Canada’s Oil Sands

A vital national asset

The world still needs oil

Countries around the world are developing rapidly – and raising their demand for modern energy services along the way. Renewables will play an increasing role in this energy future, and Canada is among the leaders internationally. Over 60 per cent of Canada’s electricity comes from hydro, with only China producing more hydroelectricity. Over the past decade, Canada’s capacity for non-hydro renewables – wind, solar and biomass – has expanded six-fold, making us fourth in the world in renewable energy1.

Renewable energy now makes up 10 per cent of the world’s energy production, but a growing global population also increases demand for housing, transportation, food and consumer products, and thus energy needs. The International Energy Agency estimates that energy use will grow 34 per cent by 2040, and despite impressive gains in renewable energy technology, oil will be the main source of transportation fuel over this period. Although promising over the long term, electric vehicles account for only one per cent of the cars sold in 2015.

With abundant resources, innovative companies, skilled workers, sound public policies and respect for human and indigenous rights, Canada is uniquely positioned to provide safe, reliable and environmentally responsible energy to growing domestic and international markets.

“Canadians will see their standards of living fall and economy falter if industry executives, politicians, First Nations leaders and environmentalists cannot work together on developing the country’s oil and gas resources.”

David McKay, President and Chief Executive Officer,

Royal Bank of Canada

1 Shelley Milutinovic, Chief Economist, National Energy Board, as quoted by the Canadian Press, October 14, 2016.

Canada’s oil sands

Canada has the third largest oil reserves in the world, behind only Saudi Arabia and Venezuela. Only 20 per cent of the world’s oil reserves are accessible for private sector development, and 50 per cent of that lies in Canada’s oil sands. All told, 97 per cent of Canada’s oil assets are in the oil sands.

Located in three areas of northern Alberta and Saskatchewan – Athabasca, Peace River and Cold Lake – the oil sands are a mixture of bitumen (molasses-like, heavy oil), sand, water and clay. Unlike conventional crude, oil sands must be mined or heated before the useable oil can be extracted and processed.

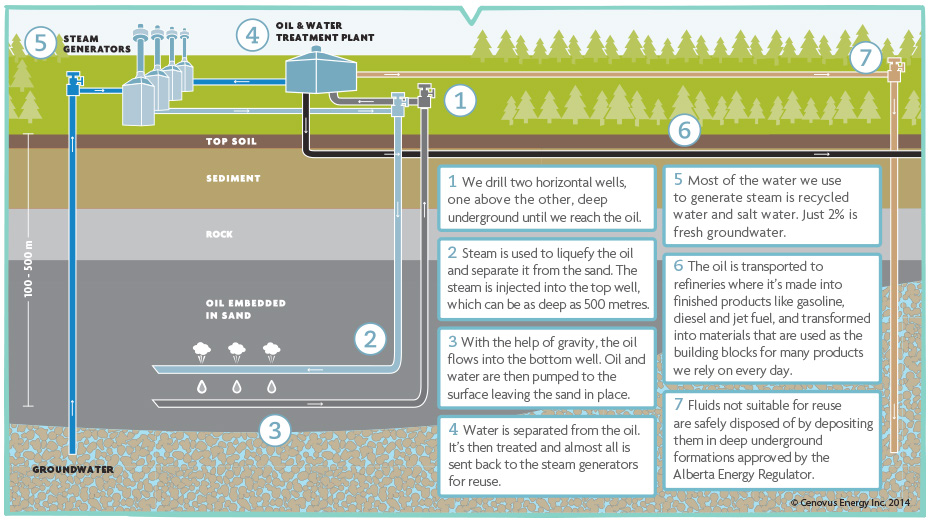

Only 20 per cent of the oil sands deposit is close enough to the surface to be mined. The remaining 80 per cent is deep underground and has to be extracted by drilling techniques referred to as “in situ”. Compared to mining, drilling reduces the environmental impact of excavation, requiring no tailings ponds and reducing land disturbances. Two technologies account for almost all of the in situ recovery – cyclic steam simulation (CSS) and steam-assisted gravity drainage (SAGD). Both technologies involve injecting steam into the ground, warming the bitumen until it can be pumped to the surface.

Accessing oil from Alberta is more technically challenging than getting it from other places, especially compared to the light oil deposits of the Middle East. But the oil sands story has always been one of new technology, highlighting the ongoing innovation since the time when the resource was considered “uneconomic.”

SAGD oil extraction method (steam-assisted gravity drainage)

Fuelling Canada’s economy

Over the next 20 years, oil sands development is expected to contribute more than $200 billion per year to Canada’s GDP, directly and indirectly employing 700,000 Canadians. Beyond this, the oil and gas sector has recently paid over $17 billion per year in taxes, royalties and fees to governments, which help fund schools, roads, health care and education in communities across the country.

Canada currently produces about 3.7 million barrels a day, twice what we consume. With so much surplus, oil accounts for 20 per cent of our total exports by value. Of the oil we export, 99 per cent goes to the U.S. This makes Canada the largest source of American foreign oil – selling them over double the amount of Saudi Arabia.

The extent of Canada’s reliance on the U.S. market also illustrates the importance of finding new markets for our oil and natural gas. While energy demand is predicted to remain flat within North America, emerging markets will see growth.

Canada’s energy industry can reinforce North America’s comparative advantage in competitively-priced energy while also being a responsible supplier to countries outside the continent.

Despite Canada having more than enough oil to meet domestic needs, Eastern Canada currently imports two-thirds of its oil, worth about $17 billion in 2015. The oil comes from countries including Saudi Arabia, Algeria, Angola and Nigeria – countries with very poor track records on environmental standards and labour and human rights.

The proposed Energy East pipeline would supply Eastern Canada with Canadian oil, as well as provide Canadian producers with much-needed access to global markets via the east coast. The net impact of the pipeline would be more exports and fewer imports, as well as jobs for Canadians, economic growth and increased government revenue. As well, Kinder Morgan’s recently-approved expansion of the Transmountain pipeline to Canada’s west coast would help secure access to Asian markets and ensure Canadian oil obtains the benefit of higher world prices.

While the federal and provincial governments debate how to boost the economy through new public spending on infrastructure, these two pipeline projects alone represent some $20 billion of private capital, available to move forward and boost the economy without government support.

The impact of low oil prices

Over the past two years, a severe downturn in oil prices dropped the price of a barrel of oil from an average of $97.80/ per barrel USD in 2013 to $40.16/per barrel USD in 2016. These numbers illustrate the importance of the sector to Canada:

- 125,000 Canadian jobs lost to date, more than 20 per cent of the previous workforce2.

- With new facilities and planned expansions now on hold, capital investment plunged from $81 billion in 2014 to $31 billion in 2016.3 That $50 billion dollar drop is significantly more than the next largest capital investor (the utility sector) spent in 2015.

- The Bank of Canada estimates that lower prices for oil and other commodity prices since 2014 has resulted in a one per cent drop in Canada’s GDP, a loss of about $60 billion in national income or $1800 for every Canadian.4

- The Bank also estimates that the Fort McMurray wildfire, which caused the closure of many oil sands facilities for several weeks, cut 1.1 per cent off real GDP growth in the second quarter of 2016, leading to an overall contraction of one per cent in the economy for the quarter.

The effects of low oil prices extend far wider than Alberta: offshore oil royalties collected by the Newfoundland and Labrador government plunged from $2.25 billion in the early 2010s to $550 million in fiscal 2015-16.5 This loss of $1.7 billion is about what the province spends annually on K-12 and post-secondary education.

Dropping oil prices have sparked a new focus on reducing costs and squeezing more production from existing facilities. According to a Bloomberg survey of the five largest producers, the average cost of producing a barrel of oil has fallen by 35 per cent since 2014.6 Anecdotally, some companies have been able to lower operating costs below $25 a barrel, and Suncor President and Chief Executive Officer Steve Williams told analysts in a recent presentation, “We can run for the next 25 years at less than US$40 a barrel, so we’ve got a long future ahead.”7

The low oil price environment for the foreseeable future will see companies relentlessly pursuing opportunities to drive costs lower. And that’s usually a win-win for the environment, because costs savings generally mean using less energy and lowering greenhouse gas (GHG) emissions.

2 Estimate from the Canadian Association of Petroleum Producers

3 Based on estimates from the Canadian Association of Petroleum Producers.

4 Speech by Lynn Patterson, Deputy Governor, Bank of Canada, to the Edmonton Chamber of Commerce, March 30, 2016.

5 Fiscal Pulse, Scotiabank, December 22, 2015.

6 As reported in The Globe and Mail, October 1, 2016, page B14.

7 Ibid.

Partnering with indigenous communities

Like other resource sectors operating in remote regions, energy companies are among the largest employers of Indigenous Peoples. Approximately six per cent of Canada’s oil and natural gas workforce is Indigenous, which is almost double the Indigenous participation rate in Canada’s total labour force.

This is critical to Canada’s future, as Indigenous youth are the fastest growing demographic in Canada, and many communities – especially in remote and Northern areas – have relatively few employment opportunities. Several companies in the sector work with post-secondary institutions to establish apprenticeship programs, provide educational scholarships and support skills training.

In part because of training, experience and the opportunity to partner with specific companies, many Indigenous employees have created their own businesses to service the industry. At present, over 300 Indigenous-owned companies, from 54 communities across Alberta, do business with the oil sands. Total business has exceeded $10 billion over the past 15 years.

One recent example is the development of Suncor’s East Tank Farm, a storage facility that will warehouse bitumen from the Fort Hills facility and connect it to pipelines to deliver to markets in Canada and the United States. Two Aboriginal communities in the region, the Fort McKay First Nation and the Mikisew Cree First Nation, will separately own equity interests totaling 49 per cent and will provide half of the capital for the estimated $1 billion development cost. Both will share in the long-term revenue stream from the project, thus providing financial stability and increased independence for their communities.

The Fort McKay Group of Companies LP (FMGOC), which works extensively with oil sands operations through its six divisions, brings in more than $150 million in revenue annually. FMGOC is completely owned and controlled by the Fort McKay First Nation.

“It’s naïve to think Canada can prosper without a healthy oil and gas industry. Those who oppose energy projects are poorly informed. The oil sands industry has enabled a group of companies owned by the Fort McKay First Nation to bring more than two billion dollars in revenues over the past five years.”

Chief Jim Boucher, Fort McKay First Nation, October 2016.

Tackling environmental challenges

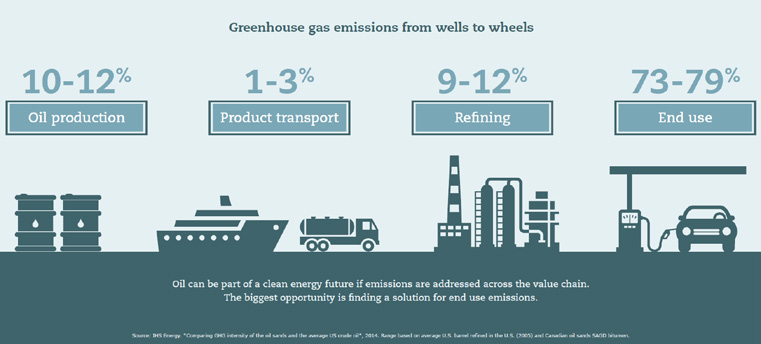

About nine per cent of Canada’s greenhouse gas emissions come from the oil sands, accounting for 0.13 per cent of emissions around the world. Between 1990 and 2013, the GHG emissions from producing a barrel of oil sands crude decreased 30 per cent.8

One of the key criticisms during the Keystone XL pipeline debate was the allegation that Canadian oil is more GHG-intensive, or “dirtier,” than other oils used in the United States. In fact, energy derived from the oil sands is less GHG-intensive than comparable oils from California, Mexico and Venezuela. Across the oil sands industry today, GHG emissions are about 9 per cent higher than the average barrel refined in the United States. For some firms, however, GHG emissions per barrel are already equivalent, and other companies are investing significantly in technologies that will help them eliminate the remaining gap. Those investments will far outweigh anything being done by producers in Venezuela, the Middle East and Africa, which compete with Canadian firms.

Investing in new technologies is key to lowering both the cost and environmental impact of producing oil. In the SAGD process, natural gas is used to generate steam which in turn heats the bitumen and allows it to flow to the surface. Canadian companies are now experimenting with solvents and other techniques that would reduce their need for steam, thus lowering the GHG emissions associated with making steam.

Shell Canada’s Quest project safely captured and stored one million tonnes of CO2 in its first year of operation — equivalent to taking about 250,000 cars off the road. The company will share knowledge and technology to improve both the costs and efficiency of cyclical stream simulation, with the potential to allow other industries around the world to lower their emissions.

Energy critics point to the impact of oil extraction on the broader environment, including land and water. Here are some important facts:

Land disturbance

Only three per cent of Alberta’s 142,000km2 of boreal forests can be mined for oil. The remaining deposits lie deeper below the surface and can only be recovered by drilling, which has minimal land impact. The land disturbed by active mining at present is about 900 km2, a little smaller in size than the city of Hamilton.

Alberta companies are required by law to develop a reclamation plan for the end of the project. Ten per cent of the active mining footprint has been, or is in the process of being, reclaimed. Disturbed land is restored through soil replacement, vegetation and tree re-planting, and wildlife habitat restoration.

Water use and recycling

Years ago, oil companies used fresh water supplies, often from the Athabasca River. Today, most companies use water from nearby saline aquifers or other sources unusable as drinking water. Companies recycle between 85 and 95 per cent of their water, and several companies are developing solvent technologies that will greatly reduce the need for water.

Tailings ponds

After bitumen (oil) is removed from the oil sands, fluid tailings are the leftover water, clay and residue hydrocarbons. Placed in large engineered dam and dyke systems, the tailings settle over time, at which point the land can be reclaimed. This process can take decades, and companies are experimenting with several processes to speed up the drying process. Some newer mining projects have eliminated, or greatly reduced, the need for tailings ponds.

For example, Canadian Natural Resources has invested more than $1.6 billion to date in tailings management research and technologies. A new process was introduced in 2015 at its Horizon facility, which injects CO2 into the tailings to enhance settling and accelerate the release of water from the tailings. This has a number of benefits:

- Lowering GHG emissions through CO2 sequestration and lower use of natural gas;

- Reducing water use by 30 per cent

- Decreasing tailings pond size by 50 per cent

- Speeding up the timeline for reclamation.

Suncor has successfully reclaimed and restored one of its original tailings ponds (Wapisiw Lookout), planting more than half-a-million trees and shrubs and restoring wetlands. The land now supports wildlife.

Notwithstanding impressive progress on many fronts, Canadian oil producers do face challenges:

- A high relative cost structure, especially compared to crude from some Middle East producers with whom they compete for access to the U.S. market;

- Challenges in reducing GHG intensity across the range of different deposits, facilities and technologies;

- The need to fit increasing oil sands production within the federal government’s long-term commitment to significantly reduce GHG emissions overall.

For more examples of innovative approaches to environmental solutions, see: www.cosia.ca.

At its Edmonton refinery, Suncor takes wastewater from the city’s treatment plant, cleans it up, and gives the leftover to ski clubs for making snow and to city parks for watering plants.

Leading the world on climate policy

Alberta is one of the very few major oil producing regions in the world with a comprehensive greenhouse gas reduction policy, including a meaningful price on emissions. Alberta’s climate plan includes:

- A carbon levy on major emitters in place since 2007, mandating improvements in emissions intensity.

- Adopting an economy-wide carbon price, beginning at $20 per tonne of emissions in 2017, rising to $30 in 2018.

- The distinction of being the only place in the world with an overall cap on the GHG emissions from oil production.

- New regulations will require a 45 per cent reduction in methane emissions from oil and gas operations.

With an estimated 4.6 billion barrels, Imperial Oil’s Kearl project is one of Canada’s highest quality oil sands deposits. Representing the next generation of oil sands mining, it combines new technology with the integration of energy-saving cogeneration (where excess heat drives turbines to produce electricity). The result is lower costs, and a GHG footprint equivalent to many crudes refined in the United States.

8 Source: Canadian Association of Petroleum Producers.

Moving oil safely

Getting Canadian oil out of the ground, moved to a refinery, and then shipped to market is a complex job. Moving oil safely, with minimal impact on the environment and communities is a major focus of the industry.

Pipelines are monitored 24/7 from high-tech control rooms. Aerial surveillance through satellites, airplanes and drones can protect against third party intrusions and help detect leaks. New video technology, advanced sensors and fibre optic cable can both improve leak detection in underground pipelines and ensure rapid communication of any potential issues to the control room. This in turn improves the ability to identify and respond to risks before they turn into incidents.

Maintaining pipeline integrity is critical to overall safety. High-strength steel and sophisticated coatings are used to prevent corrosion. Geohazard management programs are being developed to help predict the possibility of erosion or ground movement that could damage a pipeline.

Canada has one of the most highly-regulated, safest pipeline industries in the world. Through both federal and provincial regulations, pipelines must meet rigorous design, construction, operation, maintenance and spill response standards. The industry has an enviable safety record in Canada, with a goal of zero pipeline incidents.

Likewise, Canada’s railway industry has responded to concerns over the safe movement of oil by rail, through a four-pronged strategy:

- Making major investments to consistently reduce the number and severity of accidents, through investments in employee training, safety technology and promoting a culture of safety. As a result, Canadian railways have the best safety record in North America, moving 99.999 percent of dangerous goods to their destination without an accidental release.

- Funding emergency response networks and mutual aid resources, training first responders, and providing real-time shipment information so that responders can act quickly in the event of an accident.

- Re-engineering how oil is transported, including redesigning the tank car with thicker steel shells, thermal insulation, valve protection, and full head shields – all designed to greatly reduce the risk of product loss and fire.

- Focusing on product and handling safety. In this regard, diluted or lightly diluted oil sands bitumen enjoys an intrinsic safety benefit, due to the product’s low volatility and high viscosity.9

9 Source: Railway Association of Canada.

Driving innovation

The oil sands are a unique Canadian resource, and technology developed here at home was instrumental to unlock that bounty. That development began 50 years ago and technology is still key to the future of the industry in Canada.

Working together for change

Thirteen major companies in the oil sands have joined together to form the Canada’s Oil Sands Innovation Alliance (COSIA), jointly developing technologies and solutions for the most pressing environmental issues they face.

In an unprecedented move, these leading companies have agreed to forego intellectual property rights and share previously proprietary technology and information in an effort to accelerate environmental improvements across the industry.

So far, COSIA members have invested $1.3 billion in creating more than 900 technologies and innovations. In an unprecedented move, these leading companies have agreed to forego intellectual property rights and share previously proprietary technology and information in an effort to accelerate environmental improvements across the industry. They share the costs and risks related to the research and testing of new technologies, accelerating the development and adoption of the most promising ones. COSIA has seen progress in enhancing waste heat recovery, reducing water use, and accelerating reclamation of mine tailings. A sample of just some of the technologies under development by COSIA companies:

- Imperial Oil is working with a leading satellite company in Montreal to use satellites to more accurately monitor GHGs from tailings ponds and mines.

- Cenovus partnered with the University of Calgary to use molten carbonate fuel cells to capture CO2 and produce electricity with near-zero GHGs.

- CNRL is working with a company in Ontario to test the use of algae in a biorefinery. The combination of CO2, waste heat and water from oil sands facilities, and exposure to light can produce bio-oil that may be suitable as jet fuel. The application of this technology at two CNRL facilities is estimated to reduce annual GHG emissions by 1.5 million tonnes per year, equivalent to taking 300,000 cars off the road.

Shooting for the stars

Joining together once again, several COSIA companies, led by ConocoPhillips Canada, have sponsored a $20 million “XPrize” competition10. The idea is to accelerate the development of breakthrough technologies that can take waste carbon dioxide streams from industrial facilities, and turn them into valuable and useful items, from t-shirts to toothpaste. Potential uses include alternative forms of building materials, low-carbon transportation fuels and entirely new products.

Venturing change

Two leading players in the oil sands, Cenovus and Suncor, have partnered with the BC Cleantech CEO Alliance to create Evok Innovations. With a $100 million venture capital fund, Evok connects clean technology entrepreneurs with flexible financing, industry mentors and partners, to accelerate the development and commercialization of transformative energy solutions.

“If a team of innovators from around the world can dedicate their resources to figure out a way to reuse emissions and convert them into something of value, it will be a huge step for Suncor, the oil sands industry and the global climate change challenge.”

Steve Williams, President and Chief Executive Officer, Suncor Energy Inc.