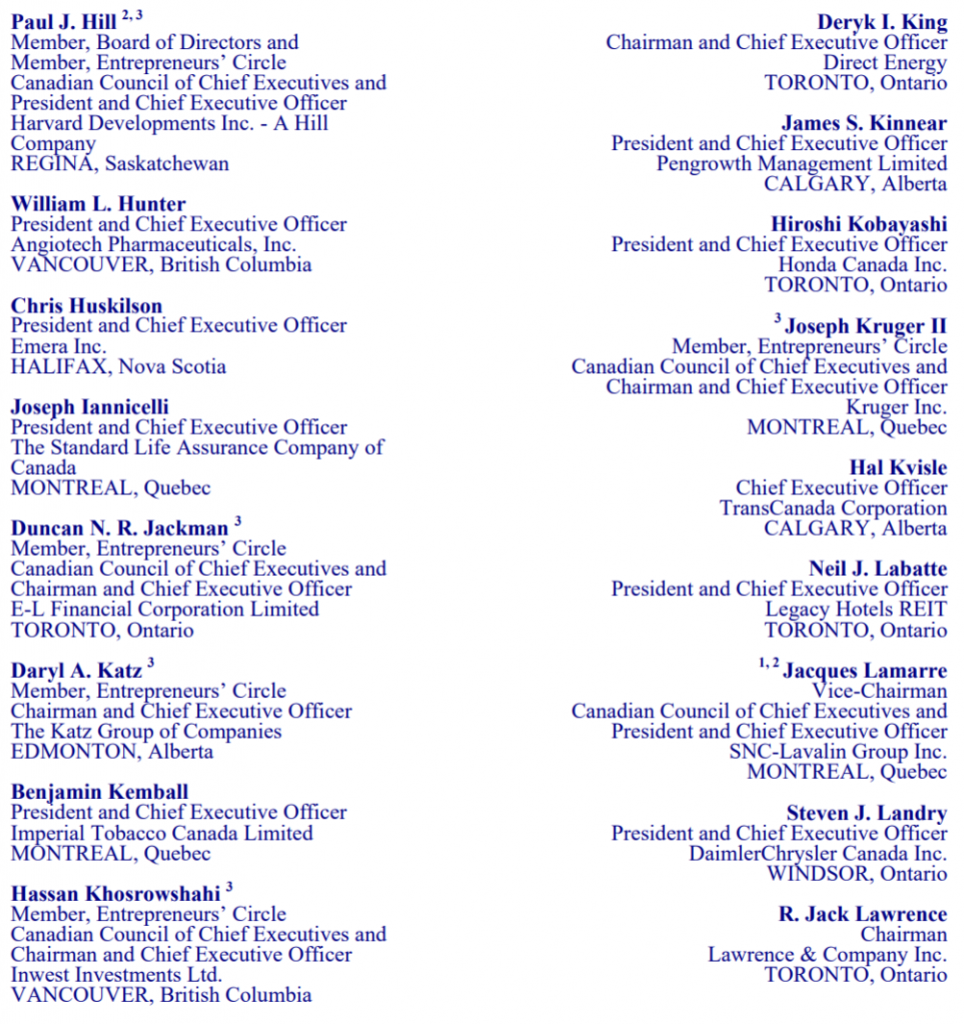

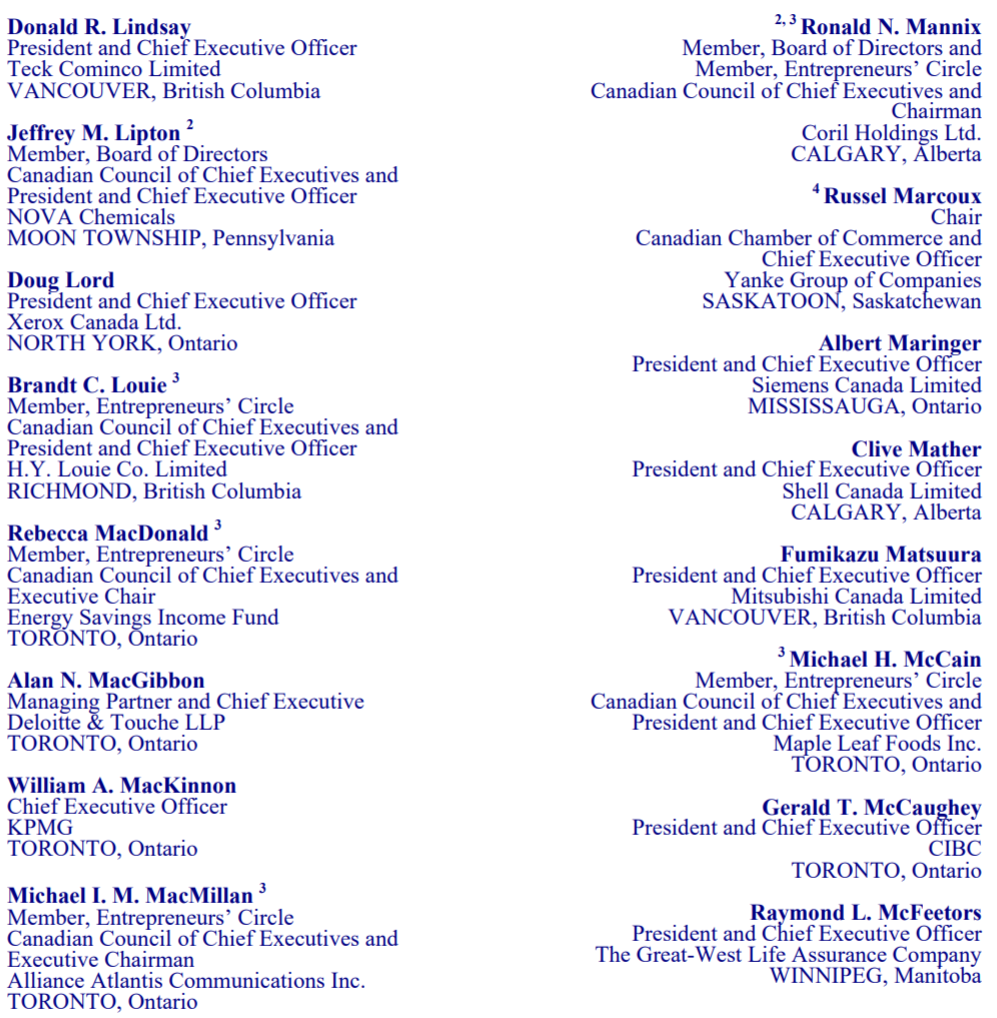

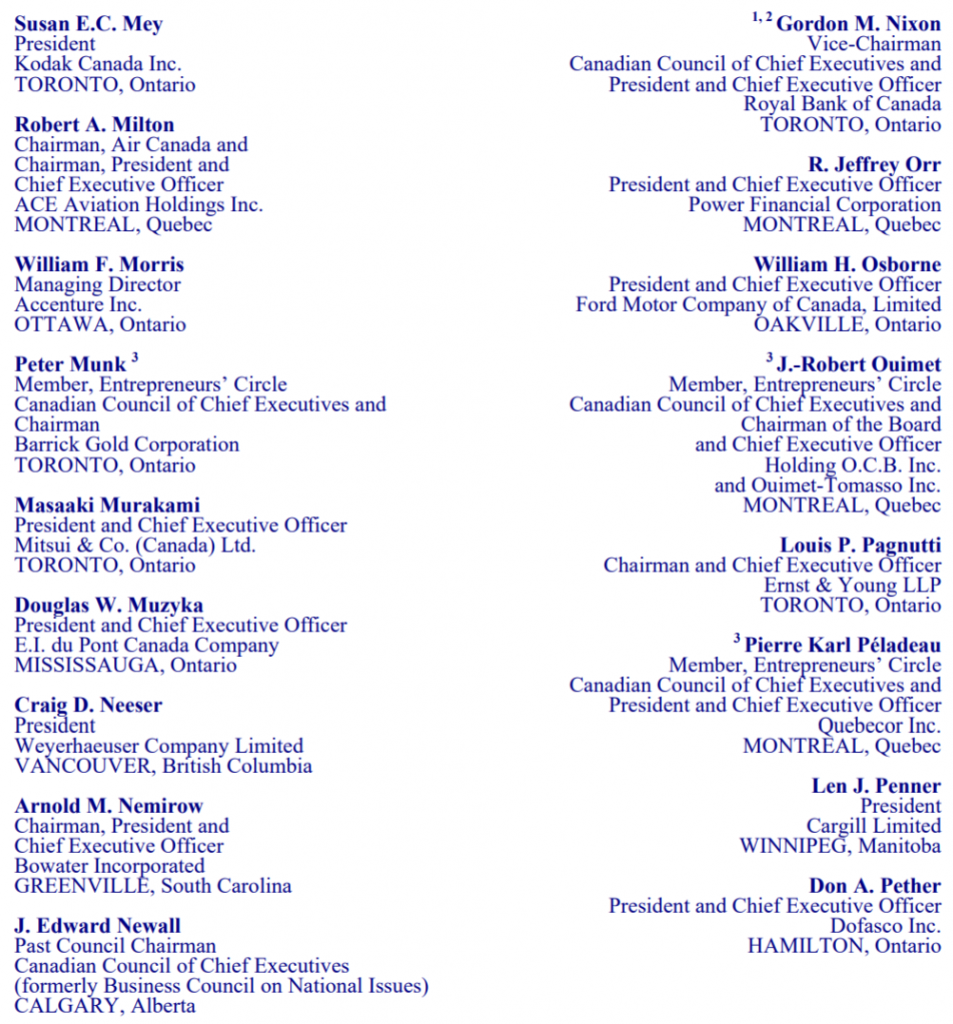

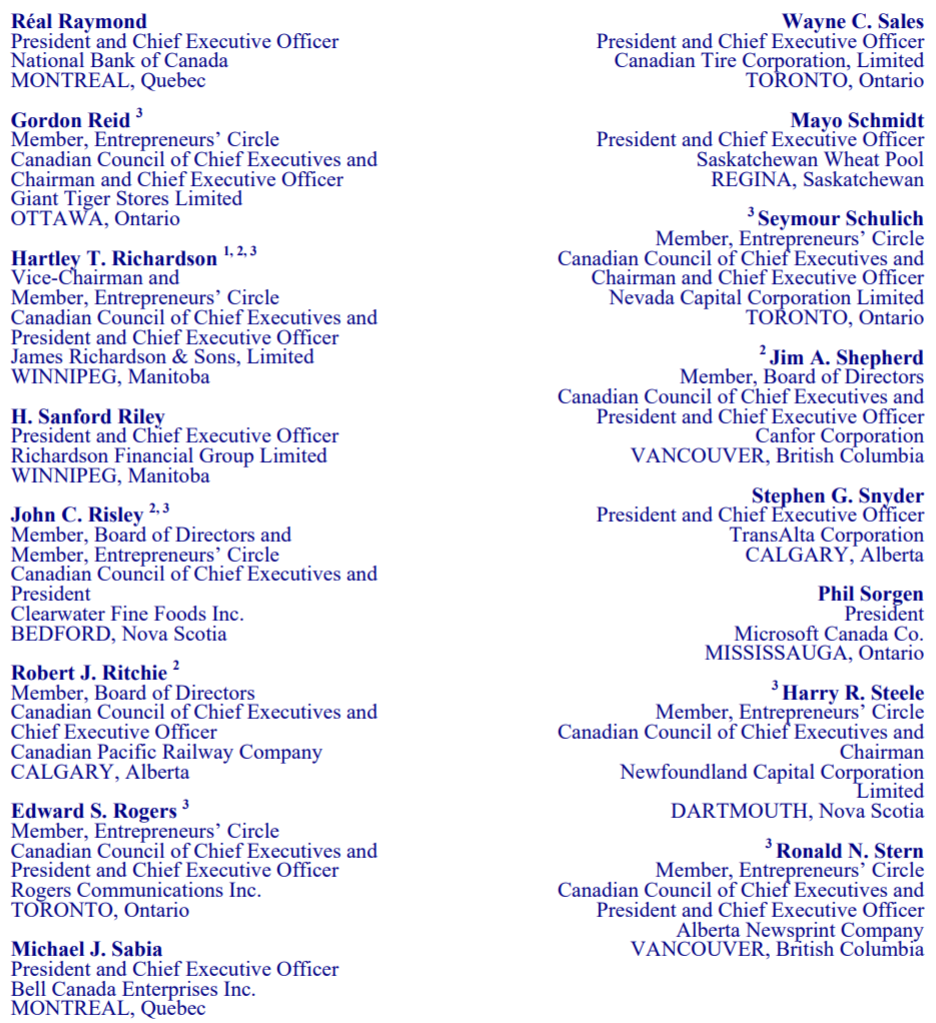

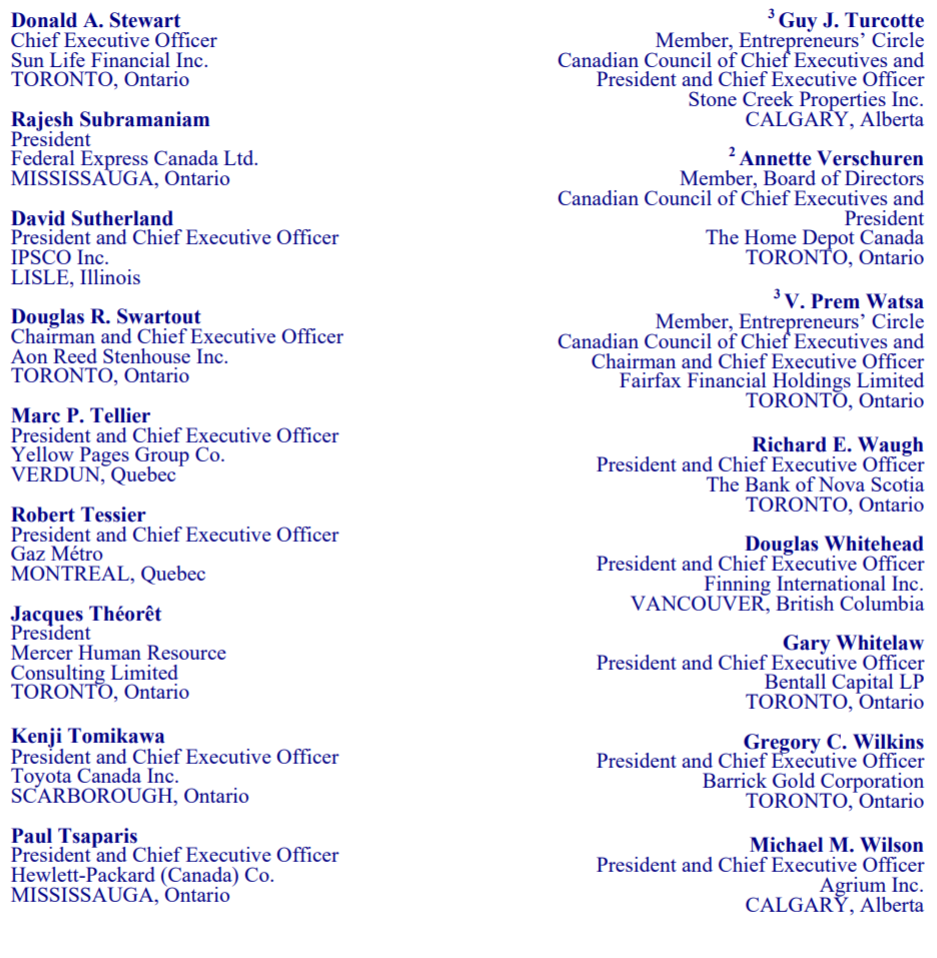

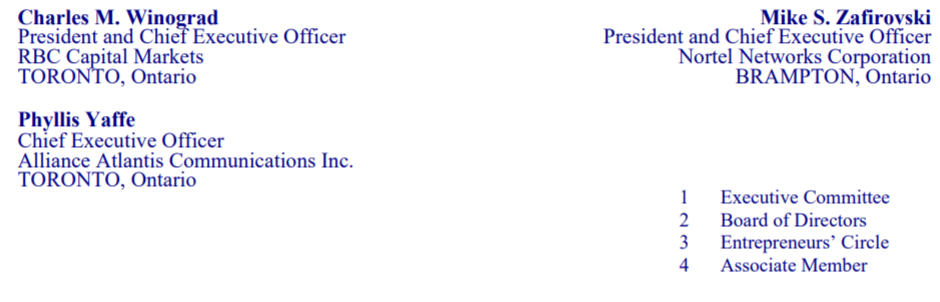

Appendix I: Canadian Council of Chief Executives

The Canadian Council of Chief Executives is Canada’s premier business organization. A non-profit, nonpartisan organization, the Council is composed of the chief executives of 150 of the country’s leading enterprises. Its member companies administer close to C$3 trillion in assets, have annual revenues of more than C$650 billion and are responsible for the vast majority of Canadian investment, exports, training and research and development.

The Council’s mission is to be a global leader among CEO-based national business associations in advancing sound public policy ideas and solutions in Canada, North America and the world. It engages in research, consultation and advocacy on a wide variety of public policy issues including fiscal and monetary policy, international trade and investment, education, health and the environment, foreign policy and security, and corporate governance.

In 2001, in celebrating its 25th anniversary, the Council made a commitment to help make Canada “the best place in the world in which to live, to work, to invest and to grow.” This remains our overarching goal today, and lies at the heart of our latest initiative, Canada First! Taking the Lead in a Transforming Global Economy, launched in June 2005.

The members of the Council’s Executive Committee are: Chairman Richard L. George, President and Chief Executive Officer of Suncor Energy Inc.; Chief Executive and President, Thomas d’Aquino; Honorary Chairman A. Charles Baillie; and Vice-Chairmen Dominic D’Alessandro, Paul Desmarais, Jr., Jacques Lamarre, Gordon M. Nixon and Hartley T. Richardson, the chief executives respectively of Manulife Financial, Power Corporation of Canada, SNC-Lavalin Group Inc., Royal Bank of Canada and James Richardson & Sons, Limited.

Appendix II: Membership – Canadian Council of Chief Executives