Developing Canada’s future workforce: a survey of large private-sector employers

Introduction

To compete in an interconnected and global marketplace, Canadian companies require an increasingly strong and skilled workforce. However, a lack of comprehensive labour market data, particularly on employment trends and skill requirements, makes it difficult to identify and analyze the current state of the Canadian job market.

This shortage of data means recent graduates are left to wonder whether they have the skills and qualifications that employers are seeking, while employers question whether it makes sense for them to invest more in building strong relationships with post-secondary institutions. At the same time, governments are left to wonder whether companies are investing sufficiently in employee training.

This report, based on a survey of 90 leading Canadian employers, examines recent and future hiring trends, demographic changes, the job market for young Canadians and the skills and attributes that large Canadian firms are looking for when they recruit employees. It is a follow-up to a report on Skills Shortages in Canada, conducted by the Business Council of Canada (formerly the Canadian Council of Chief Executives) throughout the fall of 2013 and released in two parts during the first quarter of 2014.

Overall, the survey results indicate that:

- Large companies are increasingly looking to recruit or develop employees with strong soft skills (also known as non-cognitive skills). These skills are especially important when identifying and developing future leaders;

- Large companies generally report that new post-secondary graduates are adequately prepared to enter the workforce, but that expectations for graduates are changing rapidly;

- Collaboration between post-secondary institutions and the private sector is reasonably healthy, although more is needed;

- Large companies are investing more in workforce learning and development. In many cases this includes the use of new training methods; and

- Most respondents believe their companies are well-prepared to handle anticipated demographic shifts, in particular the coming wave of retirements among baby boomers.

Methodology

This report is based on a survey of 90 large Canadian private-sector employers, conducted between August and October 2015. It is the product of a partnership between Aon Hewitt, a global leader in human resource solutions, and the Business Council of Canada, an association representing 150 of Canada’s largest firms. The companies that participated in the study employ more than 800,000 Canadians across the country in a wide range of industries.

Subject areas covered in the survey included:

- Critical skills for current and prospective employees;

- Skill shortages by regions of the country and occupational fields;

- Partnerships with post-secondary institutions;

- How large companies recruit employees, including recent graduates;

- Employer-sponsored education and training initiatives; and

- Demographic shifts and planning for employee retirements.

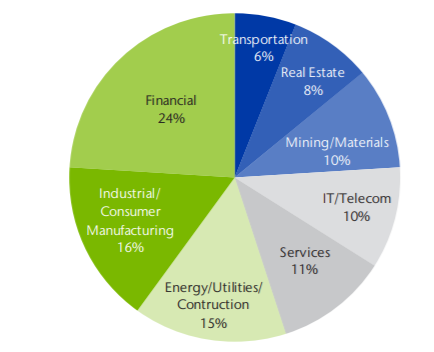

The 90 respondents were distributed across the following industry sectors:

The survey was completed online using a browser-based data collection tool, with each company invited to complete the survey using a unique URL. Respondents included chief human resources officers, vice presidents or directors of HR, and/or HR managers. Results were aggregated and grouped by industry. This survey is a snapshot of a sub-sector of the Canadian economy. It does not purport to reflect the workforce trends and challenges of all Canadian employers.

Modest Hiring Continues

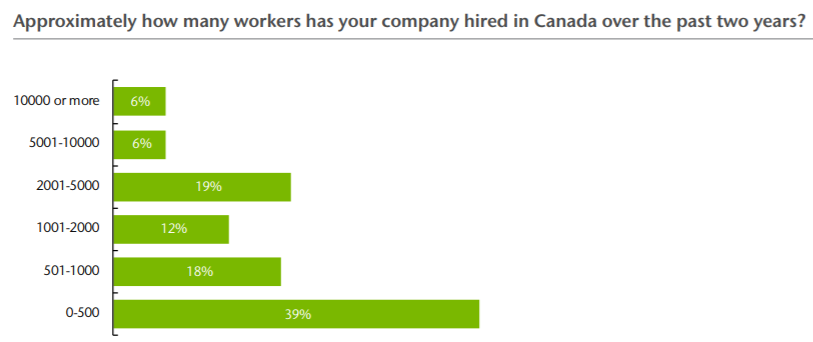

Collectively, respondents noted a decrease in hiring activity over the previous two years – the product of a slow-growth economy. In the 2013 survey, 50 percent of respondents said their companies had hired more than 1,000 people in the previous two years. In the follow-up survey, 43 percent said their firms had hired more than 1,000 people in the previous two years.

Despite the challenging economic environment, certain sectors continue to hire in fairly large numbers. Sixty percent of service-sector companies and 46 percent of financial-sector companies reported hiring more than 2,000 employees over the past two years. Companies in the industrial and consumer manufacturing sector also saw an increase in new hires since the 2013 survey, particularly in Ontario.

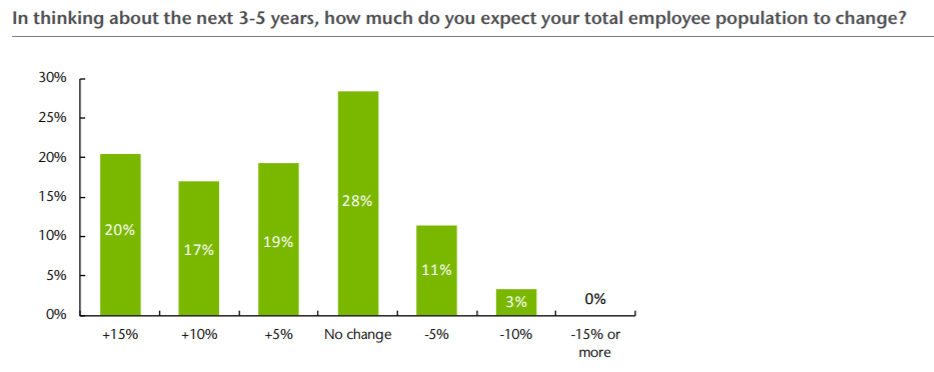

As expected, falling energy prices stifled hiring activity in the energy/utilities/construction sector, especially in Western Canada. However, several companies from this sector noted that once the region’s economy rebounds, there will be pressure to find and hire new employees rapidly. Over the next three to five years, more than half of all respondents expect the size of their workforces to grow, with close to a quarter forecasting workforce increases of more than 15 percent. These forecasts reflect average rates of employee turnover, expected retirements and revenue growth projections.

Hiring Managers Look for Soft Skills

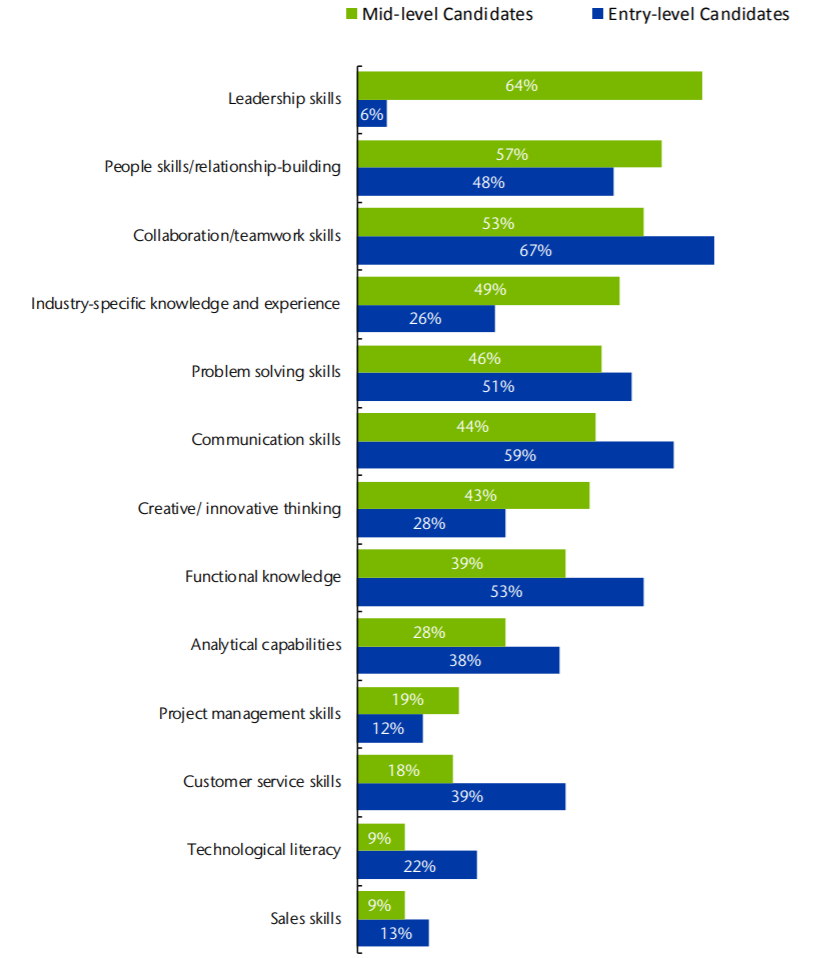

When asked which capabilities matter most when evaluating entry-level hires, respondents emphasized a focus on soft (or non-cognitive) skills.

Consistent with the 2013 survey, the soft skills most in demand included collaboration and teamwork, communication skills, problem-solving skills and people and relationship-building skills. While grades and educational credentials are certainly important to recruiters, companies are increasingly focused on finding people who can work in teams, solve complex problems and show a willingness to learn.

When evaluating candidates, which of the following skills and capabilities are most important to your company?

As one respondent put it, “We are looking for graduates who show nimbleness – the ability to navigate challenging, ambiguous environments.” In a competitive labour market, applicants who display these traits are more likely to be hired and, over time, singled out for promotion.

One significant difference from the 2013 survey was the degree to which respondents emphasized so-called hard skills. Functional knowledge (skills required to fulfill job tasks, duties and responsibilities) ranked in 7th place among sought-after skills in the 2013 survey, but rose to 3rd place in the more recent study. Many respondents indicated a specific preference for graduates with multi-disciplinary backgrounds.

The importance of soft skills relative to hard skills depends on the position an employer is seeking to fill. For instance, companies from the mining/materials and industrial/consumer manufacturing sectors placed a heavy emphasis on recruits with a strong suite of hard skills. In contrast, respondents from the financial and service sectors placed more emphasis on soft skills. Companies in the IT/telecom sector indicated a preference for both customer-service skills (typically defined as soft skills) and technological literacy, a hard skill.

When evaluating mid-level candidates, a large majority of companies focused on the presence of leadership skills, often described as a basket of skills including strategic vision, motivation, management, resilience and decision-making. Half of the respondents also looked for industry-specific knowledge and experience.

Experience is Broadly Defined

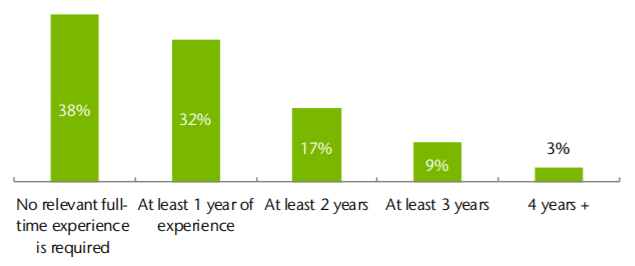

Parents and recent graduates often worry that employers who are seeking to fill entry-level positions will only consider recruits with several years of relevant full-time experience. If true, this would suggest that companies are overlooking good candidates by insisting on unrealistic levels of job-related experience.

To evaluate these concerns, we asked respondents how many years of relevant full-time experience they look for, on average, when filling entry-level jobs. Seventy percent said they expect either no relevant experience (38 percent) or one year of experience (32 percent) for such positions. In practice, many entry-level employees are recruited directly from university or college.

How many years of relevant full-time experience do you typically require for entry-level positions?

Perhaps most encouraging for recent graduates, respondents noted that co-op programs and other forms of work-integrated learning are among the most important sources of relevant work experience, a point that should be emphasized to those preparing resumes. Work-integrated learning provides recruiters with important references and the assurance that an applicant has the workplace skills to hit the ground running. Overall, the percentage of entry-level employees hired directly through work-integrated learning programs has increased since the 2013 survey.

Summer jobs, part-time work, volunteering, international experiences and extra-curricular activities also provide valuable material for resumes and help demonstrate that job applicants have acquired relevant soft skills.

New Graduates are Adequately Prepared to Join the Workforce

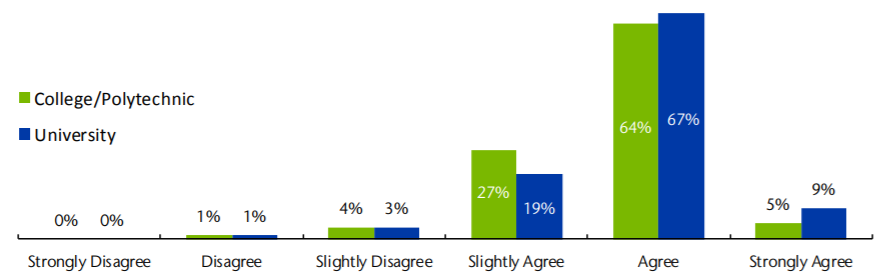

Consistent with the 2013 survey, over two-thirds of respondents believe that new university, college and polytechnic graduates are generally prepared to join the workforce.

One respondent commented that new graduates are often “very bright and keen to prove themselves.” Others pointed out that their companies go to great lengths to recruit the best candidates. Large companies, in particular, have the resources to conduct extensive recruitment campaigns and to out-bid smaller companies for top talent, meaning that they can often “recruit from the top quartile of graduating classes.”

The recent graduates we hired were prepared to join the workforce.

Many respondents commented on the changing expectations for new graduates. Because of rapid technological advancements, the potential for disruption and a hyper-competitive global labour market, companies are expecting more from their new entry-level employees. In many workplaces, the ability to carry out basic functions is no longer sufficient; instead, young workers are expected to take on “thinking roles.”

Such high expectations again highlight the importance of work-integrated learning. Several companies emphasized their preference for graduates who have participated in work-integrated learning programs, with one large employer noting, “The mix of on-the-job experience and exposure, combined with their education, prepares them very well for the workforce.”

Many companies also offer rotational programs and supplementary courses to help new hires get up to speed. One respondent noted, “Although our [entry-level employees] have been prepared reasonably well for the world of work, understanding our business is always a challenge. To enhance their chances for success, we launched a ‘year in industry’ program, which helps them integrate into our company and sector.”

Strong Partnerships Continue with Educational Institutions, but More Can be Done

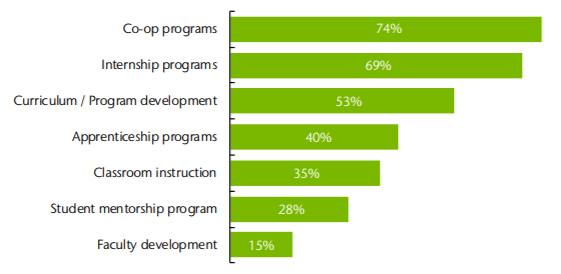

More than three-quarters of the companies surveyed have entered into a formal talent development partnership with a university, college or polytechnic. Of those companies, 74 percent developed co-op programs and 69 percent developed paid internship programs. Both types of programs are designed to give students hands-on experience.

Is your company currently working with an educational institution(s) to better prepare students for joining the workforce?

More than half of responding companies work with post-secondary institutions to develop educational curricula. This includes participating in curriculum advisory councils and the development of capstone projects (in-class projects developed alongside companies, aimed at tackling industry-specific problems). Forty percent of companies have partnerships in support of the in-class portion of apprenticeship programs, including financial support for individual programs and apprentice sponsorships.

What types of programs are included in your partnership(s)?

Partnerships are most common among companies in the transportation, mining/minerals, IT/telecom, and financial sectors, and typically involve co-op and internship programs. The financial sector is most involved in curriculum/program development, while the mining/materials sector is most engaged in classroom instruction, which includes professionals working as expert speakers. Companies in the energy/utilities/construction sector are most engaged in apprenticeship programs.

Most of the companies without a formal post-secondary partnership operate their own student bridging programs. For instance, one company highlighted its internal “student mentorship program which targets participants in [the firm’s] summer student program.”

Although a strong majority of respondents have formal partnerships with post-secondary institutions, more is needed. Amongst our closest trading partners, business-higher education partnerships are more firmly established and have a stronger strategic focus. For instance, several large US firms and post-secondary institutions have successfully launched sectoral and regional projects focused on bringing companies and institutions together to pool program costs, identify shared talent challenges and aggressively close specific regional or sector skill gaps and shortages. Canadian firms and institutions should consider these as partnership models that could ease school-to-work transitions and provide needed talent pipelines.

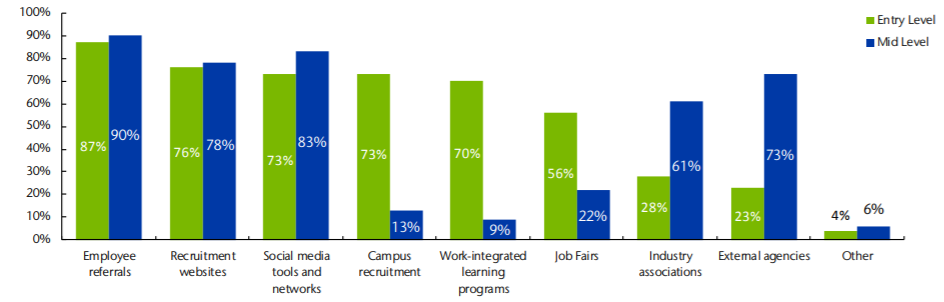

Large Canadian Companies use a Variety of Channels to Hire

To ensure they hire the best candidates, large companies use multiple recruitment channels. When hiring for entry- and mid-level positions, nearly all firms in the study use employee referrals. Studies show that referred candidates are easier and less expensive to hire than recruits hired through other means. Referred candidates also tend to get up to speed at a company more quickly, have a better track record of integrating into the workplace and stay with companies for longer periods of time.

Which recruitment channels do you typically use to source candidates? (select all that apply in each column)

When hiring entry-level employees, most respondents use a mix of recruitment websites, campus recruitment drives, social media tools and networks and work-integrated learning programs. Although respondents reported great success with work-integrated learning programs, many reported that these programs are expensive to administer.

For mid-level hires, social media tools and networks, recruitment websites and external agencies were the most popular methods of sourcing talent, after referrals.

Forty-five percent of respondents formally or informally favour entry-level applicants from specific post-secondary institutions or programs. Companies cite previous positive experiences with hires from an institution, institutional reputation and a formal partnership with an institution as reasons for prioritizing applicants from certain schools. Geographic proximity is also important, especially when recruiting from colleges and polytechnics.

Members Require Specialized and Emerging Skills to Fill Critical Roles

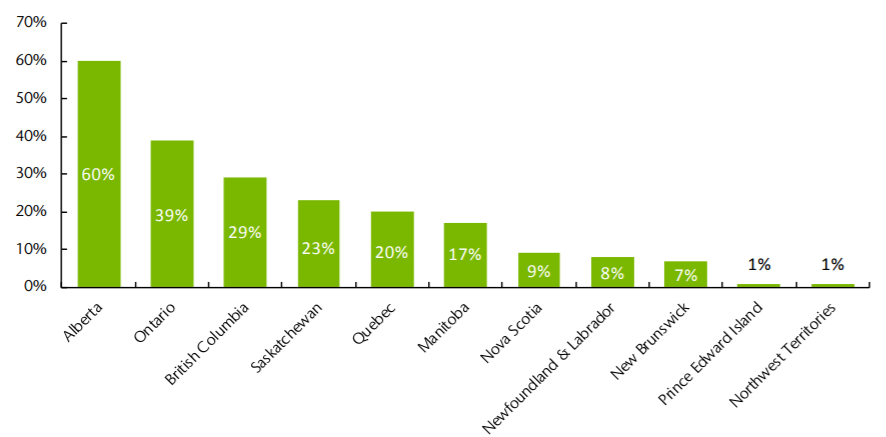

According to the survey, large Canadian companies are not facing a comprehensive skills shortage. However, acquiring and developing leaders and specialized talent for critical roles is a significant concern. As a result, shortages tend to be concentrated in certain sectors, occupations and regions.

Where are you experiencing the most persistent jobs/skills gaps?

Most provinces and territories saw the number of shortages drop since 2013, reflecting changing economic conditions across the country. Alberta saw the largest drop, falling 11 percent – a number that has likely fallen further since the survey was conducted. Ontario, in contrast, saw the largest increase in shortages at 12 percent. Respondents highlighted the financial, transportation, services and industrial/consumer manufacturing sectors as the industries with the most acute shortages.

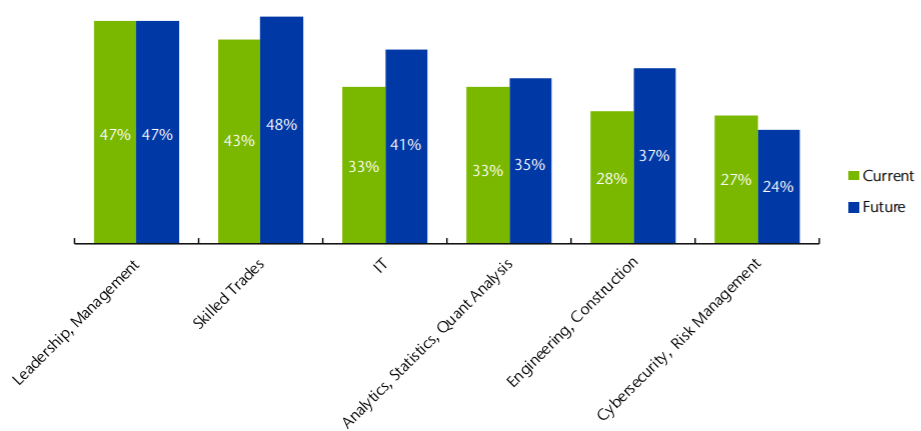

In which of the following areas is your company experiencing skill shortages? (Top Shortages)

For 47 percent of surveyed companies, leadership and management positions are the most difficult to fill, a trend expected to continue over the next three to five years.

In many organizations, the expectations placed on leaders have changed dramatically over the last decade – a product of rapid technological advances, an unpredictable economic and regulatory environment and unprecedented global competition.

Being an effective day-to-day manager is no longer enough. Leaders – from senior executives to managers – are expected to bring forward new and creative ideas, think strategically and globally, optimize operations and motivate employees.

Many respondents indicated that current leadership development programs, both internal and external, are not keeping up with these evolving requirements. According to Aon Hewitt’s Top Companies for Leaders® research, which examines leadership development practices worldwide, Canadian firms are not alone in facing this challenge.

Several large employers in other countries are also struggling to develop and source managers and executives. What separates the top performing companies from others, according to Aon Hewitt, is an intentional and unrelenting focus on building leadership pipelines.

After leadership/management, the most persistent shortages exist within the skilled trades, information technology, analytics, engineering, and cyber-security/ risk management. Respondents expect most shortages in these fields to grow over the next three to five years as the Canadian economy recovers, technology advances and the international competition for talent intensifies.

More than 75 percent of respondents cited challenges finding people with highly-specialized skills, particularly in areas such as power engineering, mechatronics, mobile software development and engineering, IT security, insurance underwriting, data science and analytics and certain Red Seal trades. Ninety-three percent of respondents believe these gaps will have an impact on company projects and investments, with over half saying the impact will be “moderate to significant.”

One HR executive from the financial sector suggested that the shortage of data scientists in the Greater Toronto Area amounted to “a couple hundred.” Yet people with these highly specialized skills are essential to the financial sector, especially as companies map out new markets, track trends, embrace disruptive technology, and safeguard consumer data.

Another respondent highlighted a shortage of cyber-security specialists. While the number of positions in shortage is fairly small, professionals with this skill set are vital to “protecting the security and privacy of customers” and “paramount to maintaining trust and confidence in our company.”

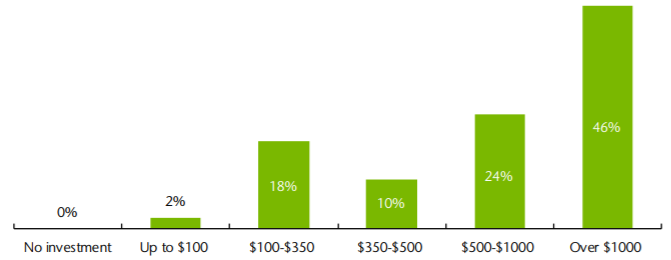

Learning and Development Investments are Increasing

In all sectors, participants continue to invest in workplace learning and development. Almost half the respondents reported spending more than $1,000 per employee every year on activities related to training, with 24 percent spending between $500 and $1,000 annually.

How much does your organization invest annually in employee learning & development activities (per employee per year)?

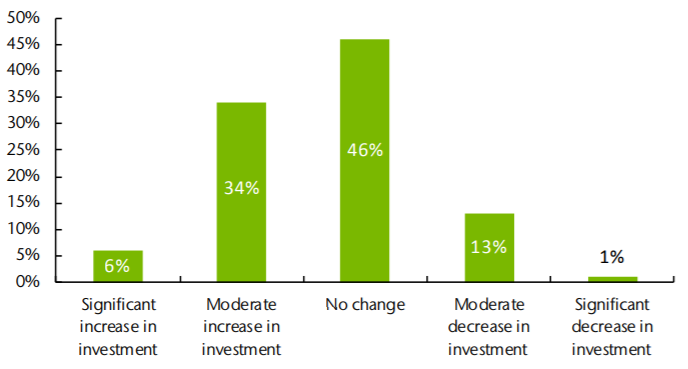

Even with a lukewarm economy, a large majority of respondents expect either no change or an increase in their learning and development investments over the next two years. As one respondent noted, “We expect to continue to expand the reach and impact of new learning strategies as we integrate more blended training solutions and technology into our programs.”

How do you expect your company’s investment in employee learning & development to change over the next two years?

These trends parallel the findings from the Conference Board of Canada’s 2015 Learning and Development Outlook, which found that total learning expenditures rose to an average of $800 per employee in 2014-2015, from $705 in 2012-2013. The Conference Board’s survey includes public sector employers, associations, SMEs and large businesses, which may account for differences in spending per employer.

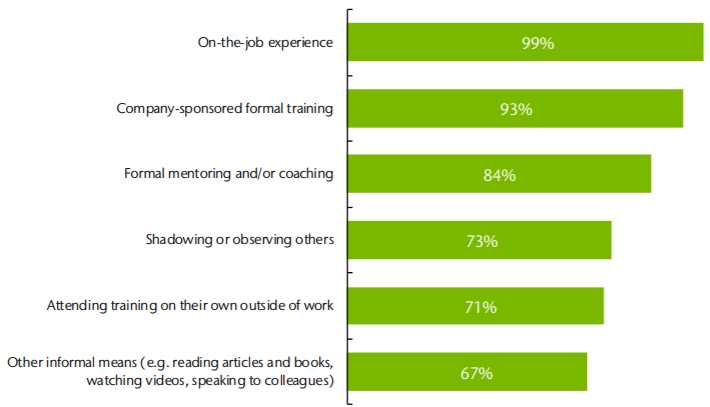

In what ways do your employees strengthen or acquire new skills?

Nearly all respondents cited on-the-job experience as the most important way to strengthen or acquire skills. This was followed by company-sponsored training and formal mentoring and/or coaching programs. The majority of companies reported using at least one new training delivery channel, such as mobile device delivery, social media tools and Massive Open Online Courses (MOOCs).

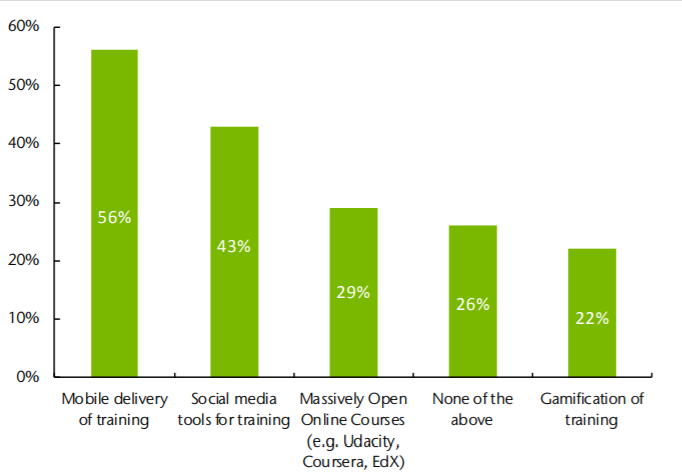

Which of the following recent developments in training, if any, is your company currently leveraging?

There were some noticeable trends in types of training across sectors, with IT/telecom companies leveraging MOOCs more often than other industries. Gamification – the use of rules, competition and teamwork to encourage engagement by mimicking games– was used most heavily in the services sector.

One respondent highlighted their company’s investments in new training technology, saying “We have recently migrated to a learning management system that offers mobile and social learning platforms, and are in the design and pilot phase. We have included gamification in some of our on-line courses.” The same company recently helped design a MOOC.

Prioritizing Leadership

Development

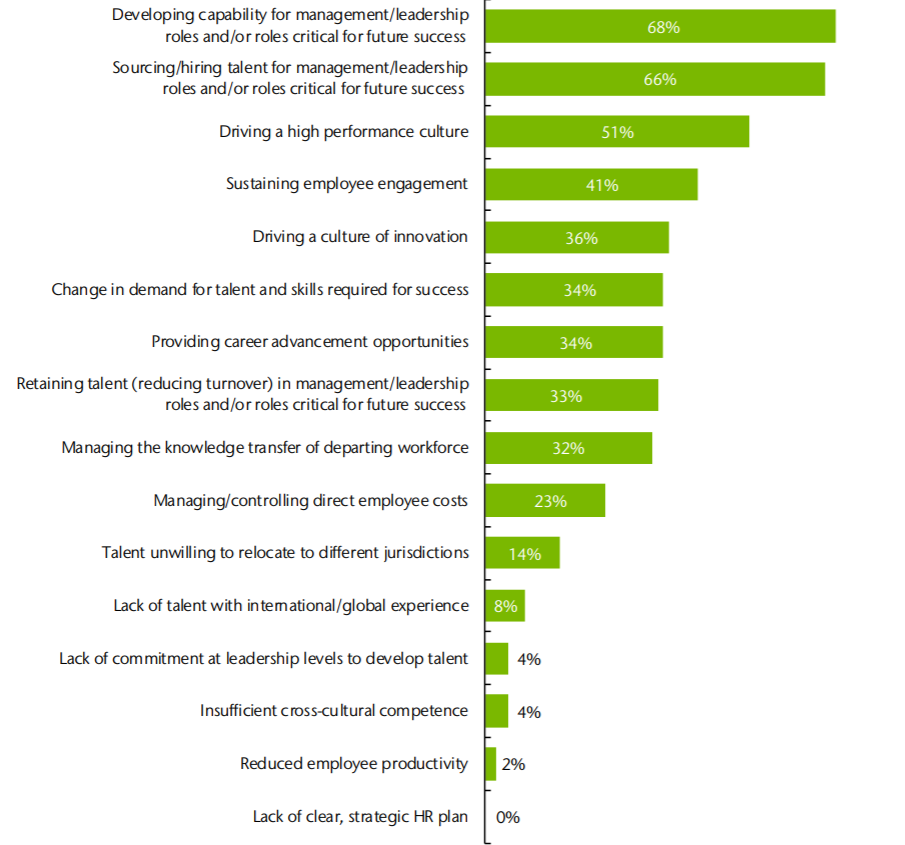

According to respondents, leadership development is a serious challenge, often resulting in shortages at the leadership/ management level.

Which of the following people challenges have the most significant impact on your business today?

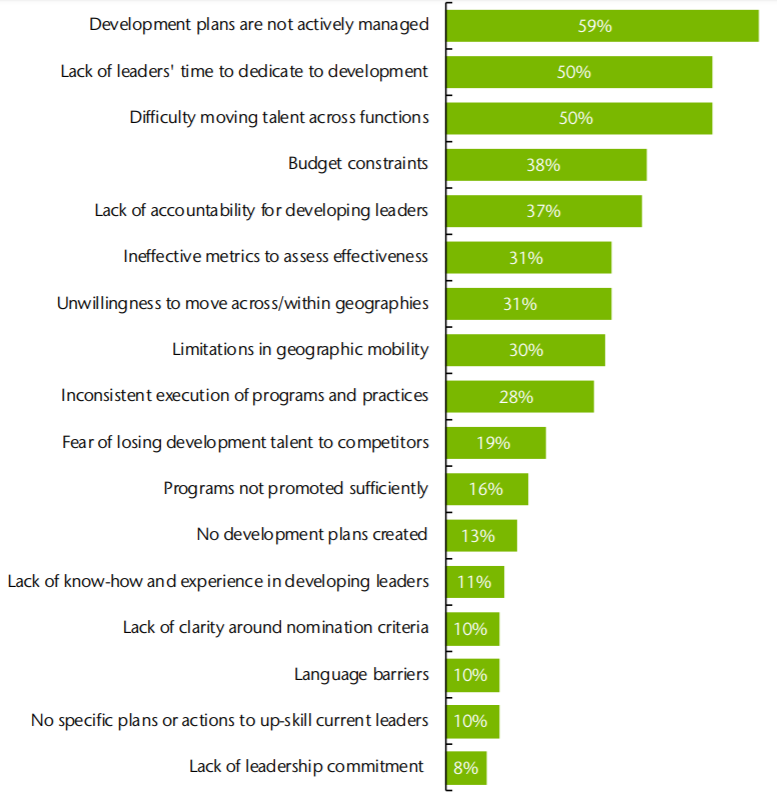

Most companies struggle to prioritize leadership development, even while acknowledging its importance. Fifty-nine percent of those surveyed said that existing leadership development plans are not being actively managed, while 50 percent said their companies’ senior executives are not devoting enough time to leadership development. Half of the respondents also noted

challenges in moving executives, managers and potential leaders from one part of the business to another.

Which of the following challenges is your company facing in developing leadership talent?

These results are consistent with research conducted by the Conference Board of Canada, which found that a majority of Canadian organizations (60 percent) consider leadership development a strategic priority, while only about one-third rate their leadership development practices as effective.

It may seem counter-intuitive that higher training budgets are not resulting in stronger leadership development outcomes. But training is only part of how companies groom next-generation leaders. Leadership development is a comprehensive and complicated process. It includes identifying future leaders, providing leadershipspecific training, incorporating potential leaders into decision-making processes and, ultimately, integrating potential leaders into a management team.

Problems arise when good performers with strong functional or technical skills are promoted without the right mix of soft skills. According to many respondents, 21st century leaders require strong communication skills, the ability to collaborate, adaptability, decisiveness, tactfulness and empathy. They must take on unfamiliar tasks, co-ordinate projects and team efforts, carry non-performers and motivate and influence employees and counterparts. Being a competent engineer, for example, does not mean one can manage people or develop long-term strategy.

This underscores the need to nurture and develop soft skills at the K-12 and post-secondary levels – an approach that would broaden the pool of future leaders in the Canadian workforce.

Anticipating Demographic Shifts

Even as Canada’s population ages, managing retirements does not appear to be a significant issue for large Canadian companies. Compared to 2013, more retirement eligible employees are staying in the workforce.

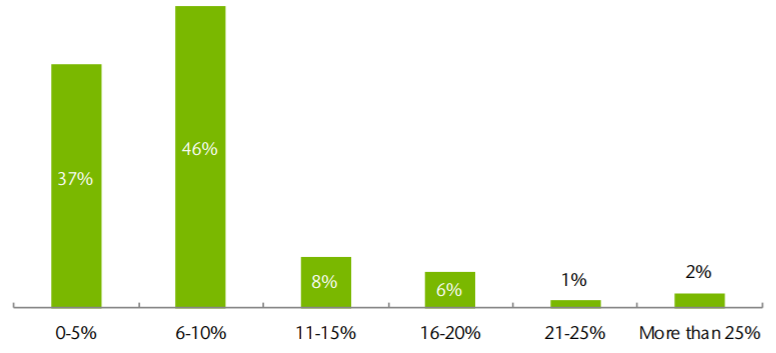

In thinking about the next 3-5 years, what percentage of your workforce do you expect to retire?

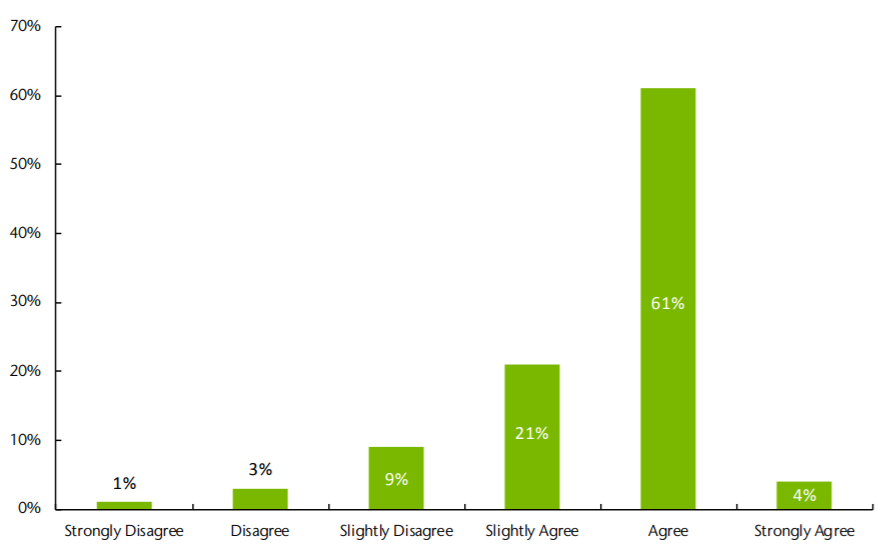

When it comes to replacing retiring workers, most respondents are confident that their company is prepared for the demographic shift.

I am confident that our company will be able to replace the skills and knowledge of retiring workers.

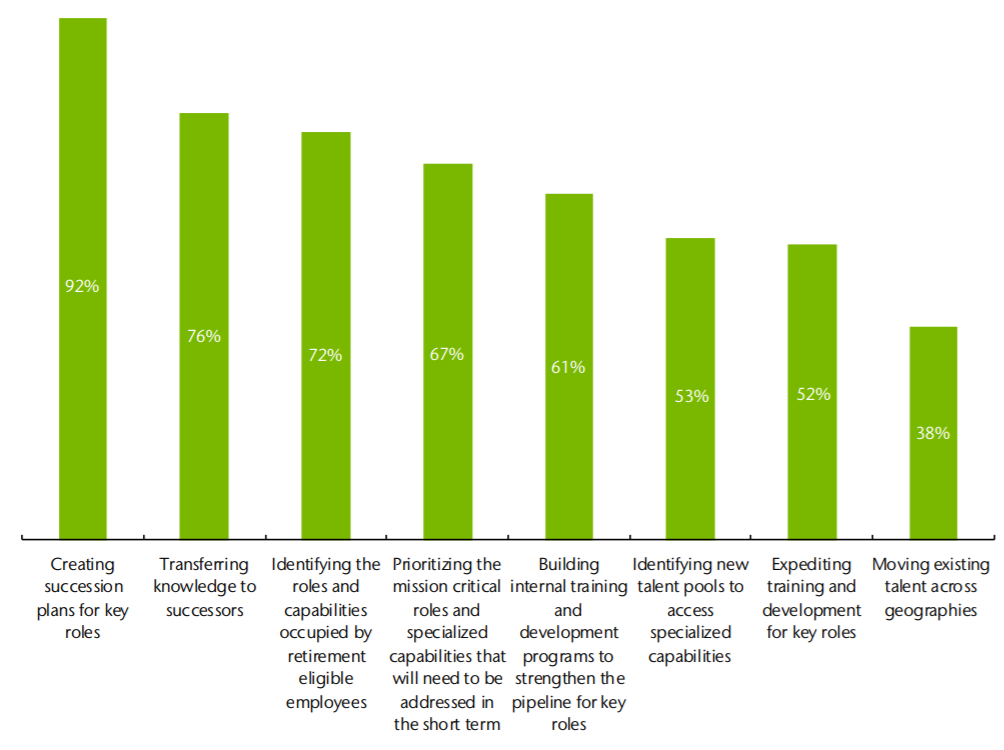

Ninety-two percent of companies have developed succession plans for retiring employees, while more than three-quarters are transferring knowledge from older workers to successors. Seventy-two percent have mapped out which positions are occupied by retirement eligible employees and two-thirds of respondents are placing a priority on succession planning for roles that are highly specialized and/or critical to the day-to-day operations of the company.

What are you currently doing, or planning to do over the next 3-5 years to address expected vacancies from retirements?

Respondents are also investigating new ways to smooth pathways between retiring workers and new staff, with one HR executive from the energy sector remarking, “we are looking at ways to enable retirement eligible employees to work reduced hours (gradual retirement) in order to transfer knowledge to younger workers.” Such flexible approaches to retirement help build bridges between different generations of employees.

Final Thoughts

At the end of 2015, the Canadian labour market was in transition:

- Low energy prices were triggering layoffs in Western Canada, ending a prolonged period of labour shortages in the energy and resources industries.

- Conversely, manufacturing exporters in Central Canada were beginning to benefit from a sharp drop in the value of the Canadian dollar, resulting in labour shortages.

- New technologies – and the threat of disruption – and a hyper-competitive global economy were rapidly raising the expectations companies have for both new employees and future leaders.

- Many of the job categories with labour shortages were highly specialized; many were also digitally oriented.

This survey provides a snapshot of how 90 large, private-sector companies are reacting and adapting to change. Although these firms represent different sectors and regions of the country, the survey results highlight several common themes:

- Large companies are increasingly looking to recruit or develop employees with strong soft skills. These skills are particularly

important when identifying and developing future leaders; - Large companies generally report that new post-secondary graduates are adequately prepared to enter the workforce, but that

expectations for graduates are changing rapidly; - Collaboration between post-secondary institutions and the private sector is reasonably healthy, although more is needed;

- Large companies are investing more in workforce learning and development. In many cases this includes the use of new training

methods; and - Most respondents believe their companies are well-prepared to handle anticipated demographic shifts, in particular the coming

wave of retirements among baby-boomers.

Our hope is that these results provide students, educators, policymakers and employers with useful information about an important

segment of the Canadian economy. We also hope this survey will contribute useful data to federal and provincial governments,

as they collaborate in developing a world-class labour market information system in Canada.