An Agenda for corporate tax reform in Canada

Overview: No Cause for Complacency

Canada’s corporate tax system has become far more competitive with other countries over the past 15 years. But we are now at risk of falling behind again.

Some provinces have eroded earlier gains by raising a variety of existing business taxes or introducing new ones. What’s more, we have not gone as far as many other advanced economies in improving the neutrality of our tax system, in other words, the extent to which the same rules apply across business sectors, and between large and small companies. Our tax policies tend to favour manufacturing over services, resulting in a bias against investment in some sectors with exceptionally strong growth prospects.

This paper questions the long-held assumption that favourable tax treatment for small businesses encourages investment, job creation and overall economic growth. In fact, tax advantages enjoyed by small business end up discouraging entrepreneurs from pursuing growth. They also distort the allocation of capital by favouring small company investment, which typically earns a lower return than investment by larger firms. To make matters worse, the favourable tax treatment of small businesses enables many wealthy Canadians to pay little or no personal income tax.

The main conclusion I draw is that Canada should retain the present system of corporate income taxes while initiating a fresh round of reforms, as follows:

- Rather than raising corporate tax rates, Canada should follow the lead of most other countries by ensuring internationally competitive rates and making the corporate tax structure more neutral, thereby broadening the tax base.

- Some options include restricting accelerated depreciation and resource deductions, reining in investment tax credits, and halving the small business deduction.

- The extra revenues that accrue from these measures should be used to lower tax rates for all businesses.

- The broader tax base would offset loss of revenue from lower rates. As a result, these proposals, taken together, would have virtually no impact on overall government revenues.

- Provinces should adopt uniform corporate tax rates.

- British Columbia, Saskatchewan and Manitoba should harmonize their retail sales taxes with the federal goods and services tax.

Canada’s Record

Canada can boast one of the strongest records of business tax reform among industrialized nations. Since the turn of the millennium, federal and provincial governments have reduced the tax burden on businesses from the highest in the OECD to the middle of the pack. Not only has the corporate tax structure become internationally competitive but the tax burden is now spread more evenly among different sectors of the economy. Overall, these reforms have encouraged more capital investment in Canada without significant erosion in corporate tax revenues as a share of GDP. It is a good news story.

However, we cannot afford to be complacent. Other countries are steaming ahead with new reforms, raising the risk that Canada will be left behind. Canada’s tax burden on capital was 14th highest among OECD countries in 2014, compared to 19th in 2012. Many targeted tax incentives, whether effective or not, remain. The business tax structure could be simplified with fewer and less complicated levies.

Some provinces have raised business taxes in recent years. British Columbia has re-imposed its retail sales tax and introduced a liquefied natural gas tax. Ontario has back-tracked on planned cuts in its corporate income taxes. New Brunswick and, most recently, Alberta have raised corporate income taxes.

Some of the recent changes, such as lower targeted incentives, are appropriate to level the playing field. But others, such as reduced small-business tax rates at the federal level and in Quebec and New Brunswick, amplify tax distortions, enabling many high-income business owners to avoid personal taxes. New levies, such as carbon taxes on large emitters, simply shift the tax burden from individuals to businesses, where they are hidden behind a corporate veil. We need to bear in mind that business taxes ultimately fall on individuals as consumers, wage earners, shareholders and pension fund beneficiaries.

Moreover, the current G20 exercise to deter multinationals from shifting profits to low-tax jurisdictions could increase the tax burden on inbound and outbound investment. While these issues are highly complicated, any move to raise Canadian taxes on multinationals operating in Canada needs to be balanced with other measures that preserve our competitiveness.

This paper lays out an agenda for business tax reform in Canada. It specifically looks at an approach that would lower rates and broaden the tax base, consistent with the reforms adopted since 2000.

I will argue that there is considerable scope to improve the tax structure, and that doing so would open the way for the federal corporate income tax rate to be lowered to 13% from the current 15%. By broadening the tax base, provinces could bring down their corporate tax rates to 10% from the present average of almost 12%. The combined federal-provincial rate would then be 23%, putting Canada on a par with Finland, Switzerland and the United Kingdom.

Lower corporate tax rates should go hand in hand with a drive to make the tax system more neutral among business activities and among large and small firms. Tax neutrality achieves a better allocation of capital investment by putting decisions on which projects offer the best return in the hands of businesses rather than governments, which are all too often swayed by non-economic considerations. Other taxes that influence business investment, such as municipal property taxes, should also be candidates for reform.

How is Canada’s Tax Structure Faring?

Business taxes are part of the overall tax structure that provides resources to governments to finance public services. The level of taxation depends on a government’s requirements, so that any reforms that raise or lower taxes ultimately depend on public spending patterns.

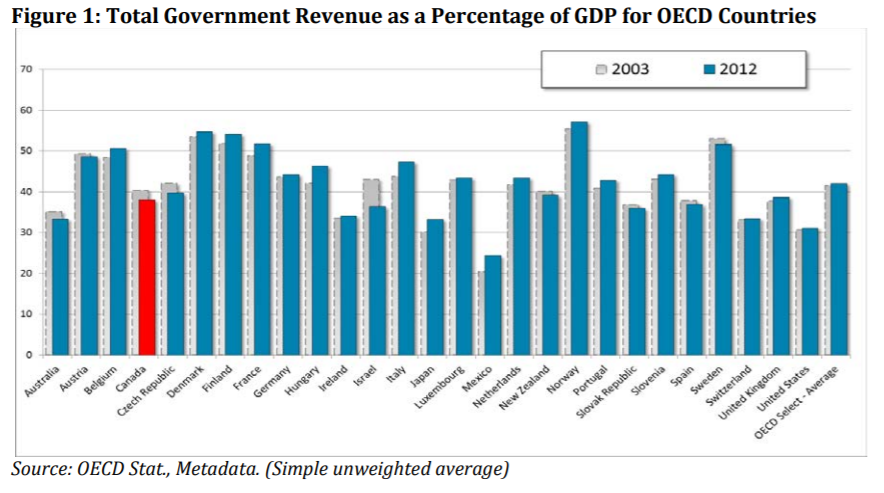

Canadian governments raise revenues from taxes (including taxes on personal income, corporate income, payrolls, commodities and property) as well as from non-tax sources, including user fees, royalties and profits earned by Crown corporations. As shown in Figure 1 below, Canadian total government revenue as a share of GDP was over 40% in 2003. With personal, corporate and sales tax reductions at federal and provincial levels, total government revenues in Canada stood at 38.1% of GDP in 2012, somewhat below the OECD average but more than a fifth higher than in the US. While the tax burden is somewhat lower today, governments still require a significant share of Canada’s GDP to fund public services.

The mix of taxes raises a different set of questions. That mix, including the balance between business and personal taxes, has a far-reaching impact on economic growth. Some taxes such as the corporate income tax impose relatively high economic costs while others such as the consumption tax impose little cost. Each dollar of tax imposes a cost on the economy by discouraging work effort, investment or risk-taking. This economic cost is the “deadweight loss” of taxation – in other words, the loss of consumption or production caused by tax distortions. Adding this deadweight loss to the cost of raising a dollar of taxes is known as the marginal cost of taxation. The marginal cost would be even higher if the calculation took into account hard-to-measure administrative and compliance costs.

Economists who have attempted to quantify marginal tax costs over the years have come to a common conclusion. Corporate taxes impose the highest marginal cost, followed by personal income taxes and payroll taxes. Consumption taxes tend to impose the lowest marginal cost. The best-known work is by Bev Dahlby who has estimated marginal tax costs for Canada and some other countries. The results of his research are striking. The marginal cost of federal corporate taxes to the economy is $1.45 and of personal taxes $1.17 for each dollar raised. The cost to the economy of provincial taxes is even higher, because tax increases cause a much bigger erosion of the provincial tax base: $3.62 and $81.61 for corporate taxes in Quebec and Alberta respectively; $3.81 and $2.15 for personal taxes in Quebec and Ontario; and $1.33 and $1.31 for sales taxes in Quebec and Ontario.

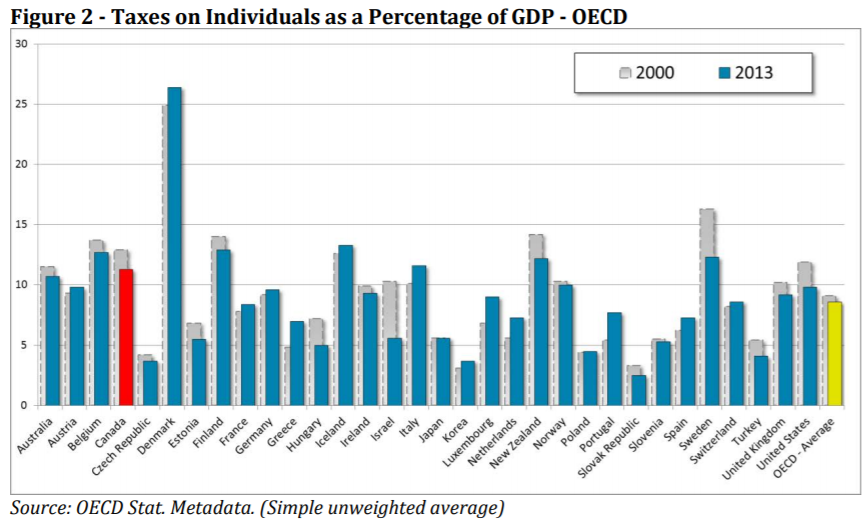

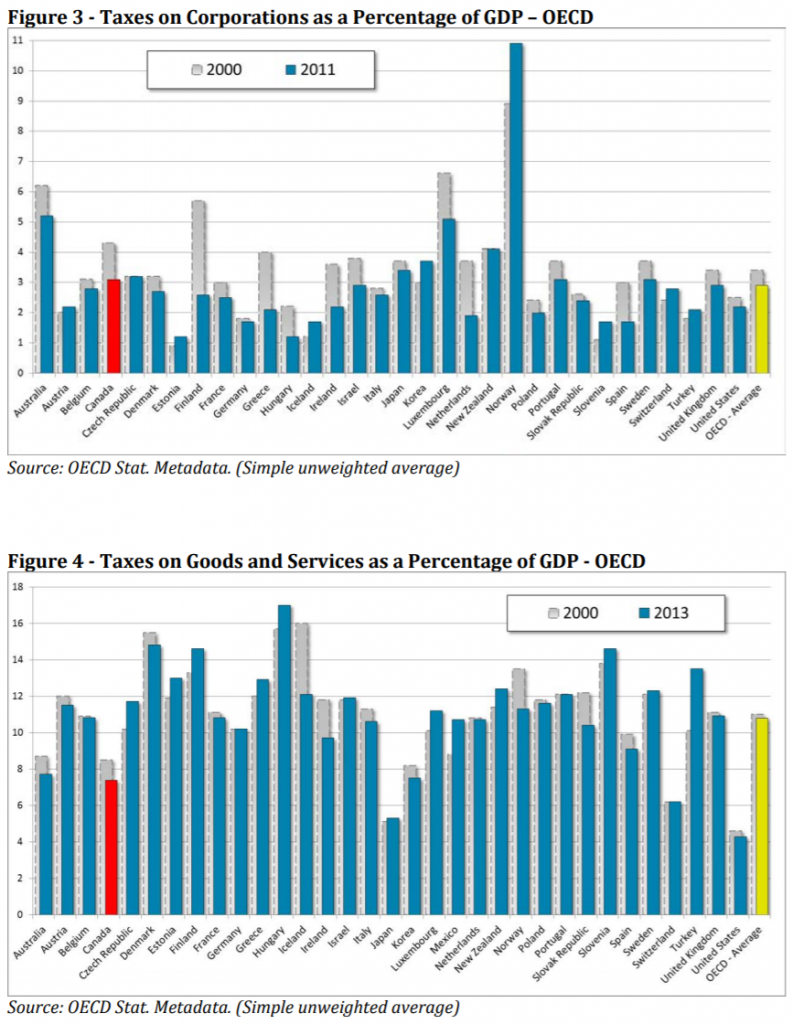

Canada’s current tax mix is weighted heavily towards corporate and personal income taxes as opposed to consumption taxes. In 2013, Canadian personal income taxes were 11.3% of GDP, well above both the OECD average and the US (this was also the case in 2000). Corporate tax revenues in 2011 (latest available) were 3.1% of GDP, also above the OECD average and the US (as in 2000). By contrast, taxes on sales of goods and services equaled 7.4% of GDP, which was less than the OECD average, but above the US.

These comparisons of taxes to GDP are sometimes interpreted as measures of tax competitiveness. In fact, they have little such relevance, for the following reasons:

- Taxes paid as a share of GDP depend on the state of the economy. For example, personal tax rates rise with income and personal tax collections tend to be higher as a share of GDP during boom times than in a recession.

- A variety of taxes, not just a single one, affect economic decisions. Corporate taxes are typically income taxes paid by companies, yet sales taxes on purchases of capital equipment and asset-based taxes such as capital and property taxes also tend to deter investment. Labour productivity is affected by personal income taxes, but also by sales and payroll tax (in the latter case, payroll taxes net of any benefits received from social security programs discourage labour effort). Household saving decisions are affected by personal income taxes on investments as well as by other levies on savings, such as financial transaction taxes.

- Gross domestic product is not a meaningful yardstick to measure the revenue base for specific taxes. Corporate taxes as a share of GDP will be low if profits are low. Similarly, consumption taxes correlate to the level of consumption, which is only one component of GDP. Personal income taxes rise and fall depending on ups and downs in personal income, not other components of GDP such as corporate profits. In Norway and the UK, the corporate income tax includes a supplementary tax paid by oil and gas producers for the extraction of non-renewable resources owned by the government.

Of course, businesses pay many different taxes, including corporate income taxes, taxes on capital inputs and labour taxes. While some studies aggregate the various taxes (including employer payroll taxes) as a share of pre-tax profits, such measures are biased against labour-intensive industries. For example, calculating payroll taxes as a share of after-tax profits grossed up by the payroll taxes, over-estimates the overall tax burden. An extreme case is an industry with negligible capital and profits. Calculating the effective tax rate as a proportion of payroll taxes to payroll taxes gives the nonsensical result of 100%. If taxes on capital and labour are to be combined, they should be measured against the value added by the business, in other words, the sum of compensation paid to employees and income paid to shareholders.

Given these arguments, tax-to-GDP and other total tax comparisons provide an inappropriate measure of tax competitiveness. If the concern is how taxes cause businesses to shift production to other jurisdictions, the focus should be on mobile factors of production. Given that most labour cannot move freely across borders due to migration constraints, any drive to sharpen Canada’s competitiveness is best focused on taxes directly related to capital investment.

The Marginal Tax Rate on Capital

Public policy analysts commonly use the marginal effective tax rate (METR) to measure how the tax structure affects capital investment. A business invests in capital until the return on that capital (net of taxes and risk) equals the cost of holding capital. Thus, taxes paid on capital investments are among the factors that influence investment decisions. If the tax burden rises, the business will at a certain point find that after-tax returns are lower than financing costs. The business will then cut back investment, approving only projects with a sufficiently high rate of return to cover both financing costs and taxes. In other words, the higher the METR, the lower the investment, and vice versa, making the METR a good indicator of how taxes affect investment.

In essence, the METR is the portion of capital-related taxes paid as a share of the pre-tax rate of return on capital for incremental investments (assuming that businesses invest until the after-tax return on capital equals the cost of financing capital). The calculation includes corporate income taxes, sales taxes on capital purchases and other capital-related taxes such as financial transaction taxes and asset-based taxes. Property taxes are excluded since effective property tax rates cannot easily be compared across industries or countries, including Canada. To measure property taxes accurately, we would also need to subtract the benefit of municipal services directly funded by those taxes.

Canada is Becoming Less Globally Tax Competitive

The federal government and the provinces have undertaken several rounds of corporate tax reform over the past 15 years that have led to a more competitive tax regime. Corporate income tax rates have come down from an average federal-provincial rate of 43% in 2000 to 26% in 2012. Capital taxes on non-financial businesses have been eliminated. (A capital tax on financial services businesses remains in all provinces except Alberta and British Columbia.) Ontario and Prince Edward Island have converted their retail sales taxes with high taxes on capital inputs into a harmonized sales tax, similar to the federal GST. All provinces east of the Manitoba-Ontario border now have value-added systems that sharply reduce taxes on business inputs compared to previous provincial sales taxes. Alberta has no sales tax.

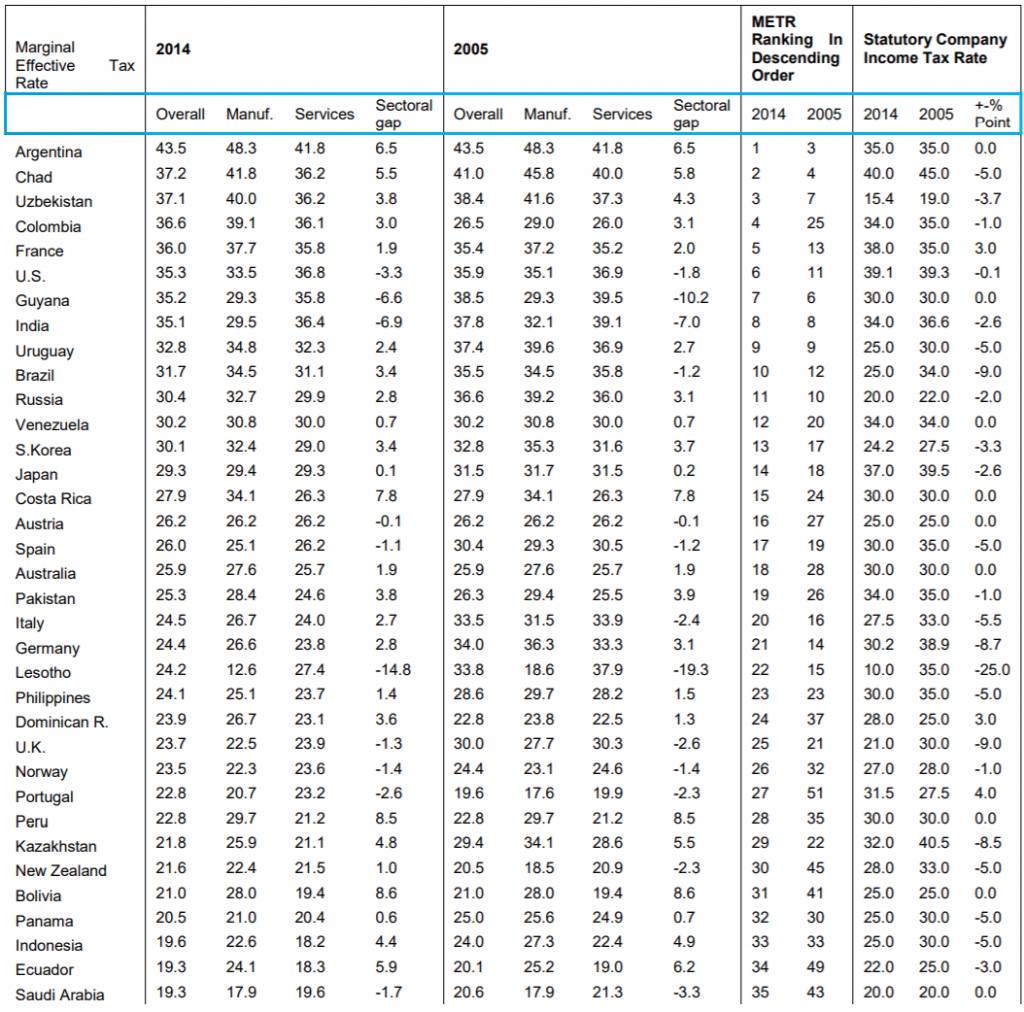

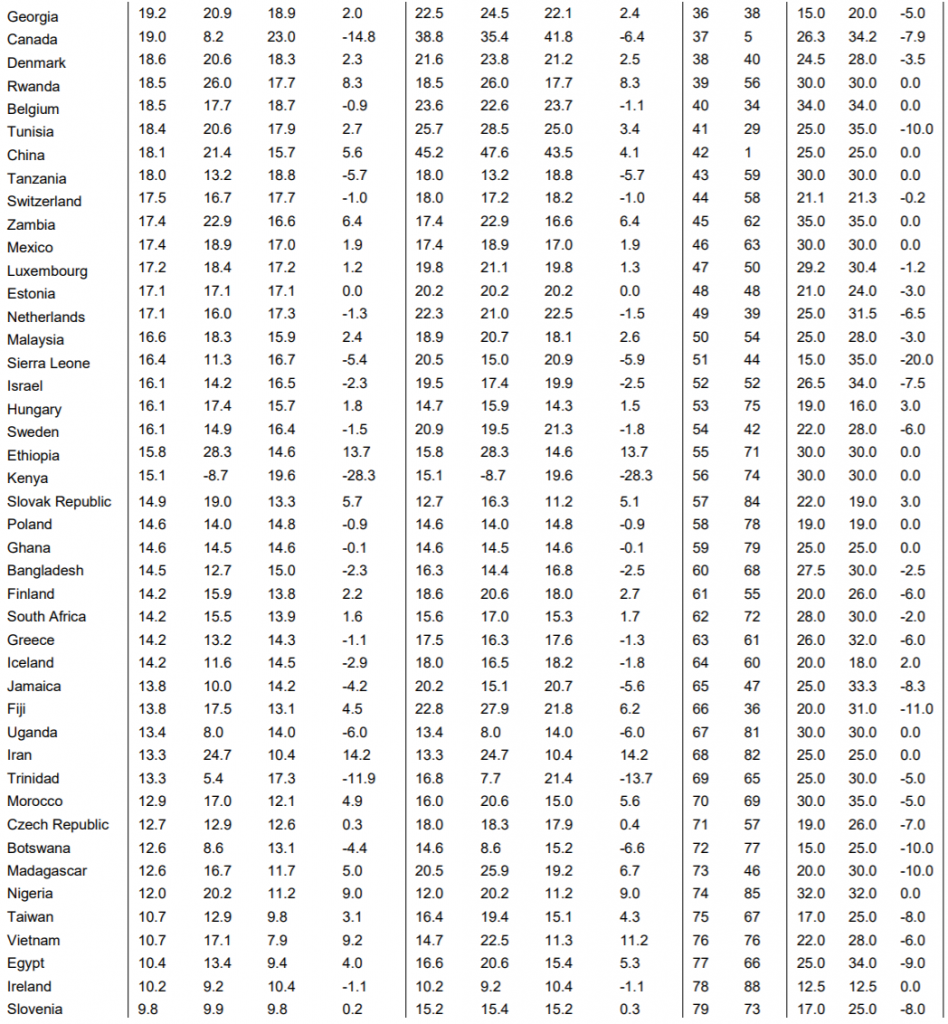

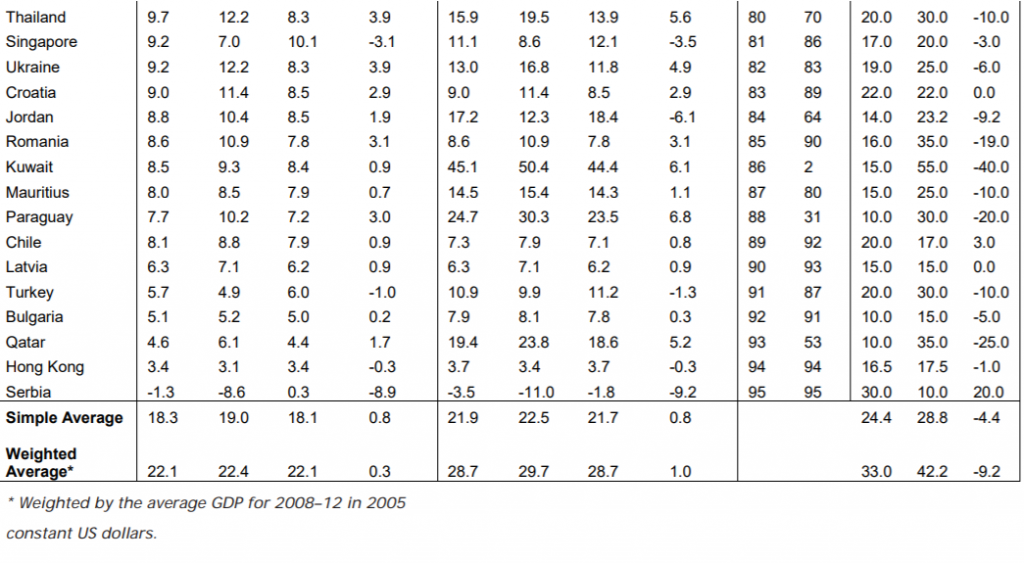

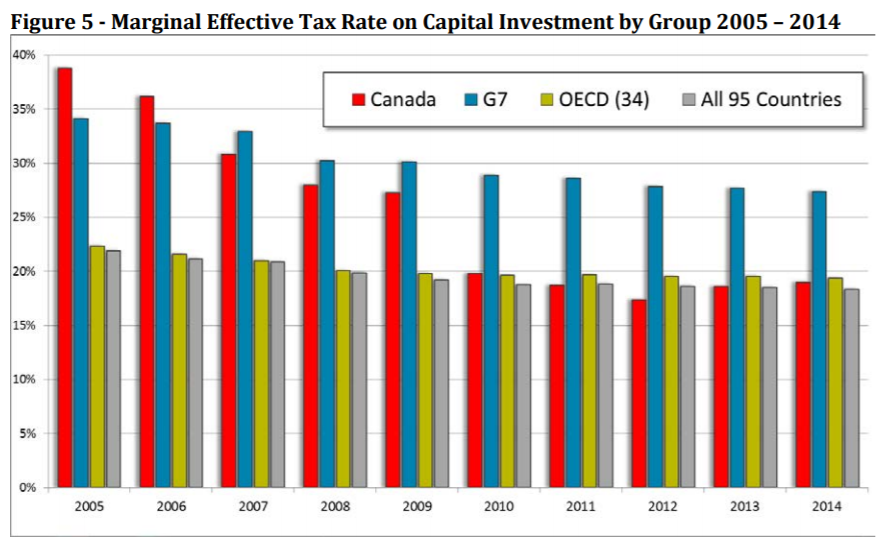

These changes have had a dramatic effect on Canada’s tax competitiveness. The business tax burden on capital investments has fallen dramatically from one of the highest in the world to the middle of the pack. As shown in figure 5, Canada’s METR has declined steadily from 38.8% in 2005 to 17.4% in 2012. While Canada had the second highest METR among OECD and BRIC (Brazil, Russia, India and China) countries in 2005, it has become more competitive in recent years.

Nonetheless, even as other countries, including other G7 countries, have continued to reduce their METRs on capital, the Canadian METR rose to 18.6% in 2013 and 19% in 2014. Alberta’s recent move to raise its corporate income tax rate pushes the overall Canadian METR up further to 19.2%.

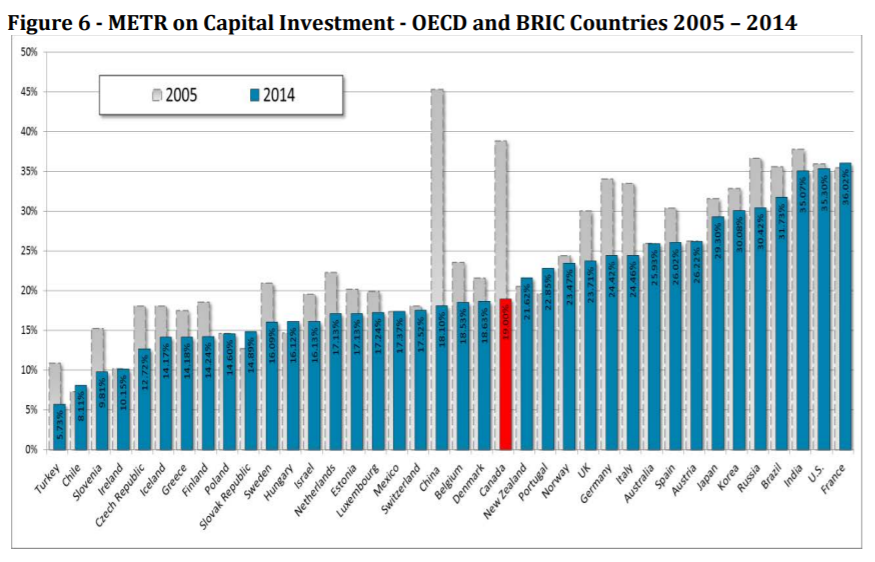

As shown in Figure 6 below, Canada’s METR is now well below the US rate, which is important given that the US is our most important rival for new investment. However, Canada remains less competitive than a large number of other countries, including Mexico (another key rival), Sweden and Ireland.

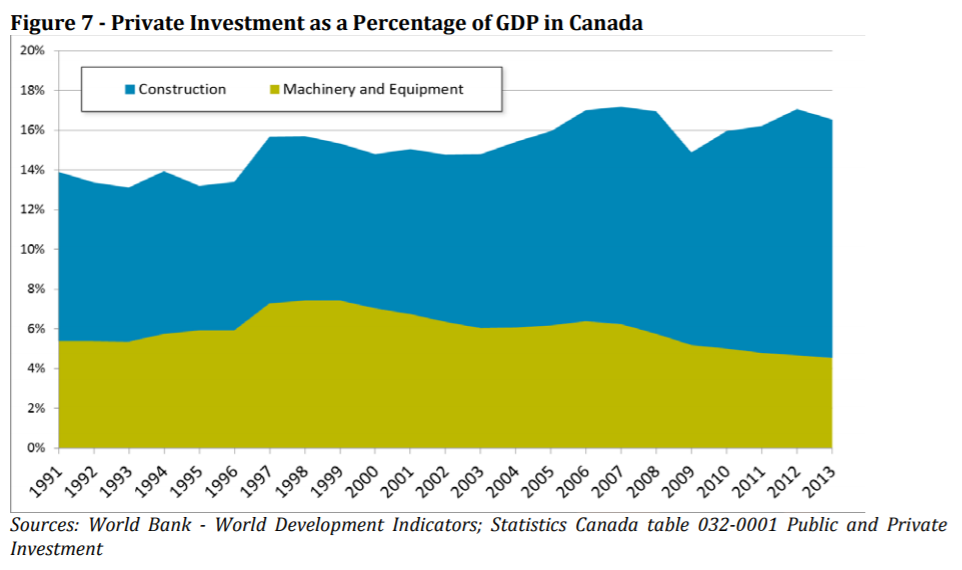

An important question is whether the reduction in Canada’s METR has encouraged more private investment. Figure 7 shows that private investment grew faster than overall GDP between 2000 and 2014 especially in construction buildings, pipelines and transmission lines). But investment in machinery and equipment as a share of GDP fell from 6 in 1997 to 5% of GDP, in part reflecting the decline in manufacturing activity.

Needless to say, taxes are not the only factor that influences investment. Indeed, private investment trends are not especially helpful in understanding the role of taxation. This is especially true since the 2008-9 global recession, which took the wind out of capital investment in many countries.

A proper analysis needs to look at competing factors affecting investment, of which the tax burden is one. In addition to aggregate demand, financing costs, transparency and inflation, economic studies have shown that private investment is sensitive to taxation. A conservative estimate is that each 10% increase in the cost of capital (adjusted for the METR, which adds to the cost of capital) causes a decline of 7% in capital stock. Other studies focusing on foreign direct investment show a bigger impact, with foreign direct investment flows growing as much as 2.5% for each one-point reduction in the corporate income tax rate.

The benefit of extra capital investment is that it tends to raise productivity by enabling businesses to increase output with the same, or even a smaller, workforce. Investment also lifts workers’ incomes through higher wages, more job opportunities, or both. Assuming slack labour demand, I estimate that a three percentage-point increase in the corporate tax rate would lead to a $67 billion drop in Canada’s capital stock, and the loss of 225,000 jobs. If the economy is at full capacity, creating new jobs would be difficult (unless immigration rises), but workers would benefit as wages are bid up.

Corporate Tax Return

The reforms since the start of the millennium have lowered corporate income tax rates across Canada. But the impact on government revenues has been at least partially offset by an expanding tax base as firms have found it more attractive to book profits in Canada. While new investment tends to raise corporate profits and thus tax collections, the main effect of lower tax rates is to give multinationals more incentive to repatriate profits to Canada and to shift debt and other expenses to jurisdictions with higher corporate tax rates.

A good example is Ireland, which has harnessed a low corporate income tax rate to its advantage over the past two decades. Thanks to the competitive rate, now 12.5%, multinationals have used transfer pricing and financing structures to shift profits from other parts of the EU to Ireland. Not only did profits booked in Ireland rise dramatically, but investment growth was stellar in the 1990s. At least one study has attributed a significant share of Ireland’s GDP growth to such profit-shifting strategies.

The Irish experience is just one story. Many recent studies have shown that cuts in corporate tax rates cause the tax base to expand, thereby cushioning the impact of on overall government revenues. Most studies show that the corporate tax base is sensitive to changes in tax rates, although estimates vary of the precise impact. Bartelsman and Beetsma conclude that when tax rates rise, two thirds of the projected increase in revenues assuming the tax base is unchanged is lost to profit-shifting. Huizinga and Laeven find that each 1 percentage point hike in the corporate income tax rate shrinks European multinationals’ tax base by 1.3%.

Three Canadian studies also point to substantial corporate tax base sensitivity to changes in tax rates. Jog and Tang find quite large reductions in debt financing by Canadian multinationals when tax rates decline. Mintz and Smart estimate that a 1 percentage point drop in the provincial tax rate expands the corporate tax base by 4.9% for large corporations that do not allocate income across provinces, and 2.3% for those that do.17 Dahlby and Ferede estimate that a one-point increase in the combined federal-provincial tax rate leads to a 2.3% contraction in the corporate tax base in the short run.

We should thus not be surprised that, in 2000, when Canada’s 43% corporate tax rate was the highest in the OECD, companies shifted a significant portion of their profits to jurisdictions with lower rates. As the rate steadily came down to around 27% by 2012 (close to the global average), companies left more of their profits in Canada. Yet despite the cuts, corporate income tax revenue as a share of GDP remained close to 3% between 2001 and 2010—about the same level as in the previous decade.

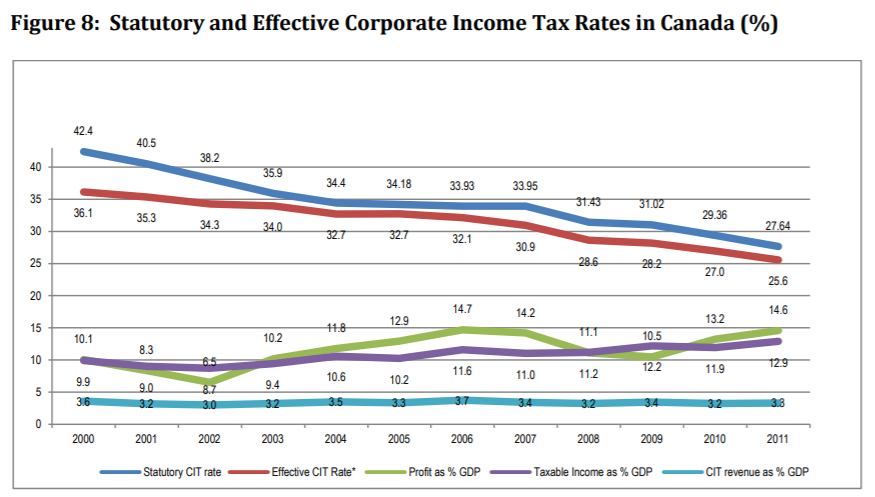

Figure 8 shows that corporate income tax revenues as a share of GDP have remained robust. Despite the 2008-9 recession when book profits declined, taxable income rose as a share of GDP. Further, policy actions that have broadened the tax base have over time narrowed the gap between statutory and effective corporate rates (the latter being corporate taxes as a share of book profits).

Provincial Variations

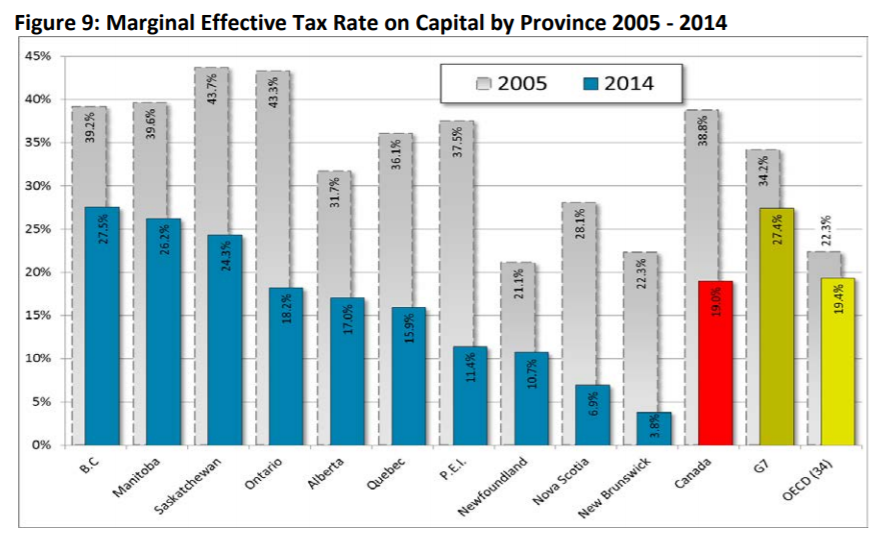

Tax reforms have also sharpened the provinces’ competitive edge since 2000. As figure 9 shows, Manitoba, Ontario and Saskatchewan were the least competitive in 2005. Today, that dubious honour belongs to British Columbia, Manitoba and Saskatchewan, largely due to their continuing reliance on retail sales taxes, of which about one-third of revenues are taxes on business intermediate and capital inputs. These three provinces’ METRs are higher than the OECD and 95- country averages.

The Atlantic provinces have the lowest METRs thanks to the federal Atlantic Investment Tax Credit, now available only to agriculture, fishing, forestry and manufacturing industries. Service businesses are taxed similarly or even higher in the Atlantic region than in other provinces. Overall, Canada’s tax policies have favoured manufacturing over services (such as construction, utilities, transport, communication and trade) resulting in a bias against investment in sectors with the strongest growth potential. Other countries have not followed the same strategy, thereby encouraging capital to move from the declining manufacturing sector into more promising parts of their economies (see Appendix).

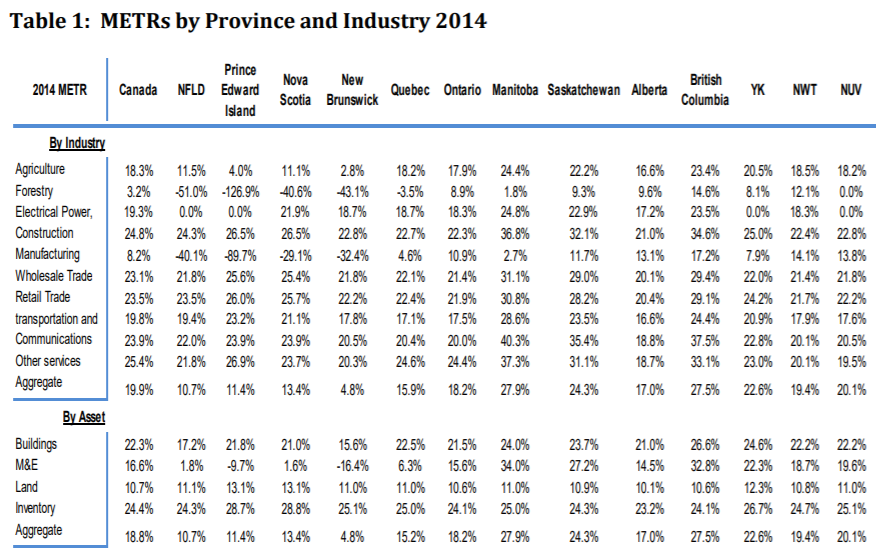

Canada’s corporate tax system continues to distort allocation of capital by favouring some business activities over others. The varying METRs across industries, as shown in Table 1 below, result in a shift of investment from higher to lower rates of return on capital. The economic cost can be counted in lost productivity and lower incomes for Canadians.

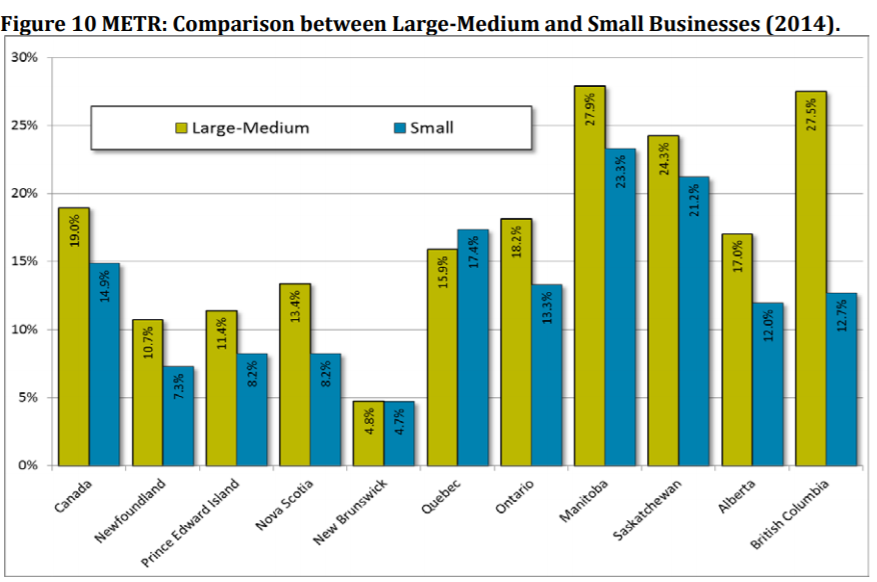

The above METRs do not account for small businesses that have a more favourable corporate tax regime. (The one exception is Quebec where capital cost write-offs available to large firms more than offset the preferential tax rate for small businesses.) Canada provides significant tax breaks to Canadian-controlled private corporations, including lower corporate income tax rates and the lifetime capital gains exemption for farmers, fishers and small business owners. This results in quite different levels of tax between small and large firms as shown in figure 10. The problem is that the tax advantages for small business end up discouraging entrepreneurs from pursuing growth. They also distort the allocation of capital by favouring small company investment, which typically earns a lower pre-tax rate of return than investment by larger firms.

To make matters worse, the favourable tax treatment of small businesses provides substantial opportunities for high-income Canadians to avoid paying personal income tax, and to split income among family members. Bazel and Mintz conclude in a forthcoming paper that roughly 60% of the value of the small business deduction accrues to households earning more than $200,000 a year.

The federal government unveiled a plan in its 2015 budget for a further cut in the small business rate, from 11% to 9% over the next four years. When fully implemented, the small-business rate will be six percentage points lower than the general corporate rate of 15%. The provinces have been similarly generous in supporting small business. Overall, their small business tax rates are roughly ten percentage points below the general rate. A zero rate applies in Manitoba. The gap between the general rate and the small business rate is smallest in Quebec at 3.9 percentage points.

The Canadian system also retains significant variations in taxes between different business activities, thereby favouring investments in some industries and asset classes over others. The most significant are accelerated depreciation for manufacturing machinery and equipment and provincial tax credits for investments in machinery used in the forest industry.

To summarize: while the overall METR has fallen to internationally competitive levels, the gains that might be expected from a more favourable investment climate have recently been reversed. There is clearly room for a fresh round of reforms

Is Corporate Income Tax Worth Keeping?

Given the distortions caused by corporate income tax on productivity and growth, it is reasonable to ask why the tax exists in the first place. An argument can even be made for its outright abolition, given that the ultimate burden for these taxes does not fall on corporations themselves. Corporations are simply legal entities that ultimately shift their tax obligations to shareholders in the form of lower dividends and capital gains; to workers through lower salaries and wages; and to consumers through higher prices. So, the argument goes, why tax the corporation when it would be fairer to tax individuals directly?

The arguments in favour of a corporate tax were first made by the Carter Report in 1966, followed by the Mintz Report of 1997. They remain equally relevant today.

- A Corporate Tax is an Essential Backstop to Personal Income Taxes: Without a corporate tax, individuals would be able to avoid paying personal income tax by leaving income in a corporation. Since the personal income tax applies to capital gains only when they are realized, owners can avoid the tax by leaving income at the corporate level without distributing it as taxable dividends, salaries, rents, interest or other forms of income. Further, the corporate tax means that tax is paid on business income accruing to pension funds and other non-taxable entities. This practice not only creates unfairness but leads to behaviours specifically designed to minimize taxes. If dividends, capital gains and interest are not taxed at the personal level, a corporate “rent” tax would be needed to tax profits in excess of the “normal” return on capital. In other words, some form of corporate tax is vital to ensure the integrity of the personal tax system.

- A Corporate Tax is a Source-Based Tax to Withhold Income from Non-Residents: A corporate tax provides revenue to a government wherever in the world a company sources its profits. The tax therefore functions as a withholding tax on profits that would accrue to foreign investors and governments. (A foreign government could provide a tax credit for Canadian taxes paid by their resident multinationals operating in Canada). With the stock of foreign capital in Canada totaling $730 billion in 2014, the ability to withhold a portion of income from foreign investors is an important element of corporate tax policy.26 It can thus be argued that corporate taxes discourage foreign investment in Canada. On the other hand, they can be justified on the grounds that they enable the public purse to share in profits or rents earned by foreign investors in this country.

- A Corporate Tax is a Surrogate User-Pay Tax: Businesses, whether domestic or foreign owned, benefit substantially from public services such as highways, communication networks, police and fire services, and the justice system. Public authorities could theoretically cover these costs through user fees, such as road tolls. But whether for political or equity reasons, such fees typically cover only a portion of these services’ true cost. When user fees do not cover the full cost, business profits benefit from access to subsidized public services. A corporate tax is able to capture at least some of these gains.

Given these arguments, it makes sense to include a corporate tax among the array of levies that governments use to fund public services. Two types of tax can be applied, depending on the objective. One is the corporate income tax, in use by most countries, which applies to profits accruing to a company’s owners, or shareholders. The alternative is a corporate “rent” tax levied on revenues in excess of labour and capital costs.

The corporate income tax

The corporate income tax functions as a backstop to the existing personal income tax which applies to income on capital, including dividends and capital gains. Without a corporate income tax, business owners could avoid personal income taxes by leaving profits undistributed. The undistributed profits option has the advantage of allowing investors to defer income. The profits that accumulate in the firm are later taxed as capital gains when owners dispose of their investments or when the firm buys back shares. Regardless, the investor is able to postpone tax obligations on business income, creating opportunities to minimize personal income tax.

An alternative would be to allow dividends to be deducted from profits, as in the case of a mutual fund corporation that operates as a flow-through entity for investors. However, dividend deductibility reduces the corporate tax on profits remitted to foreign investors even in the presence of modest withholding taxes on dividends, lessening its role as a source of government revenue. Further, the absence of a corporate tax would remove an important tool to make companies pay for public infrastructure and other services that contribute to their profits.

Since 2000, federal and provincial governments have adopted an approach that lowers corporate income tax rates and achieves a more neutral corporate tax base reflecting economic income. The result has been that effective tax rates on profits have moved closer to statutory rates (figure 8 above). The combined average federal-provincial rate has declined about 16 percentage points from 43 percent. Various budgets have expanded capital cost allowances to match economic depreciation rates. Numerous tax preferences have been removed. Among them: accelerated depreciation for oil sands investments; scaling back the Atlantic investment tax credit, so it is no longer eligible for oil, gas and mining investments; the labour-sponsored venture corporate tax credit; the preferential “small business” tax rate for credit unions; the corporate exploration tax credit; a reduction in research and development tax credits; and a tightening of the tax treatment of international income and deductions such as thin-capitalization rules.

On the other hand, several tax preferences remain, such as accelerated depreciation for manufacturing and processing equipment (reintroduced in 2006), and for liquefied natural gas plants; the small business tax deduction; and flow-through shares and various other fast write-offs for capital recovery. There is clearly room to broaden the corporate tax base still further.

A corporate rent tax

An alternative is the rent tax approach, adopted by Belgium and some other countries. This intriguing concept allows a company to deduct a presumptive cost for equity financing, called the allowance for corporate equity, or ACE. The result is that only economic rent – the surplus of revenues over operating and financing costs – is taxed, because all production costs are deductible, at least in principle. Typically, the government long-term bond rate (such as 10 years) has been applied to equity as in the case of Croatia (introduced in 1994), Brazil (1996), Austria (2000), Belgium (2007) and Latvia (2009). In some other countries, such as Italy, the deduction for equity financing applies only to the increase in equity finance.

A critical advantage of the corporate rent tax is that it reduces the disincentive to invest in capital, since both debt and equity financing costs are deductible. In other words, it sharply lowers the METR – the tax on marginal investments. The ACE also reduces the incentive to issue debt, since both equity financing costs and interest expenses on borrowings are tax deductible. The rent tax is also an effective way of recouping the benefits that companies enjoy from public ownership of resources and subsidized infrastructure.

While these are powerful arguments in favour of a rent tax, the ACE also has serious limitations that make it less appealing without reforms that go far beyond the corporate tax system:

- A corporate rent tax is impractical without significant adjustment to the personal tax regime. Given that capital gains are taxed only when assets are disposed of, an investor can avoid paying personal tax by leaving income at the corporate level. The difficulty with the mixed approach is that companies can deduct the cost of equity financing while capital gains are only taxed when they are realized. This leads to a mismatch between deductions at the corporate level and income inclusion at the personal level. The corporate income tax alleviates this problem by withholding income at the corporate level so that individuals cannot circumvent personal taxes. A rent tax makes sense only if the personal income tax regime provides for comparable treatment of capital income, as the Mirrlees report suggested.

- Multinationals would have a significant tax advantage over smaller companies, with a double deduction for financing costs in Canada and interest deductions in other countries. Such a system would create a bias in favour of inbound investment and foreign ownership compared to domestically sourced investment and ownership.

- Deductions for equity financing costs would increase the incidence of tax losses, resulting in many more companies paying no corporate income tax at all. This was one reason why Croatia abandoned its rent tax.

- Given that the US would maintain its corporate income tax, the introduction of an ACE in Canada might mean that Canadian corporate taxes would not be creditable according to US law south of the border.

ACE is worthy of consideration, but its full implications need to be carefully assessed. Certainly, a reform of this kind would need to take place in conjunction with personal tax changes to maintain the overall integrity of the tax system.

A Proposal for a Corporate Tax Reform

The drive to pursue internationally competitive tax rates and a more neutral tax system has served Canada well. Not only has it encouraged investment, but it helps allocate capital more efficiently with less interference from the tax system. That bodes well for more productive use of our economic resources. From a political point of view, governments also deserve credit for pushing towards a more neutral and competitive business tax structure.

However, recent proposals to raise tax rates risk undermining these hard-won gains. Raising taxes on businesses is politically popular, since voters typically view corporations as powerful behemoths that benefit wealthy investors. Yet studies have confirmed over the years that a significant share of business taxes is shifted onto lower-income households in the form of lower wages, and onto consumers in the form of higher prices as companies pursue attractive returns for investors. In other words, the corporate tax on larger companies is often a mildly regressive tax.

Meanwhile, as pointed out above, low tax rates for small businesses tend to favour high-income individuals. Contrary to popular opinion, fairness and compassion dictate that the tax on large companies should be reduced while the rate on small businesses should be raised.

A more neutral business tax structure with similar tax burdens on all business activities would also enhances fairness by ensuring equal tax treatment of those with similar incomes.

Rather than raising corporate tax rates, Canada should follow the lead of most other countries by making the corporate tax structure more neutral, in other words, broadening the tax base. Some options include restricting accelerated depreciation and resource deductions, reining in investment tax credits, and halving the small business deduction. These measures can be offset with lower tax rates that apply to all.

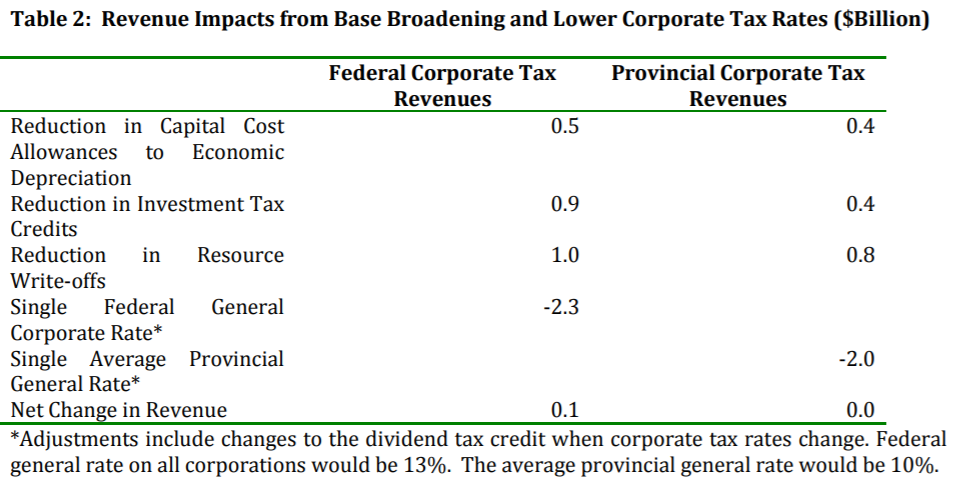

Table 2 shows the revenue impact of a reformed corporate tax system where all corporations pay a federal rate of 13% and a provincial rate of 10% (for a combined rate of 23%). To assist small businesses, all companies could expense rather than depreciate the first $2 million of expenditures on machinery and structures. Small businesses would continue to benefit from the expensing provision even if they grow. The provision would be of less significance to large companies.

Provinces should also reduce tax preferences, including those for small businesses. British Columbia, Saskatchewan and Manitoba should harmonize their retail sales taxes with the federal goods and services tax. This would remove the three provinces’ sales taxes from intermediate and capital inputs, bringing their tax rates on marginal investments closer to international levels.

Conclusion: Striving for a Competitive, Fair and Effective Tax System

Over the past 15 years, federal and provincial governments have lowered the tax burden on business investments from the highest amongst OECD countries to the middle of the pack. Not only has the business tax structure become internationally competitive but also more neutral. These reforms have encouraged more capital investment in Canada without leading to a significant loss of corporate tax revenues as a share of GDP.

Canada, however, should not be complacent. Other countries such as the UK, Denmark and Finland are moving ahead with more ambitious reforms by lowering corporate tax rates and improving neutrality. As shown below, Canada’s tax burden on capital moved from the 20th most tax competitive regime among OECD countries in 2012 to the 25th most tax competitive regime in 2014. Many narrowly targeted tax incentives, whether effective or not, remain in the business tax system. The business tax structure could be simplified with fewer and less complicated levies.

Some provinces have slipped backwards in recent years. British Columbia has re-imposed its retail sales tax and introduced a liquefied natural gas tax. Ontario has reneged on planned corporate tax cuts. New Brunswick and, most recently, Alberta have raised corporate income taxes. New levies such as carbon taxes on large emitters, are designed to shift the taxation burden from individuals to businesses, but ultimately fall on individuals as consumers, wage earners, shareholders and pension fund participants.

If the federal government scaled back tax incentives by half, the federal-provincial corporate tax rate could be reduced to 23%. These measures would not only preserve the international competitiveness of Canada’s tax system, but also enhance its fairness and effectiveness to the benefit of all Canadians.

Appendix

Marginal Effective Tax Rates by Industry and Country (2005 and 2014)