Chinese Foreign Direct Investment in Canada: Threat or Opportunity?

Executive Summary

This paper weaves together analysis of two issues of central interest to Canada as Chinese outward foreign direct investment (FDI) grows to be a major force in the international economy. First, what is the impact of Chinese FDI on the structure of natural resource industries around the globe? Second, when does Chinese FDI, through the acquisition of an existing firm, constitute a genuine national security threat to that firm’s home country?

Beginning with the first issue, the underlying question is whether the growing number of Chinese natural resource investments will have the effect of “locking up” the world’s resource base. When Chinese companies take an equity stake in African oil fields, extend loans to mining and petroleum investors in Latin America, write long-term procurement contracts for minerals in Australia, or propose to acquire natural resource companies headquartered in Canada, do these activities cut off other buyers from access to world supply? Or might Chinese investments, loans, and long-term contracts constitute a positive influence for non-Chinese buyers, helping to multiply suppliers and expand competitive entrée to the world resource base?

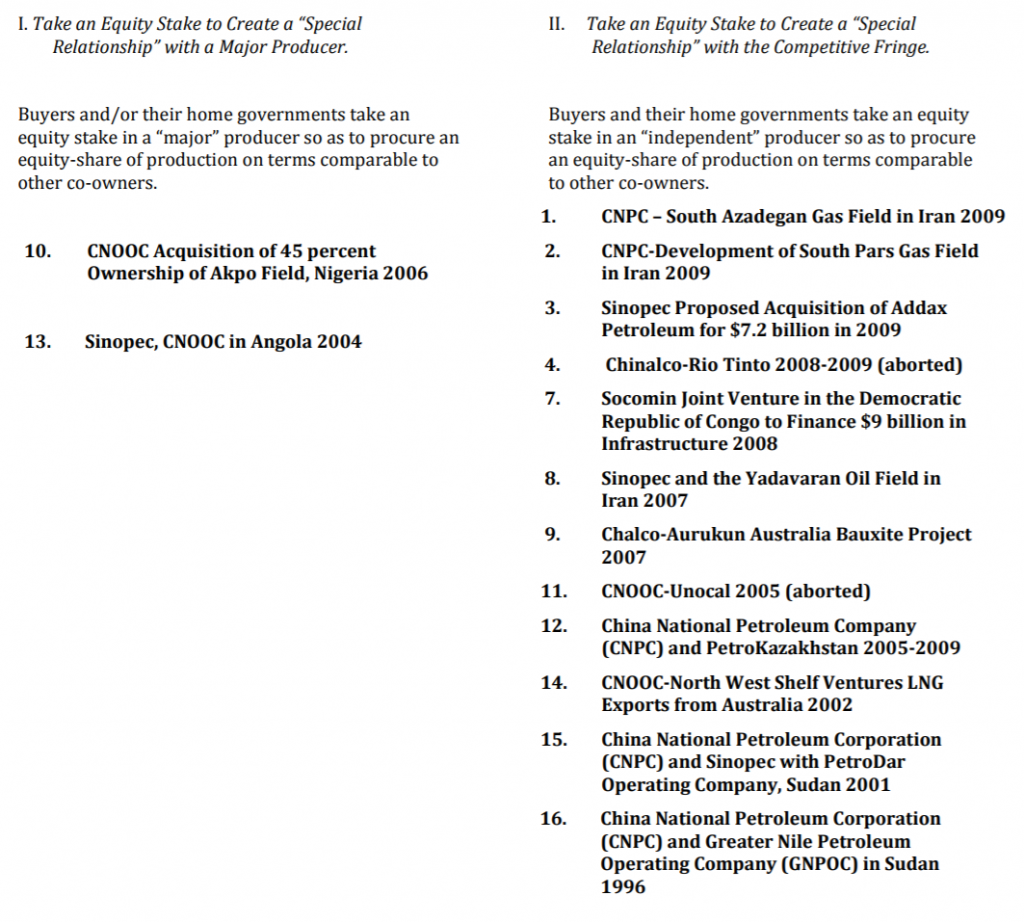

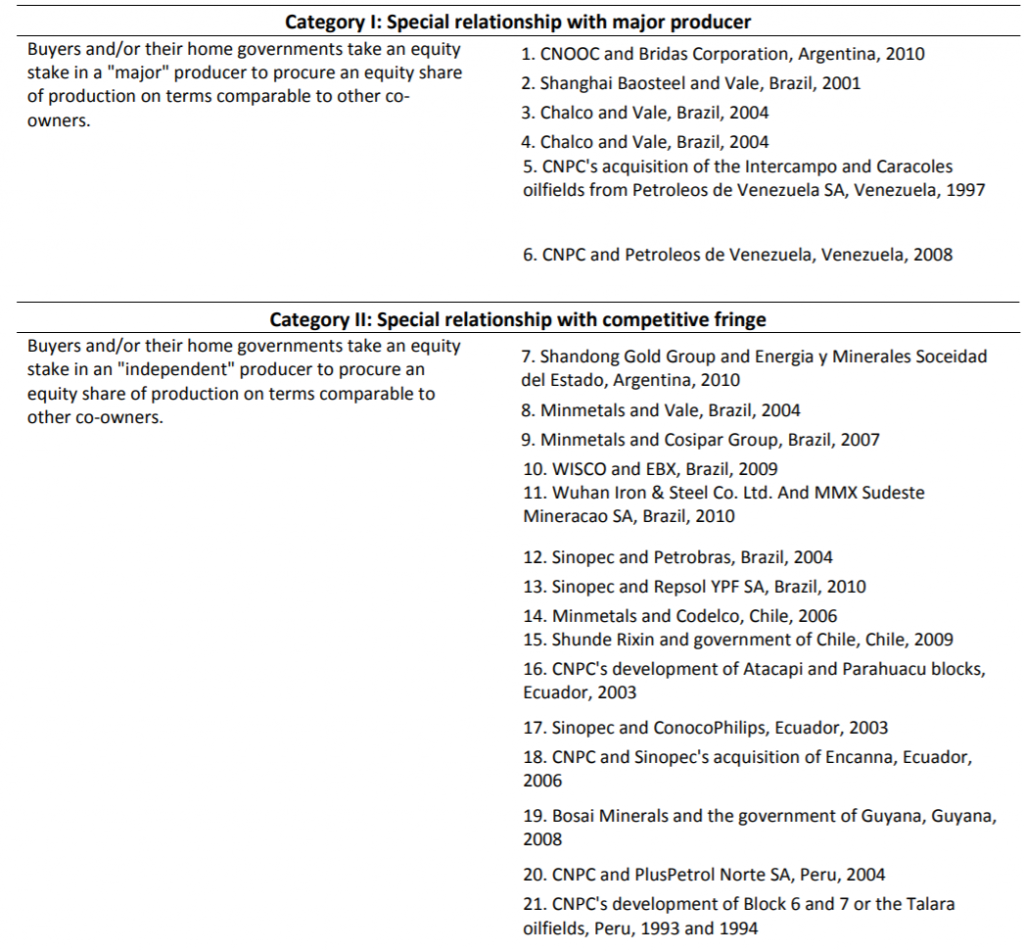

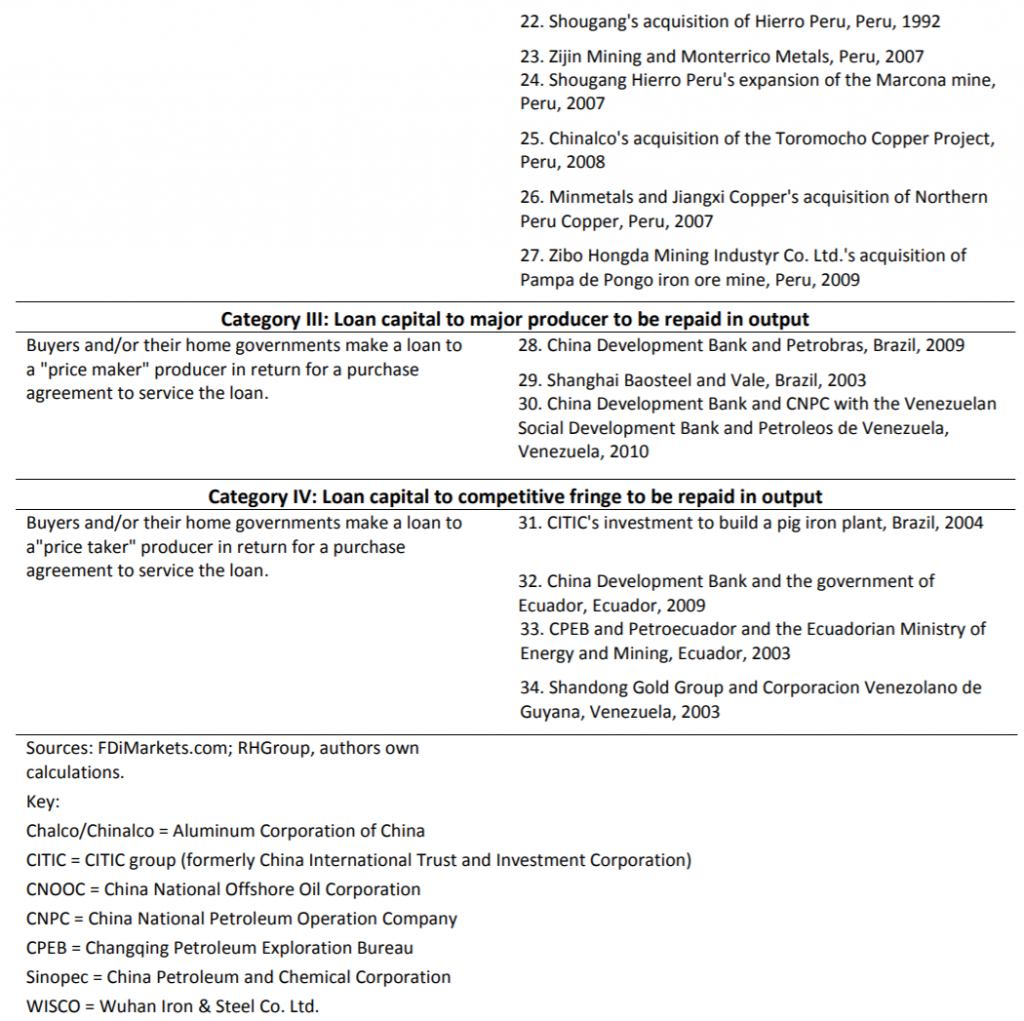

A scorecard of the 16 largest Chinese natural resource procurement arrangements outside of China’s borders reveals that the predominant pattern (13 of the 16 projects) is to take equity stakes and/or write long term procurement contracts with smaller producers (the “competitive fringe,” defined as firms that are price-takers rather than dominant players in an industry). A brief review of four smaller Chinese procurement arrangements finds only one that has negative implications for other buyers. A comprehensive examination of the universe of 35 Chinese natural resource investments and procurement arrangements in Latin America indicates that 23 of them help to diversify supply and increase competition; only 12 do not. Thus the predominant impact of Chinese procurement arrangements does not support popular concerns about Chinese “lock up” of world resources.

Upon reflection, this should not come as a surprise. In comparative perspective, the Japanese government in the early 1970s considered a strategy of creating the country’s own major “national champion” resource companies to lock up a portion of world supplies. From the late 1970s through the 1980s, however, Japan shifted toward procurement arrangements that would enhance the competitive structure of global extractive industries and diversify the geography of production, a strategy that remains in effect today.

The impact of Chinese procurement arrangements on the structure of natural resource industries around the world is only one dimension of the geopolitical challenges surrounding these endeavors. A related issue is that Chinese natural resource investment flows to problematic states and regions, including Iran, Sudan, and Myanmar. In addition, Chinese investors often expose host countries in the developing world to so-called “resource curse” practices of illicit payments, graft, and corruption, as well as poor worker treatment and lax environmental standards.

Furthermore, it is important to note that not all Chinese strategic maneuvers toward natural resource procurement reflect the predominant trend toward making the supplier base more competitive. Chinese policies to exercise control over “rare earth” mining run precisely in the opposite direction, a fact that will feature prominently in any proposed Chinese acquisition of rare earth firms in Canada or in already-concentrated resource industries in general (such as potash).

Turning to the second issue – the need to establish a framework for distinguishing genuine national security threats from implausible assertions of such threats – a comparative review of U.S. cases reveals three kinds of threats. The first category (which I will refer to as “Threat I”) consists of proposed acquisitions that would make the home country dependent upon a foreign-controlled supplier that might delay, deny, or place conditions upon the provision of goods or services crucial to the functioning of the home economy. The second category (“Threat II”) is a proposed acquisition that would transfer, to a foreign-controlled entity, technology or other expertise that might be deployed by the entity or its government in a manner harmful to the home country’s national interests. The third category (“Threat III”) is a proposed acquisition that would enable the insertion of some potential capability for infiltration, surveillance, or sabotage into the provision of goods or services crucial to the functioning of the home economy.

For any of these three threats to be credible, the affected industry would have to be tightly concentrated, with a limited number of close substitutes, and high costs associated with switching to one of those substitutes. One might ask, for example, whether Lenovo’s 2005 acquisition of IBM’s PC business posed a credible national security threat to the United States. Looking at Threat I (denial) and Threat II (leakage of sensitive technology), competition among personal computer producers is sufficiently intense that basic production technology is considered “commoditized”. It is therefore farfetched to think that Lenovo’s acquisition of IBM’s PC business represented a “leakage” of sensitive technology, or provided China with military-application or dual-use capabilities that are not readily available elsewhere. Nor could Lenovo manipulate access to PC supplies in any meaningful way. As for Threat III (infiltration, espionage, and disruption), any purchasers who feared bugs or surveillance devices within Lenovo PCs could have eschewed Lenovo and purchased any one of numerous alternatives.

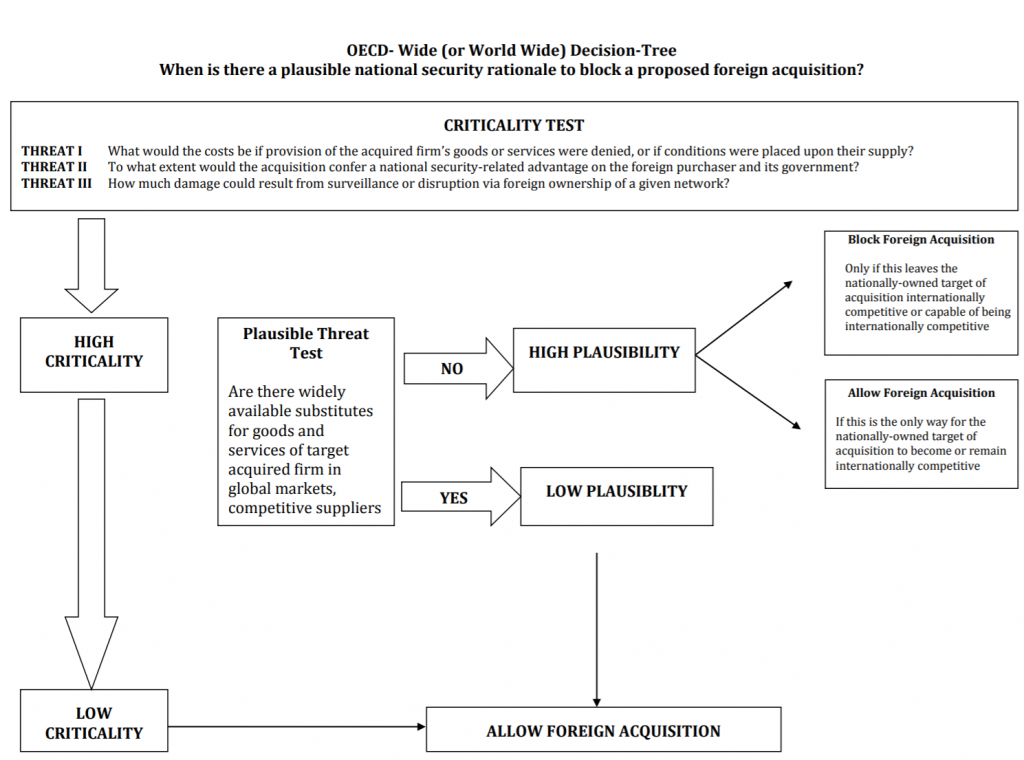

The “Three Threats” framework can serve as the basis for multilateral application by all countries. It offers a decision-tree for threat assessment that would improve upon the definition of strategic industries employed by the Organisation for Economic Cooperation and Development (OECD). OECD guidelines permit identification of strategic industries such that entire sectors – energy, military suppliers, financial institutions, infrastructure – can be protected from foreign takeovers because they are crucial to the functioning of the home economy. The algorithm introduced here requires that national security strategists evaluate both whether the good or service provided by the foreign-acquired company is crucial to the functioning of a country’s economy, and the extent to which the particular threat from a proposed acquisition is credible due to the concentrated nature of the industry.

This assessment framework would appear to fit Canadian needs quite appropriately, beginning with potential foreign acquisitions of Canadian companies in the extractive sector. While a complete analysis of the evolving structure of the international fertilizer industry is beyond the scope of this paper, the evidence suggests that supplies of both potash and phosphates are becoming more concentrated, with the former centered in Canada and the latter centered in Morocco. Within this context, BHP Billiton’s hostile bid for Potash Corporation of Saskatchewan (PotashCorp) would have transferred control of a major world source of supply to foreign hands rather than helping to expand, diversify, and make more competitive the world supplier base.

Popular speculation at the time of the BHP Billiton bid for PotashCorp suggested that a Chinese or even a Russian firm might be an alternative to BHP. From a national security point of view, neither of these alternative

acquirers would have been preferable to BHP, since in each case an external actor would have gained control of a major world source of supply in an increasingly concentrated industry.

It should be noted that the framework for evaluating implications of foreign acquisitions introduced here is directed at potential national security threats per se, and excludes other considerations of “net benefit” as contained in the Investment Canada Act. Thus, in the PotashCorp case above, a Chinese acquirer or a Russian acquirer might have offered a higher price to shareholders than BHP Billiton, or might have made more generous commitments to preserve and/or create jobs. Such considerations, however, would not alter the national security calculation. (A quick review of the concentrated structure of the international nickel industry suggests that China Minmetals’s proposed acquisition of Noranda in 2004 – never completed – would also have qualified for national security examination

rather than a simple “net benefits” assessment.)

A similar calculus could be applied to potential acquisitions of Canadian mining companies that produce rare earth elements (REEs) – 17 metals that are vital to the defence, electronics and other key industries. For example, a hypothetical Chinese acquisition of Avalon Rare Metals or Great Western Minerals Group would further consolidate Chinese control over the global REE industry. Indeed, Canadian authorities might want to be concerned about such consolidation even if a proposed Chinese acquisition did not involve a production site on Canadian soil. Again, as a purely hypothetical example, a proposed Chinese acquisition of Great Western Minerals Group’s operations at Steenkampskraal in South Africa would qualify to be blocked by Canada on national security grounds.

The above example demonstrates that a national security test along the lines suggested here would introduce considerations beyond what might ordinarily be contained in a standard Investment Canada Act review of a potential acquisition. Canadian authorities would want to be cognizant of the geopolitical implications of Chinese government restrictions on rare earth exports, rather than looking solely at anti-competitive impact in economic terms. In this sense, national security reviews could draw on widely accepted industry concentration measurements but would also have to take into account more subtle considerations of national interest.

In contrast to the PotashCorp case, two recent Chinese investments in Canada’s energy industry – PetroChina’s decision to exercise its option to acquire all of the undeveloped MacKay River project from Athabasca, and Sinopec’s acquisition of new drilling lands owned by Calgary-based Daylight Energy – would appear, to the outside observer, to be helping to expand and diversify Canada’s energy base.

The national security framework presented here would appear to fit well with Canadian concerns about foreign acquisitions outside of the natural resource sector, such as the proposed purchase in 2008 of the space

technology division of Vancouver-based MacDonald, Dettwiler and Associates (MDA) by Alliant Techsystems Inc. (ATK) of the United States. From a national security point of view, the proposed sale would have transferred control of Radarsat-2, a distinctive high-resolution satellite with an unusual polar orbit, to ATK. Alliant obligated itself to honor all of MDA’s outstanding contracts with the Canadian government, including access protocols to Radarsat-2 for surveillance of the Arctic. But Alliant could not promise that the U.S. government would refrain from imposing controls on information-sharing in the event of a dispute between the United States and Canada focussed on Arctic sovereignty. The United States rejects Canada’s claim over the Northwest Passage shipping channel and might conceivably seek to stop Canada from using Radarsat-2 surveillance to enforce its claim.

It is difficult for an outsider to assess the depth and significance of a future hypothetical U.S.-Canada dispute over Arctic sovereignty, but the logic of rejecting the proposed acquisition of MDA on Canadian national security grounds (“Threat I”) does not appear inappropriate.

This brief review of how a new national security test might apply to sensitive cases in Canada should not divert attention from one of the most important functions of such a rigorous framework – namely, to show that the vast majority of proposed foreign acquisitions pose no plausible threat whatsoever. Application of this framework in Canada could – as elsewhere – help to discourage politicization of individual cases, and lead to swift and

confident approval of those acquisitions where genuine national security threats are absent.

Sommaire

Le présent document analyse de manière interreliée deux questions d’intérêt central pour le Canada dans le contexte du rôle important qu’est sur le point de jouer l’investissement direct étranger (IDE) chinois dans l’économie internationale. En premier lieu, quelle est l’incidence de l’IDE chinois sur la structure des industries de ressources naturelles de par le monde ? En second lieu, quand l’IDE chinois représente-t-il une véritable menace à la sécurité nationale du pays d’origine d’une société existante à la suite de l’acquisition de cette société ?

En ce qui concerne le premier enjeu, il s’agit, de manière sous-jacente, de déterminer si l’importance accrue des investissements chinois dans les ressources naturelles aura pour effet de « bloquer » la base de ressources mondiale. Lorsque des entreprises chinoises prennent une part de capital dans des champs pétrolifères africains, accordent des prêts aux investisseurs miniers et pétroliers en Amérique latine, concluent des marchés d’acquisition à long terme touchant des ressources minérales en Australie ou proposent d’acquérir des entreprises d’exploitation de ressources naturelles au Canada, cela empêche-t-il d’autres acheteurs d’accéder à l’offre mondiale ? Ou les investissements, prêts et marchés à long terme chinois ne sont-ils pas susceptibles d’exercer une influence positive sur les acheteurs non chinois, contribuant à multiplier les fournisseurs et à élargir l’accès concurrentiel à la base de ressources mondiale ?

La fiche de pointage des seize plus importants accords d’achat de ressources naturelles de la Chine à l’extérieur des frontières de ce pays révèle que le modèle prédominant (13 projets sur 16) consiste à prendre des parts de capital et/ou à conclure des marchés d’acquisition à long terme avec des producteurs plus petits (la « concurrence à la marge », par laquelle les sociétés sont des preneuses de prix plutôt que des joueurs dominants dans une industrie). Un bref examen de quatre accords d’acquisition chinois de moindre importance révèle qu’un seul a des répercussions négatives sur les autres acheteurs. Un examen complet de l’univers de 35 accords d’investissement et d’acquisition chinois relatifs à des ressources naturelles en Amérique latine indique que 23 d’entre eux contribuent à diversifier l’offre et à accroître la concurrence et que seulement douze n’y contribuent pas. Par conséquent, l’effet prédominant des accords d’acquisition chinois ne donne pas raison aux préoccupations populaires entourant le blocage possible par la Chine des ressources mondiales.

À la réflexion, cela ne devrait pas surprendre. En guise de perspective comparative, mentionnons que, au début des années 1970, le gouvernement du Japon a envisagé une stratégie visant à créer ses propres grandes sociétés de ressources, cataloguées « championnes nationales », dans le but de bloquer une partie des approvisionnements mondiaux. À partir de la fin des années 1970 et tout au long des années 1980, toutefois, ce pays s’est tourné vers des accords d’acquisition qui allaient renforcer la structure concurrentielle des industries extractives mondiales et diversifier la géographie de la production. Cette stratégie est toujours en vigueur aujourd’hui.

L’incidence des accords d’acquisition chinois sur la structure des industries

de ressources naturelles de par le monde n’est qu’une dimension des défis de nature géopolitique qui entourent ces initiatives. L’un des enjeux qui s’y rattachent est le fait que des investissements chinois dans le domaine des ressources naturelles sont effectués dans des États et des régions problématiques, notamment l’Iran, le Soudan et le Myanmar. En outre, il arrive souvent que les investisseurs chinois exposent les pays hôtes du monde en développement aux pratiques liées à ce qu’on appelle la « malédiction des ressources » que sont les paiements illicites et la corruption de même que le mauvais traitement des travailleurs pauvres et les normes environnementales laxistes.

Il est par ailleurs important de souligner que toutes les manœuvres stratégiques chinoises visant l’acquisition de ressources naturelles ne reflètent pas la tendance prédominante à rendre le noyau de fournisseurs plus concurrentiel. Les politiques chinoises de contrôle de l’exploitation des « terres rares » s’inscrivent précisément à l’inverse de cette tendance, fait qui ressortira dans toute proposition d’acquisition chinoise de sociétés de terres rares au Canada ou dans des industries de ressources déjà concentrées de manière générale (comme la potasse).

En ce qui concerne le second enjeu, soit la nécessité d’établir un cadre en vue de distinguer les menaces réelles à la sécurité nationale des assertions peu plausibles à l’égard de ces menaces, un examen comparatif des cas répertoriés aux É.-U. fait ressortir trois sortes de menaces. La première catégorie (qu’on appellera « Menace I ») concerne des propositions d’acquisition qui auraient pour effet de rendre le pays d’origine dépendant d’un fournisseur sous contrôle étranger qui pourrait retarder ou refuser la fourniture de biens ou de services indispensables au fonctionnement de l’économie de ce pays ou encore l’assujettir à des conditions. La deuxième catégorie (« Menace II ») concerne des propositions d’acquisition qui entraîneraient le transfert à une entité sous contrôle étranger d’une technologie ou d’une autre expertise qui pourrait être déployée par l’entité en question ou son gouvernement de manière à nuire aux intérêts nationaux du pays d’origine. La troisième catégorie (« Menace III ») concerne des propositions d’acquisition qui permettraient l’intégration d’une capacité d’infiltration, de surveillance ou de sabotage à la fourniture de biens ou de services indispensables au fonctionnement de l’économie nationale.

Pour que l’un ou l’autre de ces trois types de menace soit crédible, l’industrie concernée devrait être fortement concentrée, le nombre limité de proches substituts faisant en sorte que les coûts liés au passage à l’un de ceux-ci seraient élevés. On peut se demander, par exemple, si l’acquisition de la division PC d’IBM par Lenovo en 2005 a constitué une menace crédible à la sécurité nationale des États-Unis. Si l’on prend en considération la Menace I (refus) et la Menace II (fuite de technologie stratégique), la concurrence entre les producteurs d’ordinateurs personnels est assez forte pour que la technologie de production de base soit considérée « plus usuelle ». Il est donc exagéré de penser que cette acquisition a constitué une fuite de technologie stratégique ou a procuré à la Chine des capacités d’application militaire ou d’application bivalente qui ne soient pas déjà disponibles ailleurs. Lenovo ne pourrait, non plus, manipuler l’accès aux fournisseurs de PC de quelque manière importante que ce soit. Pour ce qui est de la Menace III (infiltration, espionnage et perturbation), tout acheteur qui craindrait la présence de bogues ou de dispositifs de surveillance dans les PC Lenovo pourrait se tourner vers l’une ou l’autre des nombreuses marques concurrentes.

Ce cadre axé sur les « trois menaces » peut servir de base d’application multilatérale pour tous les pays. Il offre un arbre de décision pour l’évaluation des menaces qui est susceptible de s’améliorer avec la définition des industries stratégiques utilisée par l’Organisation de coopération et de développement économiques (OCDE). Les lignes directrices de l’OCDE permettent l’identification des industries stratégiques, de sorte que des secteurs entiers – énergie, fournisseurs militaires, institutions financières, infrastructures – peuvent être protégés contre les prises de contrôle étrangères parce qu’ils sont indispensables au fonctionnement de l’économie nationale. L’algorithme que nous introduisons ici exige que les stratèges de la sécurité nationale déterminent si le bien et le service fourni par la société acquise par une firme étrangère est indispensable au fonctionnement de l’économie d’un pays ainsi que dans quelle mesure la menace particulière pouvant découler d’une proposition d’acquisition est crédible eu égard au caractère concentré de l’industrie.

Il semble que ce cadre d’évaluation répondrait de manière très appropriée aux besoins du Canada, à commencer par les acquisitions étrangères potentielles d’entreprises canadiennes dans le secteur de l’extraction. Bien qu’une analyse complète de la structure d’évolution de l’industrie internationale des engrais dépasse la portée du présent document, tout indique une concentration accrue des stocks de potasse et de phosphates au Canada et au Maroc respectivement. Dans ce contexte, l’offre d’achat hostile de BHP Billiton à l’égard de la Potash Corporation of Saskatchewan (PotashCorp) aurait eu pour effet de transférer une source d’approvisionnement mondial majeure à des mains étrangères plutôt que d’élargir, de diversifier et de rendre plus concurrentiel le noyau de fournisseurs mondial.

Les conjonctures généralement exprimées entourant le moment de l’offre de BHP Billiton à l’égard de PotashCorp laissaient croire qu’une société chinoise ou même russe pouvait constituer une solution de rechange à BHP. Or, du point de vue de la sécurité nationale, aucun de ces éventuels nouveaux acquéreurs n’aurait été préférable à BHP étant donné que, dans chaque cas, un acteur externe aurait acquis le contrôle d’une source majeure d’approvisionnement mondial dans une industrie de plus en plus

concentrée.

Il convient de souligner que le cadre d’évaluation des répercussions des acquisitions étrangères présenté ici concerne les menaces potentielles à la sécurité nationale comme telles et exclut les autres considérations d’« avantages nets » contenues dans la Loi sur Investissement Canada. Par conséquent, dans le cas de PotashCorp cité précédemment, un acquéreur chinois ou russe pourrait avoir offert aux actionnaires un prix plus élevé que BHP Billiton ou aurait pu prendre des engagements plus généreux à l’effet de préserver et/ou de créer des emplois. Ce genre de considérations ne modifierait toutefois pas le calcul relatif à la sécurité nationale. (Un examen rapide de la structure concentrée de l’industrie internationale du nickel laisse croire que la proposition d’acquisition de Noranda présentée par China Minmetals en 2004 – et qui n’a jamais été menée à terme – se serait également qualifiée pour un examen de sécurité nationale plutôt que pour une simple évaluation d’« avantages nets ».)

On pourrait appliquer un calcul semblable aux acquisitions possibles d’entreprises minières canadiennes qui produisent des métaux du groupe des terres rares – 17 métaux ayant une importance vitale dans les domaines de la défense, de l’électronique et d’autres industries clés. Par exemple, l’acquisition hypothétique par une société chinoise d’Avalon Rare Metals ou du Great Western Minerals Group renforcerait encore davantage le contrôle chinois sur l’industrie mondiale des terres rares. En effet, les autorités canadiennes pourraient vouloir s’en préoccuper même si une proposition chinoise d’acquisition ne portait pas sur un site de production en sol canadien. À nouveau, à titre d’exemple purement hypothétique, une proposition d’acquisition par une société chinoise des installations du Great Western Minerals Group à Steenkampskraal, en Afrique du Sud, pourrait être bloquée par le Canada pour des motifs de sécurité nationale.

L’exemple précédent démontre que des critères de sécurité nationale selon les paramètres présentés ici amèneraient des considérations qui iraient audelà de ce que peut comporter l’examen standard d’une potentielle acquisition en vertu de la Loi sur Investissement Canada. Les autorités canadiennes voudraient connaître les répercussions géopolitiques de restrictions émises par le gouvernement chinois sur les exportations de terres rares plutôt que de se pencher uniquement sur l’impact anticoncurrentiel au plan économique. En ce sens, les examens de sécurité nationale pourraient s’appuyer sur des mesures de concentration industrielle largement acceptées, mais ils devraient également tenir compte de considérations d’intérêt national plus subtiles.

Contrairement au cas PotashCorp, deux investissements chinois récents dans l’industrie canadienne de l’énergie – la décision de PetroChina de se prévaloir de son option d’acquérir la totalité du projet non concrétisé de la rivière MacKay d’Athabasca et l’acquisition par Sinopec des terres exploitées et détenues par Daylight Energy, de Calgary – pourraient sembler, aux yeux d’un observateur externe, contribuer à élargir et à diversifier l’assise énergétique du Canada.

Il semble que le cadre de sécurité nationale présenté dans le présent document répondrait adéquatement aux préoccupations canadiennes entourant les acquisitions étrangères à l’extérieur du secteur des ressources naturelles, comme la proposition d’acquisition de la division des technologies spatiales de la société vancouvéroise MacDonald, Dettwiler and Associates (MDA) par Alliant Techsystems Inc. (ATK) des États-Unis, en 2008. Du point de vue de la sécurité nationale, la proposition de vente aurait eu pour effet de transférer à ATK le contrôle de Radarsat-2, un satellite haute résolution particulier gravitant sur une orbite polaire inhabituelle. Alliant s’est astreinte à honorer tous les contrats en cours de MDA avec le gouvernement canadien, y compris les protocoles d’accès à Radarsat-2 pour la surveillance de l’Arctique. Mais Alliant ne pouvait promettre que le gouvernement des É.-U. s’abstiendrait d’imposer des mesures de contrôle sur le partage de l’information dans l’éventualité d’un différend entre les États-Unis et le Canada relativement à la souveraineté dans l’Arctique. Les États-Unis rejettent la revendication de souveraineté du Canada sur le chenal de navigation du passage du Nord-Ouest et pourraient tenter de l’empêcher de recourir à la surveillance par le truchement de Radarsat-2 pour appliquer sa revendication.

Pour l’observateur externe, il est difficile d’évaluer la profondeur et la signification d’un différend éventuel entre les deux pays en ce qui concerne la souveraineté dans l’Arctique, mais la logique qui sous-tend le rejet de la proposition d’acquisition de MDA pour des motifs de sécurité nationale pour le Canada (« Menace I ») ne semble pas inappropriée.

Ce court examen de la manière dont de nouveaux critères de sécurité nationale pourraient s’appliquer à des cas stratégiques au Canada ne devrait pas faire oublier l’une des fonctions les plus importantes d’un cadre aussi rigoureux : démontrer que la vaste majorité des propositions d’acquisitions étrangères ne présentent aucune menace plausible. La mise en œuvre de ce cadre au Canada pourrait – comme ailleurs – contribuer à décourager la politisation des cas individuels et mener à une approbation rapide et sûre de ces acquisitions en l’absence de menaces réelles à la sécurité nationale.

Introduction and Overview

This paper weaves together analysis of two issues of central interest to Canada as Chinese outward foreign direct investment (FDI) grows to be a major force in the international economy. First, what is the impact of Chinese FDI on the structure of natural resource industries around the globe? Does Chinese FDI “lock up” supplies of iron ore, coal, copper, nickel, gas and oil (not to mention other resources such as potash) in a zero-sum manner that deprives non-Chinese users from access to the world supply base? Second, when does the foreign acquisition of an existing firm constitute a genuine national security threat to the home country of the acquired firm? The scope of this second query includes acquisitions of firms in the natural resource sector, but the framework for threat assessment extends to proposed acquisitions in all sectors.

Treatment of these two issues requires separate and distinctive modes of analysis, but the conclusions for policymakers in Canada and elsewhere intersect in important overlapping ways. The assessments presented here derive from ongoing research at the Peterson Institute for International Economics, with new focus on cases and questions of particular interest to Canada.

I. The Impact of Chinese FDI on the Structure of Global Natural Resource Industries

Are the growing number of Chinese natural resource investments “locking up” the global resource base?1 When Chinese companies take an equity stake in African oil fields, extend loans to mining and petroleum investors in Latin America, write long-term procurement contracts for minerals in Australia, or propose to acquire natural resource companies headquartered in Canada, do these activities cut off other buyers from access to world supply? Or, might Chinese investments, loans, and long-term contracts constitute a positive influence for non-Chinese buyers, helping to multiply suppliers and expand competitive entrée to the world resource base?

On the demand side, China’s appetite for vast amounts of energy and minerals clearly puts tremendous strain on the international natural resource sector. On the supply side, Chinese efforts to procure raw materials might indeed exacerbate the problems of strong demand, or they might actually help solve the problems of strong demand. The outcome depends on whether those arrangements solidify a concentrated global supplier system (and enhance Chinese ownership/control within that system), or expand, diversify, and make more competitive the global supplier system.

The Peterson Institute for International Economics (PIIE) has investigated this question as an empirical inquiry; the opening premise has been that either outcome is possible.

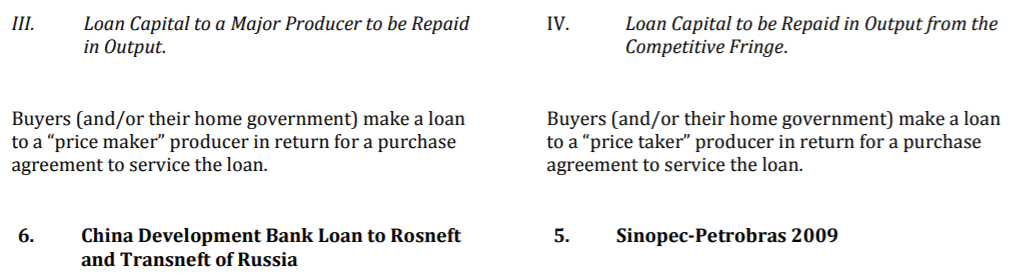

The Chinese deployment of capital to procure natural resources takes four forms:

- In the first procurement arrangement, Chinese investors take an equity stake in a large established producer so as to secure a share of production on terms comparable to other co-owners.

- In the second procurement arrangement, Chinese investors take an equity stake in an up-and-coming producer so as to secure a share of production on terms comparable to other co-owners.

- In the third procurement arrangement, Chinese buyers and/or the Chinese government provide financing to a large established producer in return for a purchase agreement to service the loan.

- In the fourth procurement arrangement, Chinese buyers and/or the Chinese government provide financing to an up-and-coming producer in return for a purchase agreement to service the loan.

These four structures provide the basis for giving operational definition to the concept of “tying up” supplies. If the procurement arrangement simply solidifies legal claim to a portion of the output of an established large producer (the first and third structures above, which I will refer to as Category I), “tying up” or gaining “preferential access” to supplies has zerosum implications for other consumers. However, if the procurement arrangement expands and diversifies sources of output more rapidly than growth in world demand (the second and fourth structures above, referred to as Category II), the zero-sum implication vanishes as other consumers gain easier access to a larger and more competitive global resource base.

Drawing on PIIE research carried out in 2010, Appendix I shows a scorecard that classifies the 16 largest Chinese natural resource procurement arrangements around the world within these four categories. The scorecard of China’s procurement arrangements shows a few instances in which Chinese natural resource companies take an equity stake to create a “special relationship” with a major producer. But the predominant pattern (13 of the 16 projects) is an arrangement in which a Chinese company purchases an equity stake and/or enters into a long-term procurement contracts with what economists refer to as the “competitive fringe” – a smaller player or new entrant.

A brief review of four smaller Chinese procurement arrangements undertaken at the same time does not suggest that there is significant selection-bias in looking at these 16 largest projects. Three projects in Australia, Myanmar, and Canada display the characteristics of Category II. The Canadian case involved acquisition of Calgary-based EnCana Corporation’s assets in Ecuador by a Chinese consortium called Andes Petroleum Company. Based on details outlined in Appendix 3, this Chinese acquisition was coded Category II. One project in Indonesia, on the other hand, presented more the characteristics of Category I.

As a follow-on project, our team at PIIE undertook in 2011 a comprehensive examination of the universe of 35 Chinese natural resource investments and procurement arrangements in Latin America (see Appendix 2). Twentythree of the 35 Chinese investments and procurement arrangements serve to help diversify and make more competitive the portion of the world

natural resource base located in Latin America. Twelve do not.

Thus the predominant impact of Chinese procurement arrangements does not support popular concerns about Chinese “lock up” of world resources. Upon reflection, such an outcome is not surprising. During the 1970s, Japan sought to create its own major “national champion” resource companies, while making equity investments and signing procurement arrangements to secure “special relationships” with major resource companies and/or producer governments. From the late 1970s through the 1980s, however, Japanese policies shifted toward procurement arrangements with smaller producers. As a result, Japanese investment, loans, and off-take contracts became a major force in enhancing the competitive structure of global extractive industries and diversifying the geography of production, a strategy that continues today. Japanese participation in worldwide natural resource projects currently consists primarily of minority equity stakes in a large array of extractive projects, backed by purchase contracts for a portion of the output.

Evidence from a case in which there is credible narrative about Chinese decision-making processes backs up this statistical analysis. In 2008-2009, state-owned Aluminum Corp. of China (Chinalco) signed agreements to acquire a growing number of shares in Australia’s Rio Tinto. This Chinalco effort has to be seen, according to Peter Drysdale and Christopher Findlay, in light of BHP Billiton’s hostile bid in 2008 to take over Rio Tinto.3 At a meeting of government officials, steelmakers, big coal mining companies, and the China Development Bank in Beijing, Xiao Yaqing, then-President of Chinalco, proposed that his company present itself to Rio Tinto as a “white knight” that could help Rio Tinto avoid the unwanted takeover.4 Chinalco’s explicit objective was to stymie any BHP Billiton/Rio Tinto super-merger. Chinalco was ultimately unsuccessful in acquiring a significant Rio Tinto stake, but the effort reveals a desire on the part of Chinese buyers to avoid facing a tightly concentrated base of external resource suppliers.

The impact of Chinese procurement arrangements on the structure of natural resource industries around the world is only one dimension of the geopolitical challenges surrounding these endeavors. It must also be noted that Chinese natural resource investments flow in some instances to problematic states and regions, including Iran, Sudan, and Myanmar. In addition, such investments can expose individual host countries in the developing world to so-called “resource curse” practices of illicit payments, graft, and corruption, as well as poor worker treatment and lax environmental standards. In a recent World Investment Report devoted to transnational corporations, the United Nations Conference on Trade and Development (UNCTAD) notes, as do other authoritative sources, that non-OECD investors – most prominently Chinese investors, operating under a doctrine officially labeled “non-interference in domestic affairs” – often undermine hard-won governance standards observed by other multinational corporations. These governance standards include home country legislation that conforms to the OECD Convention on Combating Bribery, such as the U.S. Foreign Corrupt Practices Act. Some Chinese companies have also ignored or bypassed best-practice environmental standards insisted upon elsewhere.

In addition, it must be acknowledged that not all Chinese strategic maneuvers toward natural resource procurement reflect the predominant trend toward making the supplier base more competitive. Indeed, Chinese policies to exercise control over “rare earth” mining run precisely in the opposite direction. Rare earth elements (REE) are crucial for a wide array of civilian and military products. In 2009-2010 China’s Ministry of Industry and Information Technology set an export quota of 35,000 tons per year, with a potential ban on exports of at least five types of REEs and other steps to control mining. Chinese investors have simultaneously sought equity stakes in new REE producers, in particular in Australia. Deng Xiaoping is often quoted as pointing out that while the Middle East has oil, China has rare earth elements. In the fall of 2010, Chinese custom authorities refused to issue export licenses for rare earths destined for Japan, and perhaps for other countries as well. They subsequently lifted the ban on export licenses. In 2011-2012 Chinese explanations of national policy highlight a desire to consolidate the domestic industry to limit environmental damage; Chinese policy actions simultaneously focus on attracting more valued-added in processing and using rare earth elements within China. Beyond the economic sphere, Chinese manipulation of REE exports plays a role in geopolitical maneuvers vis-à-vis Japan.

This propensity on the part of Chinese authorities to play a role as a quasi-monopolist in rare earth elements should be kept in mind when assessing Chinese proposals to acquire other sources of scarce natural resources, such as Canadian rare earth deposits or – perhaps – potash.

II. A Framework for Assessing Genuine National Security Threats that might Result from Foreign Acquisition of a National Company

Foreign direct investment that occurs through the acquisition of an existing company has long been the subject of particular sensitivity around the world, with frequent allegations that the outcome might negatively affect the national security of the home country. Within OECD states, an estimated 80 percent or more of all FDI takes place via acquisition of existing firms, rather than as greenfield investments.

How might “national security threats” be defined, and how can realistic threats be distinguished from implausible allegations of threat?6 In the United States, policymakers have grappled with the notion of what constitutes a national security threat for more than 20 years; the U.S. experience offers a useful framework for other nations as well. The cases that have dominated U.S. analytical focus since the enactment of the 1988 Exon-Florio Amendment – which authorized the President to investigate foreign investments in U.S. companies from a national security perspective – suggests that potential threats to national security that might result from such investments fall into three distinct categories:

- The first category (“Threat I”) consists of acquisitions that would make the home country dependent upon a foreign-controlled supplier that might delay, deny, or place conditions on the provision of goods or services crucial to the functioning of the home economy (including the functioning of the defense industrial base).

- The second category (“Threat II”) consists of acquisitions that would allow the transfer to a foreign-controlled entity of technology or other expertise that might be deployed by the entity or its government in a manner harmful to the home country’s national interests.

- The third category (“Threat III”) consists of acquisitions that would enable the insertion of some potential capability for infiltration, surveillance, or sabotage – via a human or non-human agent – into the provision of goods or services crucial to the functioning of the home economy (including, but not exclusively, the functioning of the defense industrial base).

The enactment of the Exon-Florio provision in 1988 reflected broad concern about the possible decline of U.S. high tech industries, aggravated by aggressive competition and increased investment flows from Japan – not unlike some contemporary apprehensions about China. A brief review of the U.S. historical experience may be instructive for Canadian authorities seeking to address national security considerations under the Investment Canada Act.

Threat I: Denial or Manipulation of Access

The case that provided much of the impetus behind the passage of the ExonFlorio provision was the proposed sale of Fairchild Semiconductor by Schlumberger of France to Fujitsu in 1987. Opponents of the sale voiced concern that it would give Japan control over a major supplier of microchips to the U.S. military. In the end, Fujitsu withdrew its bid before U.S. authorities could conduct extensive analysis to determine whether there were sufficient grounds to fear foreign “control” and excessive

“dependence”.

Criticism of the proposed acquisition rested on the premise that the target firm was in an industry “crucial” to the U.S. economy and defense – in other words, that the United States would suffer large negative impacts if it had to do without the goods and services in question. However, in the Fairchild Semiconductor case there was no careful analysis of the conditions under which supply could be manipulated, or whether such manipulation would have any practical impact.

This changed in 1989 with the battle over Nikon’s proposal to acquire Perkin Elmer’s “stepper” division. Steppers are advanced lithography systems used to imprint circuit patterns on silicon wafers in the semiconductor industry. At the time of the proposed acquisition, Nikon controlled roughly half of the global market for optical lithography and Canon, another Japanese firm, controlled another fifth. If the acquisition had been allowed to proceed, U.S. producers would have been highly constrained with regard to their purchases of machinery to etch micro- circuits on semiconductors. The sale would effectively place quasi-monopoly power in the hands of the new owner, and – by extension – the Japanese government. The novel insight from the Perkin Elmer case was that the term “crucial” – namely, the cost of doing without – had to be joined with a parallel consideration: for there to be a credible likelihood that a good or service can be withheld at great cost to the economy, or that the suppliers (or their home governments) can place conditions upon the provision of the good or service, the industry must be tightly concentrated, the number of close substitutes limited, and the switching costs high. Under such conditions, home country national security might credibly be placed at risk.

Of particular note, for there to be a credible risk to national security in a highly concentrated industry it is not necessary that the home government of the acquirer be an “enemy” of the nation in which the acquisition would take place, nor that the home government have an ownership stake in the acquirer. Even though the U.S.-Japan foreign policy relationship was broadly cooperative, it was not inconceivable that the Japanese government might instruct U.S. subsidiaries of Japanese companies to behave in ways inimical to U.S. national interests. In a case not involving any acquisition whatsoever, Japan’s Ministry of International Trade and Industry, under pressure from Socialist members of the Diet, did force Dexel, the U.S. subsidiary of Kyocera, to withhold advanced ceramic technology from the U.S. Tomahawk cruise missile program.

The relevance of this growing insight about concentration, substitutes and switching costs becomes more apparent if one jumps ahead in time to consider the case of a Russian oligarch’s 2006 purchase of Oregon Steel. The acquirer was the Russian company Evraz, which is partly owned by Roman Abramovich, a Russian billionaire with close ties to the Kremlin. In the public debate over this deal, the word “crucial” was sometimes replaced with “critical”, with the same implication of a high cost if supply were manipulated.

Did the Evraz-Oregon Steel takeover represent a national security threat to the United States? To determine whether a foreign acquisition such as this poses a threat, analysts have to evaluate both whether the good or service provided by the foreign-acquired firm is crucial to the functioning of a country’s economy (including but not limited to its military services), and whether there is a credible likelihood that the acquirer or its home government could withhold or place conditions on supplies of the good or service.

The purchase of Oregon Steel by Evraz clearly meets the first test. Steel is a major component of military equipment, from warships, tanks, and artillery to components and subassemblies of myriad defense systems. Uninterrupted access to steel is likewise crucial for the everyday functioning of the U.S. civilian economy.

But the second evaluation dispels those concerns: in the international steel industry, the top four exporting countries account for no more than 40 percent of the global steel trade. Alternative sources of supply are widely dispersed, with nine countries apart from Russia that export more than 10 million metric tons a year (Japan, Ukraine, Germany, Belgium-Luxembourg, France, South Korea, Brazil, Italy, and Turkey). There are 20 additional suppliers that export more than five million metric tons a year. It is difficult to imagine a scenario in which the Russian government or a Russian oligarch could manipulate output from Oregon Steel in a way that was more than a minor inconvenience to buyers in the United States. The globalization of steel production allows U.S. customers to take advantage of the most efficient and lowest-cost sources of supply without concern that the United States is becoming “too dependent” on foreigners.

Threat II: Leakage of Sensitive Technology of Know-How

Almost by definition, a proposed foreign acquisition offers the buyer some production or managerial expertise that it did not formerly possess. This in turn provides the home government of the foreign parent with an opportunity to control or influence the ways in which that expertise is deployed. Often this additional production or managerial expertise can be seen as strengthening, even if only marginally, that government’s national defense capabilities.

So this second test interacts with the first: How broadly available is the additional production or managerial expertise involved, and how big a difference would the acquisition make for the new home government? The prototypical illustration of potentially worrisome technology transfer can be found in the landmark case of the proposed acquisition of LTV Corporation’s missile business by Thomson-CSF of France in 1992.

The LTV Corporation found itself in bankruptcy due to under-funded pension obligations associated with the parent company’s steel-making operations. To raise cash, a Federal bankruptcy court in New York considered proposals from Martin Marietta, Lockheed, and Thomson-CSF of France to purchase LTV’s missile division, and approved a sale to the latter. Some of LTV’s missile division capabilities were sufficiently close to those of multiple alternative suppliers that Thomson-CSF could obtain them elsewhere with relative ease. However, three product lines – the MLRS multiple rocket launcher, the ATACM longer ranger rocket launcher, and the LOSAT anti-tank missile – had few or no comparable substitutes. Another, the ERINT anti-tactical missile interceptor, included highly classified technology that was at least a generation ahead of rival systems. It is not clear from public sources exactly which LTV missile division products and services were formally included in the U.S. export-control regime of the time.

Thomson-CSF was 58-per-cent-owned by the French government, and had a long history of following French government directives. The potential for sovereign conflict over the disposition and timing of Thomson-CSF sales, should the LTV missile division become part of the group, was substantial. Prior Thomson-CSF sales to Libya and Iraq had already provoked considerable controversy; for example, a Thomson-built Crotale missile had shot down the sole U.S. plane lost in the 1986 U.S. bombing raid on Tripoli, and Thomson radar had offered Iraq advance warning in the first Gulf War.

The U.S. Department of Defense initially informed Congress that it would insist upon a Special Security Agreement (SSA), or blind trust, to perform the security work on LTV programs, an arrangement at first opposed by Thomson-CSF but ultimately accepted. Later, the Committee on Foreign Investment in the United States (CFIUS), an inter-agency government committee that reviews the national security implications of foreign investments, rejected the proposed acquisition when Thomson and the Pentagon failed to agree on how to protect sensitive U.S. technology.

Thus the methodology for determining whether a foreign acquisition might result in the “leakage” of technology or other sensitive knowledge follows the same path outlined above. The key lies in calculating the concentration or dispersion of the particular capabilities possessed by the acquired entity. When the entity possesses unique or tightly held capabilities that might be deployed in ways that could damage the national security interests of the home country, the risk is genuine.

These analytics will be helpful in understanding U.S. cases such as Lenovo’s 2005 acquisition of IBM’s PC business, and the proposal that same year by China National Offshore Oil Corporation (CNOOC) to buy Unocal Corporation, a California-based oil company. These analytics will also be useful in examining the addition of a national security consideration to the assessment of foreign acquisitions in Canada.

Threat III: Infiltration, Espionage, and Disruption

The Dubai World Ports (DWP) case brought to the fore an additional concern – namely, that a foreign owner might be less than vigilant in preventing hostile forces from infiltrating the operations of an acquired company, or might even be complicit in facilitating surveillance or sabotage. In 2005, DWP sought to acquire the Peninsular and Oriental Steam Navigation Company (P&O), a British firm. P&O’s main assets were terminal facilities owned or leased in various ports around the world, including in six U.S. cities: Baltimore, Houston, Miami, New Orleans, Newark, and Philadelphia. This time, CFIUS initially approved the acquisition.

The issue in the DWP case was not whether foreign ownership of a given service provider might lead to a denial of services at the behest of the new owner or its home government. Nor was there a concern that sensitive technology or other management capabilities might be transferred to the new owner or its home government. Instead, the question was whether foreign ownership might enable what Edward “Monty” Graham and David Marchick have called a “fifth column” to penetrate the new foreign-owned structure.9 In other words, foreign acquisition might afford the new owner’s government a platform for clandestine observation or disruption.

In such cases, national authorities (such as CFIUS in the United States) could reject the proposed acquisition, or they could impose conditions similar to those used for foreign takeovers involving classified technologies and materials – such as a requirement to set up separate compartmentalized divisions in which employees require home country citizenship and special security vetting. As part of the process that led to the first CFIUS approval in the DWP case, for example, the Department of Homeland Security negotiated a “letter of assurances” stipulating that Dubai Ports would: operate all U.S. facilities with U.S. management; designate a corporate officer with DP World to serve as point of contract with DHS on all security matters; provide requested information to DHS when requested; and assist other U.S. law enforcement agencies on all matters related to port security, including disclosing information as U.S. agencies requested.

In the end, the public outcry against the Dubai Ports bid was sufficiently great that this mitigation agreement was dismissed out of hand, leading the parent company to withdraw its offer.

Applying the Three Threats Prism to Two Proposed Chinese Acquisitions in the United States

How might the “Three Threats” framework be applied to proposed Chinese acquisitions such as Lenovo’s purchase of IBM’s personal computer business or CNOOC’s proposed purchase of Unocal?

Lenovo-IBM

Looking first at Lenovo’s proposal to acquire IBM’s PC business, could this acquisition pose a credible national security threat to the home country of the target company?

Examining the proposed acquisition within the framework of Threat I (denial) and Threat II (leakage of sensitive technology), it must be acknowledged that competition among personal computer producers is sufficiently intense that basic production technology is considered “commoditized”. More than a dozen producers compete for 50 percent of the PC market, with no one company enjoying dominance for long. It is therefore farfetched to think that Lenovo’s acquisition of IBM’s PC business represented a “leakage” of sensitive technology, or provided China with military-application or dual-use capabilities that were not readily available elsewhere. Nor could Lenovo manipulate access to PC supplies in any significant way.

As for Threat III (infiltration, espionage, and disruption), any purchaser who feared the presence of bugs or surveillance devices within Lenovo PCs could simply have eschewed Lenovo’s products and purchased any one of numerous alternatives.

CNOOC-Unocal

Turning next to CNOOC’s proposed acquisition of Unocal, the “Three Threats” assessment tool again provides a useful framework for analysis. To the question of whether oil is “crucial” for the functioning of the home country’s economy and military, the answer is clearly yes. For many, this meant case closed.11 Yet a more detailed analysis demonstrates that the case is far from closed. What about the concentration of alternative suppliers and potential switching costs? What about the potential “leakage” of sensitive technologies and managerial expertise?

In the year preceding the proposed acquisition (2004), Unocal produced 159,000 barrels of oil per day (70,000 barrels per day in the United States) and 1,510 million cubic feet of gas per day (577 million cubic feet per day in the United States). Thirty-three percent of its oil and natural gas production was within the United States, sixty seven percent outside. Unocal had proven reserves of 659 million barrels of oil and 6,658 billion cubic feet of natural gas. Twenty-six percent of these reserves were within the United States, sixty four percent outside.

Opponents of the takeover expressed concern that CNOOC might divert Unocal’s energy supplies exclusively to meet Chinese needs. In the extreme, CNOOC might reroute Unocal’s U.S. production of 70,000 barrels of oil per day and 577 million cubic feet of gas per day back to China. Leaving aside the fact that this would be a highly complicated and expensive undertaking, the bottom-line question is: Would this outcome harm the United States?

As argued above, such a diversion would constitute a “threat” to the United States only if sources of supply were tightly concentrated and switching costs high. Yet 21 countries (only six of which are members of the Organization of Petroleum Exporting Countries, or OPEC) produce oil for export in quantities greater than Unocal’s entire U.S. production. Six more could be called upon to make up a large fraction of Unocal’s U.S. output.

What about the second threat test? Might the sale of Unocal to CNOOC have represented a leakage or loss of technology that could damage the United States?

Looking strictly at oil production technology, the answer is quite to the contrary. To the extent that the incorporation of Unocal’s technology and managerial expertise might have enhanced CNOOC’s performance in discovering and producing oil, the acquisition would have eased pressure on world energy markets. That is, the spread of Unocal expertise throughout CNOOC would likely have had a positive, if small, impact on global supply.

On the demand side, China’s increasing thirst for oil creates obvious challenges for other customers. But on the supply side, the Chinese drive to develop new energy sources is part of the solution, not part of the problem.

Still, a complete assessment of CNOOC’s proposed acquisition of Unocal requires a second pass through the questions of excessive dependence and potential technology leakage.

The question of excessive dependence arises because the Unocal purchase would have included a wholly owned subsidiary, Molycorp, which owns the United States’ only rare-earth mine, at Mountain Pass, California. Molycorp ceased mining at Mountain Pass in 2003, but the property remained open on a care-and-maintenance basis and now proposes to renew production by the end of 2012. As noted above, rare-earth supplies have become a matter of increasing concern in recent years. Hence a hypothetical national security review of the Unocal case today would want to consider whether the new owner should be required to spin off Molycorp to an American buyer.

With regard to potential leakages of sensitive technology, some analysts suggested that seismic technology used by Unocal to explore for oil might also reinforce Chinese anti-submarine warfare capabilities. To investigate these assertions would involve highly specialized – perhaps highly classified – expertise. Once again, however, the key concern is whether the acquisition of Unocal seismic technology would confer capabilities that are not available for purchase or hire from other sources.

Toward Multilateral use of the Three Threats Framework

Contemporary work at the Peterson Institute suggests that the “Three Threats” framework introduced here could be generalized for adoption by all OECD countries, and beyond. The framework complements and enhances the principles set forth in the OECD’s Guidelines for Recipient Country Investment Policies Relating to National Security – principles of nondiscrimination, transparency of policies, predictability of outcomes, proportionality of measures and accountability of implementing authorities (Recommendation adopted by the OECD Council on 25 May 2009).

Adoption of the above decision tree as a tool for threat assessment would improve upon the OECD Guidelines in two ways. First, the Guidelines permit each country to determine what is necessary to protect its own national security. The decision-tree above would establish a common discipline for use by OECD members in evaluating whether concerns about a possible national security threat are plausible. Second, the OECD Investment Committee occasionally uses the term “strategic industries” in ways that suggest entire sectors – energy, military suppliers, financial institutions, infrastructure – might be excluded from foreign takeovers. In contrast, the threat assessment tool provides a means of determining whether a proposed foreign acquisition within such a sector might pose a threat and when it would not.

Is there some quantitative standard that might be used to guide the “plausible threat test” as set out in the decision tree above? One way of measuring the degree of competition among suppliers is to use the longstanding U.S. Department of Justice/Federal Trade Commission guidelines on mergers and acquisitions, or the similar European Union competition rules. The goal is not to turn the national security framework into an antitrust issue; rather, the objective is to limit national security scrutiny to circumstances in which denial of access to an acquired firm’s goods or services would impose high costs, or in which the foreign purchaser and its government would gain significant unwanted advantage, or in which damage from surveillance or disruption via foreign ownership of a supplier would be unavoidable. In each case, national security monitors would want to look for consequences that affected the home country in ways much beyond raising prices.

III. Implications for Canada

In considering how this “Three Threats” framework might be applied in Canada, one might begin by asking whether Canada’s national interests are best served by an international natural resource supply base that is as diversified and competitive as possible. Officials in Brazil and Australia occasionally resort to rhetoric and/or policy actions that might be better suited to a quasi-monopolistic resource producer, e.g. with regard to exports of coal or iron ore. Does Canada prefer to adopt a similar stance as a quasi-monopolistic world supplier of, for example, energy or potash?

Looking more specifically at potential foreign acquisitions of Canadian companies in the extractive sector, the framework above would appear to fit Canadian circumstances quite appropriately. While a complete analysis of the evolving structure of the international fertilizer industry is beyond the scope of this paper, the evidence suggests that supplies of both potash and phosphates are becoming more concentrated (with the former centered in Canada and the latter centered in Morocco) as U.S. sources diminish. Within this context, BHP Billiton’s hostile bid for Potash Corporation of Saskatchewan (PotashCorp) would have placed control of a major world source of supply in foreign hands rather than helping to expand, diversify,

and make more competitive the world supplier base.

Popular speculation at the time of the BHP Billiton bid for PotashCorp suggested that a Chinese or even a Russian firm might be an alternative to BHP. From a national security point of view, neither of these alternative acquirers would have been preferable to BHP, since in each case it would still mean transferring to an external actor control over a major source of supply in an increasingly concentrated industry.

It should be noted that the framework for evaluating implications of foreign acquisitions introduced here is directed at potential national security threats per se, and excludes other considerations of “net benefit” as contained in the Investment Canada Act. Thus, in the PotashCorp case above, a Chinese or a Russian acquirer might have offered a higher price to shareholders than BHP Billiton, or might have made more generous employment commitments, but this would not alter the national security calculation. (A quick review of the concentrated structure of the international nickel industry suggests that China Minmetals’s unsuccessful bid for Noranda in 2004 would also qualify for national security examination rather than a simple “net benefits” assessment.)

Potential acquisitions of Canadian rare earth elements companies might be subjected to the same calculus as PotashCorp. A hypothetical Chinese acquisition of Avalon Rare Metals or Great Western Minerals Group would further consolidate control over the global REE industry. Indeed, Canadian authorities might want to be concerned about such consolidation even if a proposed Chinese acquisition did not involve a production site on Canadian soil. Again as a purely hypothetical example, a proposed Chinese acquisition of Great Western Minerals Group’s operations at Steenkampskraal in South Africa would, using the “Three Threats” framework, qualify to be blocked by Canada on national security grounds.

In contrast to the PotashCorp case, two recent acquisitions by Chinese energy producers – PetroChina’s purchase of the undeveloped MacKay River project from Athabasca Oil Sands Corp., and Sinopec’s acquisition of Calgarybased Daylight Energy Ltd. – would appear, to the outside observer, to be helping to expand and diversify Canada’s energy base. While both PetroChina and Sinopec embody Chinese state ownership, this does not alter the national security calculus. Nor does the possibility that Chinese companies might be seeking access to oil sands production technology for use in China’s own oil sands, since doing so would potentially increase world energy supplies.

To be sure, there are valid reasons for subjecting state-owned enterprises (SOEs) to close scrutiny in cases involving foreign acquisitions. But it must also be acknowledged that ostensibly independent private investors in a relatively concentrated international industry can be subject to home country geopolitical pressures and directives. Thus the overriding question from a national security perspective is the structure of the international

industry.

Outside of the natural resources sector, the national security framework presented here would appear to fit well with Canadian concerns about such arrangements as the 2008 proposed sale of the space technology division of Vancouver-based MacDonald, Dettwiler and Associates (MDA) to Alliant Techsystems Inc. (ATK) of the United States. At the time, MDA argued that the $1.3 billion sale would enable the company to devote more resources to its faster growing information technology (IT) businesses, while getting out from under increasingly burdensome U.S. regulations on the sale of satellite technology. For its part, Industry Canada asserted that the sale would not provide a net benefit to Canada, a conclusion presumably based on a comparison of the potential benefits to Canada from MDA’s expansion in the IT sector with the losses that would result from the possible relocation outside Canada of MDA’s space technology operations. (There is no evidence that the “net benefit” calculation took into account the opportunity cost of less MDA expansion in the IT sector.)

From a national security point of view, however, the proposed sale of MDA’s space technology division raised other concerns. The deal would have given ATK control of Radarsat-2, a distinctive high-resolution satellite with an unusual polar orbit. Alliant was prepared to honor all of MDA’s outstanding contracts with the Canadian government, including access protocols to Radarsat-2 for surveillance of the Arctic. But Alliant could not promise that the United States government would refrain from imposing controls on such information-sharing in the event of a Canada-U.S. dispute over Arctic sovereignty. For example, the United States rejects Canada’s claim over the Northwest Passage shipping channel, and might conceivably refuse to let Canada use Radarsat-2 surveillance to enforce its claim. Given the unique nature of Radarsat-2’s technology and polar orbit, Canada would have no other source of such information, and therefore what has been labeled “Threat I” would come into play.

It is difficult for an outsider to assess the depth and significance of a future hypothetical US-Canada dispute over arctic sovereignty, but the logic of rejecting the proposed acquisition for Canadian national security reasons (“Threat I”) does not appear inappropriate.

This brief review of how a new national security threat assessment apparatus might apply to sensitive cases in Canada should not divert attention from one of the principal benefits of such a rigorous framework – namely, to show that the vast majority of proposed foreign acquisitions pose no plausible threat. Application of this framework in Canada and elsewhere would help to dampen politicization of individual cases, enabling swift and confident approval of those acquisitions from which genuine national security threats are absent.

Appendix 1: Scorecard of China’s Procurement Arrangements

Appendix 2: Chinese FDI in Natural Resources: South America

Appendix 3: CNPC, Sinopec in Ecuador 2005

On September 13, 2005 Calgary-based EnCana Corporation announced its plan to sell all of its oil and gas assets in Ecuador to the newly formed Chinese consortium Andes Petroleum Company for $1.42 billion. Under the terms of the deal the consortium, led by Chinese firms CNPC and Sinopec, would acquire all of EnCana’s shares in subsidiaries that owned oil or pipeline interests in Ecuador. Reports had emerged the previous August that EnCana intended to sell all of its assets outside North America in order to concentrate on its strategic interests within North America.14 India’s state-owned ONGC was among the bidders for the Ecuadorian assets.

On February 28, 2006 EnCana and the Andes Petroleum Company announced that the deal had been closed. The Chinese consortium paid $1.42 billion for EnCana’s Ecuadorian assets that possessed a net book value of $1.4 billion. EnCana’s holdings in Ecuador included full ownership of the Tarapoa block, producing 38,000 barrels per day of oil as well as a 40 percent stake in another block producing 30,000 barrels per day. Additionally, the consortium acquired EnCana’s 36.3 percent stake in a 310-mile pipeline carrying 450,000 barrels per day. At year-end in 2004, EnCana had 143 million barrels of proven oil reserves in Ecuador.

The Andes Petroleum Corporation was formed in order to purchase EnCana’s assets in Ecuador. In the time after the September 2005 transaction announcement, CNPC, Sinopec and other Chinese firms negotiated the distribution of interest in the consortium, with CNPC ultimately acquiring 55 percent and Sinopec 45 percent. CNPC was to focus on the oil fields’ operation while Sinopec would focus on refining. Following the deal the Andes Petroleum Corporation became the largest foreign operator in Ecuador.

Sinopec is China’s second largest producer of crude oil and natural gas and its largest oil refiner (ranking third in the world in refining capacity). CNPC is the largest oil and gas producer and supplier in China. It specializes in oil field development and engineering and has a presence in 29 countries. Both firms are state-owned.