The business case for a smart transition

As published in Policy Magazine

Alex Pourbaix prefers to talk about “diversification” rather than “energy transition” these days.

As a longtime leader in the oil patch and now the executive chairman of Cenovus Energy Inc., Pourbaix has been at the forefront of a national re-thinking of what oil and gas mean to the Canadian economy.

As a prominent voice for the oilsands, he has argued for increased production and better infrastructure to facilitate exports.

And yet, in April he was centre-stage at an Ottawa conference on net zero, speaking before a group of policy wonks right before Environment Minister Steven Guilbeault. It was a recognition that unless Canada’s oil and gas sector is fully engaged in the vigorous national conversation on how to cut emissions, corporate success and policy success are both in peril.

“We’re going to see a little more of everything, including oil and gas, renewables and nuclear power,” Pourbaix told the crowd attending the Canada 2020 Net Zero Leadership Summit.

There’s no doubt the industry, like the broader economy, is in transition. Canada’s largest corporate interests are evolving as they respond to market forces and regulations that are pushing with increasing urgency to control climate change. To Pourbaix’s point, that’s as much an investment strategy as it is a requirement to comply with rules.

He’s not alone. A cross-sectoral group of CEOs recently contributed to a Business Council of Canada (BCC) report that highlights the challenges and opportunities of Canada’s energy transition. It’s only the latest in a series of calls to action from BCC members dating back to 2007, when they called for a national price on carbon.

It’s essential that Canada’s public and private sectors work together to address climate change and this year’s federal budget marks a milestone. Finance Minister Chrystia Freeland is spending some political capital with her own government by introducing tax breaks and new funding to help corporations do what the government, acting alone, just can’t.

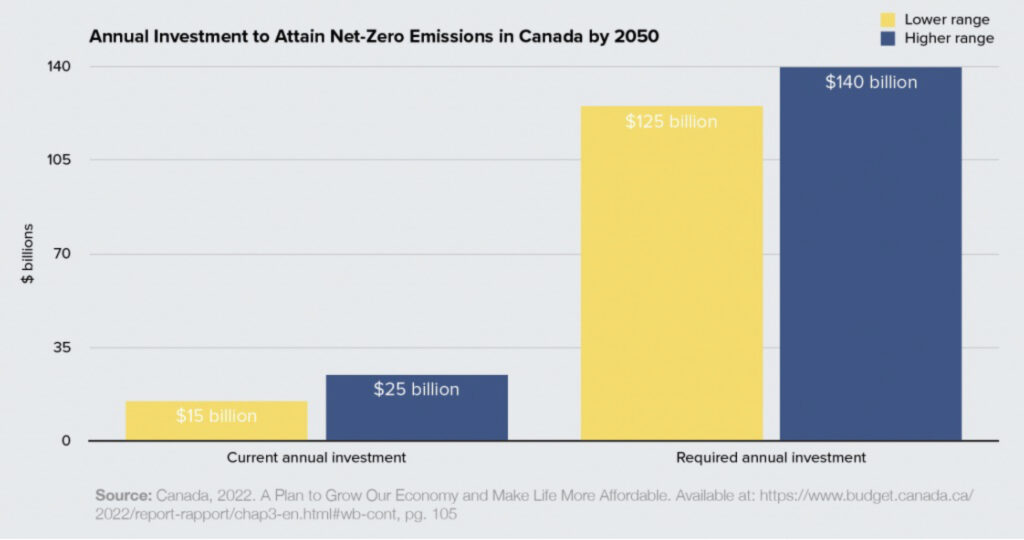

The challenge is mind-boggling, riddled with yawning gaps between ambition and activity. The budget allocates about $21 billion — largely in tax credits — over the next five years, and government officials foresee spending more than $80 billion in the coming decade. But Canada needs investment of about $125 billion to $140 billion every year to meet its goal of net zero by 2050, with some of the best estimates suggesting that the scale of investment required to achieve our goals will be roughly $2 trillion.

That’s where the intense involvement of Pourbaix and his colleagues in the energy industry becomes so central.

Canada’s oil and gas sector continues to be a mainstay of the country’s economy, contributing to roughly 10 percent of GDP each year and injecting billions to government revenues through taxes, leases and royalty payments. Canadian oil continues to be the country’s largest export earner, generating revenues that cover the net import costs of consumer goods and travel services each year. Clearly, for the sake of prosperity alone, the health of the oilpatch is as important as ever. It makes sense, for the sake of diversifying and the environment both, that those same energy companies use their expertise and their investment strategies to seize opportunities in the energy transition.

Some of the most recent and credible scenarios highlight that the world will require fossil fuels for several decades, although debate continues as to when and how quickly demand may lessen. There is a strong case for Canadian oil and natural gas retaining, and even expanding, its share of the global market, regardless of how demand evolves over time.

There’s no doubt Canadian energy can compete on the basis of its ESG credentials, regulatory standards, community and Indigenous engagement and high labour standards.

That’s where Pourbaix’s “diversifying” approach comes in – a conviction that Canada can maintain its economic strength, provide the world with oil and gas, and also lead in the fight against climate change. And indeed, large emitters are becoming large investors when it comes to innovating around clean technology.

Increasingly, we see not just independent clean-growth initiatives sprouting up across the country, but also a growing commitment from large emitters themselves to experiment with diversification and innovation in emissions reductions.

Credible scenarios highlight that the world will require fossil fuels for several decades, although debate continues as to when and how quickly demand may lessen. There is a strong case for Canadian oil and natural gas retaining, and even expanding, its share of the global market, regardless of how demand evolves over time.

The sector accounts for an estimated 75 percent of Canadian business spending on clean tech. Each year, they invest north of $1 billion to create new technologies that drive down carbon emissions, water use and land disturbance.

Energy companies are also investing in areas outside of traditional oil and gas, diversifying their products to include renewable diesel and natural gas, hydrogen, wind and solar. Meanwhile, companies are greening their operations by using advanced technologies and more electricity, and are working closely with nuclear technology providers to explore the use of small modular reactors as they come onboard.

Many Canadian businesses are already making significant investments to support their net zero commitments, and our financial services sector is mobilizing hundreds of billions of dollars to finance clean innovation. Further, Canadian companies produce many of the products – ranging from energy in all of its forms, to steel, cement, and critical minerals – that are necessary to achieve net zero emissions.

In many cases, Canadian producers have some of the lowest GHG footprints anywhere in the world. Canada also has emerging strengths in innovative technologies – such as hydrogen, biofuels, battery storage, small modular reactors and carbon capture – that can help it and the world achieve their climate objectives.

Canada is also becoming a leader in developing sector-specific net zero strategies. Last year, the federal government and the Cement Association of Canada co-developed a roadmap that seeks to combine research and development, funding for major decarbonization projects, standards and skills development, and market development for Canadian low-carbon cement and concrete.

But the most important technology that collaborative initiatives such as the Pathways Alliance – which includes Pourbaix’s Cenovus – point to when it comes to cutting emissions is carbon capture, utilization and storage, or CCUS. It still needs financing, it still needs permitting, and more than anything else, it needs iron-clad certainty that investment in the technology will be supported by public policy over the long term.

And that policy commitment will be key to Canada’s ability to attract much-needed transition investment, because even as innovation sprouts within Canada’s borders, opportunities abound elsewhere – often supported by heavy government investment. Home-grown companies are restructuring, eyeing opportunities south of the border and beyond, in order to make the most of the global market’s thirst for solid low-carbon plans. Some made-in-Canada innovation is being snapped up by giants south of the border.

That’s because Canada’s biggest business partner, the United States, is attracting foreign investment and clean energy innovation by offering up hundreds of billions in subsidies.

The US Inflation Reduction Act offers tax credits and subsidies for at least 10 years to advance America’s mid-century climate goals. President Joe Biden was clearly determined to pull clean-economy investment from all over the world into his American market.

Fearing all their best-laid plans for pushing the private sector to invest heavily in Canada’s clean-energy sector would go up in smoke, Canadian government officials frantically surveyed all their incentives, crunched the numbers, and let it be known that they were prepared to rise to the challenge. The result was Budget 2023 – a plan that leaves many questions, not to mention a high fiscal cost.

Electricity is central to low-carbon production of anything and everything, and so the budget’s focus on driving investment into building and bolstering a national grid is encouraging. After all, recent estimates suggest that Canada will require two to three times more electricity capacity to fulfill its net zero ambition by 2050.

Tax incentives to set up hydrogen and other clean energy facilities should help Canada at least be considered in the same ballpark as the United States. While these credits can offset some capital expenditures, a shift to creating revenue streams and supporting operational expenditures is necessary to improve project economics and maintain the competitiveness of Canadian firms.

Budget 2023 purports to offer such a plan. The Canada Growth Fund seeks to offer a range of instruments like carbon contracts for difference that hedge against price volatility to support clean growth projects. In theory, such an instrument would backstop the future price on carbon and supporting credits and provide firms with a predictable revenue stream for their decarbonization projects. In doing so, it could mitigate the potential risks created by policy reversals.

These instruments need to be designed with finesse. And they need to catch the eye of investors willing to take the plunge. But much work remains to be done to stand up the Canada Growth Fund and define the full range of what it can offer to Canadian firms. And, even then, it and the other budget measures fall short of what is needed to unlock the necessary investment for transition.

Canada has a reputation for dragging its feet on regulatory approval, and while there’s a process to take a look at that over the coming year, there’s no assured outcome. A “business-as-usual” approach means that many positive decarbonization efforts will take far too long to get built, compromising the country’s ability to meet the government’s ambitious reduction goals and realize the economic opportunities associated with energy transition.

And then of course there’s an obligation – judicial, economic and moral – to have Indigenous participation and approval. Many Indigenous communities are seeking equity stakes in the pending wave of investment – a meaningful step towards economic reconciliation. Budget 2023 gives a nod here, allowing the Canada Infrastructure Bank (CIB) to provide loans to Indigenous communities wishing to invest in CIB projects. But we’re still missing a national Indigenous loan guarantee program that would enable more Indigenous involvement in energy transition projects.

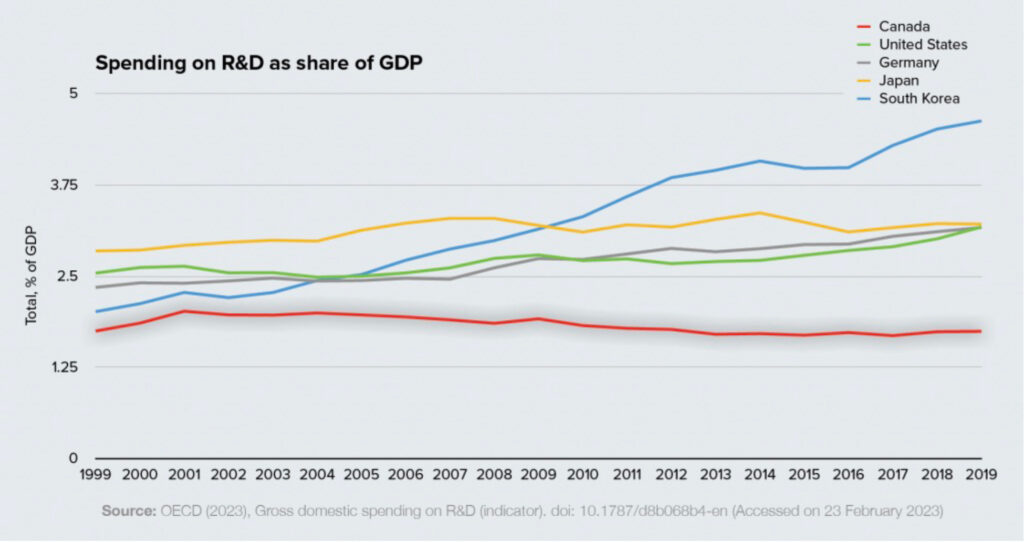

Plus, the budget falls short on measures to push higher levels of investment in research and development. As a percentage of GDP, Canada’s combined public and private expenditures on R&D have been declining since 2001 and Canada ranks poorly relative to most Organisation for Economic Cooperation and Development (OECD) countries.

Hopefully, the soon-to-be-developed Canada Innovation Corporation (CIC) will focus on the energy transition and position itself as a partner to industry.

One of Canada’s traditional competitive advantages is its rich endowment of natural resources, and that remains the case today. The world is eyeing our critical minerals, our hydro and our expertise in producing energy of all kinds. They’re also sizing up our ability to deliver fossil fuels while cutting emissions.

The challenge has been accepted.